4. On December 31, the physical inventory excluded $25,000 of merchandise inventory held on consignment by a customer. Conway Corp. is the consignor. 5. Goods are in transit from a vendor to Conway Corp. on December 31. The invoice cost was $40,000 and the goods were shipped f.o.b. shipping point on December 26. The merchandise was excluded from the physical inventory count because the merchandise had not been received. 6. Merchandise with a cost of $30,000 is held in the receiving department for return, but Conway still controls this inventory. The merchandise was excluded from the physical inventory count. Required Calculate the adjusted inventory balance on December 31. $ 845,000

4. On December 31, the physical inventory excluded $25,000 of merchandise inventory held on consignment by a customer. Conway Corp. is the consignor. 5. Goods are in transit from a vendor to Conway Corp. on December 31. The invoice cost was $40,000 and the goods were shipped f.o.b. shipping point on December 26. The merchandise was excluded from the physical inventory count because the merchandise had not been received. 6. Merchandise with a cost of $30,000 is held in the receiving department for return, but Conway still controls this inventory. The merchandise was excluded from the physical inventory count. Required Calculate the adjusted inventory balance on December 31. $ 845,000

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter13: Accounting For Merchandise Inventory

Section: Chapter Questions

Problem 1MP: Hurst Companys beginning inventory and purchases during the fiscal year ended December 31, 20-2,...

Related questions

Question

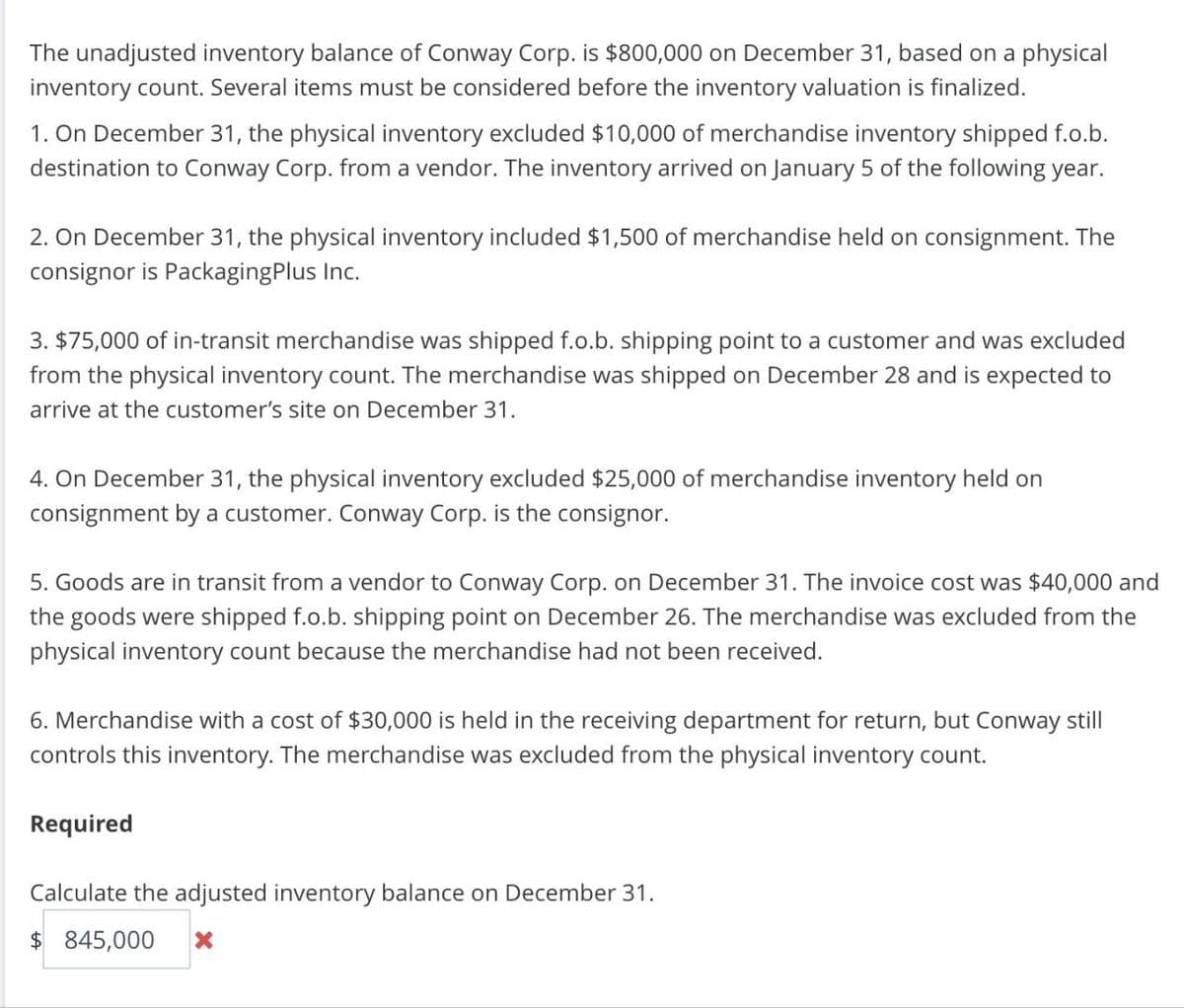

Transcribed Image Text:The unadjusted inventory balance of Conway Corp. is $800,000 on December 31, based on a physical

inventory count. Several items must be considered before the inventory valuation is finalized.

1. On December 31, the physical inventory excluded $10,000 of merchandise inventory shipped f.o.b.

destination to Conway Corp. from a vendor. The inventory arrived on January 5 of the following year.

2. On December 31, the physical inventory included $1,500 of merchandise held on consignment. The

consignor is PackagingPlus Inc.

3. $75,000 of in-transit merchandise was shipped f.o.b. shipping point to a customer and was excluded

from the physical inventory count. The merchandise was shipped on December 28 and is expected to

arrive at the customer's site on December 31.

4. On December 31, the physical inventory excluded $25,000 of merchandise inventory held on

consignment by a customer. Conway Corp. is the consignor.

5. Goods are in transit from a vendor to Conway Corp. on December 31. The invoice cost was $40,000 and

the goods were shipped f.o.b. shipping point on December 26. The merchandise was excluded from the

physical inventory count because the merchandise had not been received.

6. Merchandise with a cost of $30,000 is held in the receiving department for return, but Conway still

controls this inventory. The merchandise was excluded from the physical inventory count.

Required

Calculate the adjusted inventory balance on December 31.

$ 845,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning