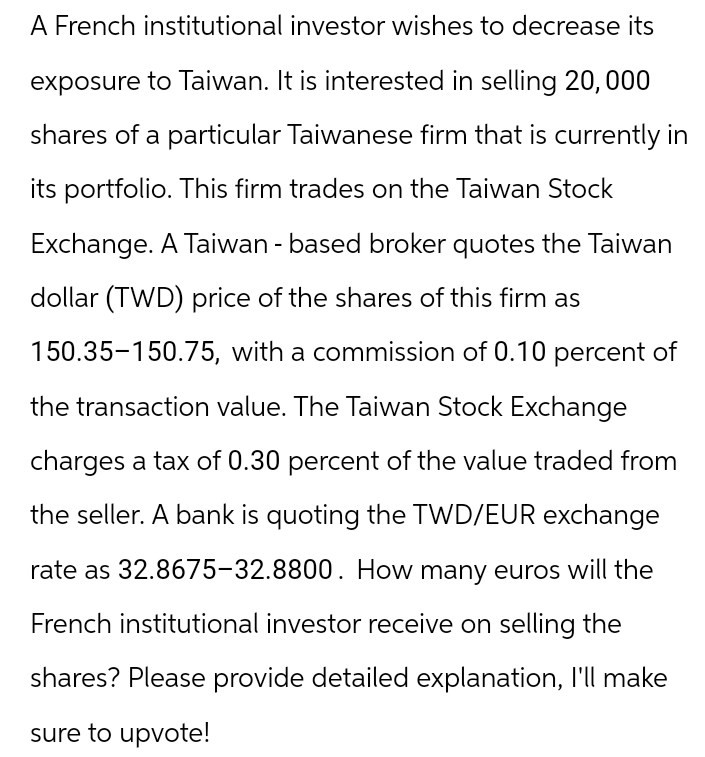

A French institutional investor wishes to decrease its exposure to Taiwan. It is interested in selling 20,000 shares of a particular Taiwanese firm that is currently in its portfolio. This firm trades on the Taiwan Stock Exchange. A Taiwan - based broker quotes the Taiwan dollar (TWD) price of the shares of this firm as

Q: Solving A = Pet for P, we obtain P=Ae" which is the present value of the amount A due in t years if…

A:

Q: The equation e² = 10(x² - 1) has two positive roots and one negative root. (a) Find all three roots…

A: Attached solution Explanation:To find the roots of the equation correct to two decimal places, we…

Q: (e) Which error is more serious? Why?

A: Radon is a colorless, odorless, invisible gas that seeps into residential homes and has been linked…

Q: Using Archimedes' ideas only, find the area of the segment of the parabola shown at right. Very…

A:

Q: Answer this question use pencil and paper to solve it, dont use Ai. Let A = {2, 3, 5} and B = {x,…

A: `a.` `p_1(2,y)=2` and `p_1(5,x)=5` .Also the range of `p_1` is `{2,3,5}`.`b.` `p_2(2,y)=y` and…

Q: Solve the IVP using the Laplace transform. y″ – 5y' + 6y = e²¼, y(0)=1, y′(0) = 0 4t

A:

Q: Prove Prop 11.4: If a and n are positive integers such that a | n, then a ≤ n.

A:

Q: Let [1 A = 3 1 2 0 1 2 2 10 13 Find all vectors in the null space of A.

A:

Q: answer this question and use pencil and paper

A: The image to show a table for filling out the truth values of all possible two-input Boolean…

Q: Question 1: (a) Consider the n-point Newton-Cotes quadrature rule n [^ f(x)dx ~ Σ wif(xi). i=1 (1)…

A: The solutions have been attached below.Explanation:Approach to solving the question: Detailed…

Q: Find the transformation matrix for the following figure: B'(-5,3) A(-5,0) C(-3,0) B(-5,-3) A(-3,-3)

A: Given the triangle A(−3,−3),B(−5,−3),C(−3,−6).We need to find the transformation matrix so that we…

Q: f(x) = x(Lx), for 0 < x < L. Sketch the graph of the even periodic extension (period 2L).

A: Consider the function , for .We need to sketch the graph of the even periodic extension.We know that…

Q: question attached in ss thanks for help appreciaetd it ajoaijar oihjar ihoari harjha jir

A: The objective of the question is to identify the correct form of the product rule for…

Q: PLS HELP ASAP ON ALL GIVEN QUESTIONS PLS

A: final answer 5) C optionavg rate change is =2118)1.remainder not zero2. remainder =0 k = -13/2…

Q: Find U14 and 14, where: a. A₁ = {{0,1,2) for every positive integer i. b. A₁ = {2i + 1} for every…

A:

Q: Set up, but do not evaluate, an integral for the area of the surface obtained by rotating the curve…

A: The graph of is shown below:

Q: 3. y'=1+cosx−ycotx;y()= -ycot.x:y()= {y= /3 2 sin r 1 cot x+=sin x}

A:

Q: Let f (x) = cos x and g(x) = sin x. Find the center of gravity (x, y) of the region between the…

A: The given function A= Area in between curves The graph of region

Q: 1 1. y'+y=x 3 3 1 y' + y = x²³y³ { \ = = = x² + cr² } X 2 y 2 4

A: Given differential equation .We have to solve the differential equation.

Q: 2. Consider the equation of simple harmonic motion considered in Example sheet 14: d²x + w²x = 0,…

A: Please refer below page.If you have any doubts please feel free to ask.Explanation:Step 1: Step 2:…

Q: Tonya's class planted sunflowers and the students are tracking the growth of their individual…

A: Time (days)Height (inches)Based on the given data we have to construct a function representing the…

Q: e 0 J。 leit – al² where |a| is not 1 b 2 = (eit - a)(e-it - ā) grate on a unit circle Q using Cauc

A:

Q: the brackets are [ ] these for the phrase [n(n+1)/2]^2

A:

Q: Find a basis of the given subspace by deleting linearly dependent span of { | } [3] }}

A: To find the basis of the given subspace we need to find echelon form of the corresponding matrix.…

Q: In voting among three candidates, the outcomes are reported as: (ABC) (ACB) (BAC) (BCA) (CAB) (CBA)…

A: The outcomes of voting are :ChoicesABCACBBACBCACABCBANumber of votes752173The main aim is to…

Q: Given the following integral I(n) = f₁₁(1-2)" dr. We want to ultimately show that 22n+1 (n!)2 I(n) =…

A: The given integral is .We need to evaluate and .

Q: 4. Calculate Res z2 2+1 +9' - Зі

A: Here's the solution of given question. We use residue formula at a given point of complex function.…

Q: Suppose that S is a vector space that is a subspace of the space of functions from R to R.…

A:

Q: A system of linear equations was reduced to the form below. Continue to use Gauss-Jordan elimination…

A: LetA system of linear equations was reduced to the form above. We have to continue to use…

Q: refer to image below.

A: Lineraly dependentv3={-1/3} v1 +{1/3} v2Explanation:Step 1: Step 2: Step 3: Step 4:

Q: Using sexagesimal only, multiply 0;25,15,38 by 120.

A:

Q: Let F be a smooth 2-dimensional vector field defined on an open set U in the plane containing a…

A: To find the curl of the vector field F at a point P along the field line r(t), it can use the…

Q: Determine if the following graphs A) a are bipartite. b f e a B) d f 0 e d

A:

Q: Solve for t to two decimal places. 4 = 0.021 4=e t≈ ☐

A:

Q: Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based…

A: - For product J78: $17.72- For product B52: $52.30Explanation:To compute the unit product cost of…

Q: * Question Completion Status: QUESTION 3 Consider the following four open inervals (1,3), (2,5),…

A: Answer is a = 2b = 3c = 2d = 4Explanation:Step 1:Step 2:Hope it helps youStep 3: Step 4:

Q: 1. Find a matrix A such that the linear system d/dt( x(t)) = −7x+2y d/dt (y(t))= −1x−8y is given by…

A: dtd(x(t)y(t))=A(x(t)y(t))dtd(x(t)y(t))=A(x(t)y(t))Explanation:1. To find matrix A , we…

Q: 0.006x =35 (Simplify your answer. Type an integer or a decimal. Round to four decimal places as…

A:

Q: Recently, a certain bank offered a 5-year CD that earns 2.3% compounded continuously. Use the given…

A:

Q: C = {1,4,9}, D = {2,3,5,7}, E = {2, 4, 6, 8, 10}, F = {1, 2, 3, 4, 5}. List the elements of the…

A:

Q: 2. Provide a graphical (one combined) solution for the system of linear inequalities below: 3 y + t…

A: See explanation for the graphical solution.Explanation:i. 3">y+(73)t>3Solve the inequality…

Q: A natural cubic spline S(x) on the interval 0≤x≤2 is defined by S(x) | S (x) 0≤x≤1 = |S₁₂ (x) 1≤x≤2…

A: The answer is explained is belowExplanation:Step 1: Step 2:

Q: Find the Optimal solution for the below Linear Program by Simplex method: Maximize Z = 200x + 80y…

A: Simplex method is one of the ways to arrive at an optimal solution for the linear programming…

Q: (b) The row vectors of an n x n upper triangular matrix form a basis in R" if all entries in the…

A: The objective of the question is to determine whether the row vectors of an n x n upper triangular…

Q: Use the Composite Simpson's rule with n =4 to approximate the following integral. L'e'de exdx where…

A: The approximate value of the given integral by using Composite Simpson rule is 108.48Explanation:To…

Q: Let S C C be a domain that is bounded, and let f: SC be continuous, and f = O(U) is holomorphic. If…

A: To prove that f must have a zero in S, it can use the Maximum Modulus Principle. The Maximum Modulus…

Q: Problem 1. We are shipping boxes from central to local warehouses. Transportation costs per box are…

A: The objective of this question is to formulate a linear programming problem to minimize the total…

Q: = bt al Recall that cosh bt = (ebt + e¯bt)/2 and sinh bt sasbivo 10, find the Laplace transform of…

A: The objective of the question is to find the Laplace transform of the given functions. The Laplace…

Q: Determine the solution explicitly of the following differential equation x(y^2) y' -(y^3) =1

A:

Q: Consider the function f(x)= x/√((x^2) +1). study its critical points, increase and decrease, points…

A:

Step by step

Solved in 3 steps with 1 images

- Suppose that a French firm would like to have its stock available through an American Depository Receipt (ADR). If the firm’s stock is currently selling for €75 and that the exchange rate between the € and the $ is €1.0=$1.0592. What price should we expect for the ADR in US dollars? Suppose that over the next year the dollar reaches parity with the Euro, i.e., $1.00=€1.00 and that the price of the French firm’s stock rises to €100. What would expect the price of the ADR to be?A U.S. dollar-based investor buys shares in a Brazilian exchange-traded fund in local currency on January 12 that replicates the Bovespa (the Sao Paulo stock market index). The Bovespa is trading at 48,164 and the exchange rate is 2.66 reals per dollar. The investor closes out the trade a year later. At that time the Bovespa is trading at 51,000 and the exchange rate is 1.80 reals per dollar. a) What is the investor’s U.S. dollar return, in percent, on this transaction?In each of the following cases, calculate the price of one share of the foreign stock measured in United States dollars (US$). a. A Belgian stock priced at 103.1 euros when the exchange rate is 1.0787 US$/ (i.e., each euro is worth $1.0787). b. A Swiss stock priced at 92.5 Swiss francs (Sf) when the exchange rate is 1.0385 US$/Sf. c. A Japanese stock priced at 1,386 yen (¥) when the exchange rate is113.9988 ¥/US$. Question content area bottom Part 1 a. The Belgian stock priced in U.S. dollars is $111.14 (Round to the nearest cent b. The Swiss stock priced in U.S. dollars is $................ (Round to the nearest cent.) c. The Japanese stock priced in U.S. dollars is $.......... (Round to the nearest cent.)

- Suppose a U.S. investor wishes to invest in a British firm currently selling for 50 pounds per share by buying 200 shares of the British firm. The current exchange rate is $1.31 per pound. After one year, the exchange rate is $1.60 per pound and the share price is 59 pounds per share. What is the dollar-denominated return in percentage?A US investor wishes to invest in a British firm currently selling for GBP 40 a share. He has $10 000 to invest, and the current exchange is $2/GBP. (a) How many shares can the investor purchase? (b) Given share prices of GBP 35, 40 and 45, and exchange rates of $/GBP 1.80, 2 and 2.20 respectively, calculate the $ and GBP rates of return for each of the nine scenarios (three possible prices per share in GBP times three possible exchange rates. (c) If each of the nine outcomes is equally likely, find the standard deviation of both the GBP and $ denominated rates of return.A U.S.-based importer, Zarb Inc., makes a purchase of crystal glassware from a firm in Switzerland for 39,960 Swiss francs, or $24,000, at the spot rate of 1.665 francs per dollar. The terms of the purchase are net 90 days, and the U.S. firm wants to cover this trade payable with a forward market hedge to eliminate its exchange rate risk. Suppose the firm completes a forward hedge at the 90-day forward rate of 1.682 francs. If the spot rate in 90 days is actually 1.6580 francs, how much will the U.S. firm have saved or lost in U.S. dollars by hedging its exchange rate exposure?

- A US investor wishes to invest in a British firm currently selling for GBP 40 a share. He has $10 000 to invest, and the current exchange is $2/GBP. Required: (a) How many shares can the investor purchase? (b) Given share prices of GBP 35, 40 and 45, and exchange rates of $/GBP 1.80, 2 and 2.20 respectively, calculate the $ and GBP rates of return for each of the nine scenarios (three possible prices per share in GBP times three possible exchange rates. (c) If each of the nine outcomes is equally likely, find the standard deviation of both the GBP and $ denominated rates of return.A US investor wishes to invest in a British firm currently selling for GBP 40 a share. He has $10 000 to invest, and the current exchange is $2/GBP. Required: (a) How many shares can the investor purchase? (b) Given share prices of GBP 35, 40 and 45, and exchange rates of $/GBP 1.80, 2 and 2.20 respectively, calculate the $ and GBP rates of return for each of the nine scenarios (three possible prices per share in GBP times three possible exchange rates?In the spot market, 1 Philippine peso can be exchanged for 2.51 Japanese yen. In the 1-year forward market, 1 Philippine peso can be exchanged for 2.53 Japanese yen. The 1-year, risk-free rate of interest is 5 percent in the Philippines. If interest rate parity holds, what is the yield today on 1-year, risk-free Japanese securities?

- In one sense, international investing may be viewed as no more than a straight-forward generalisation of portfolio selection in a domestic market on the other hand, international investments pose problems not encountered in domestic markets. (a) In what ways can the challenges and problems of international investing be mitigated or managed? Outline and discuss the approaches in detail. (b)An investment in risk-free British government securities paying 10% annual interest in British pounds is made by an American investor who starts with $ 20 000. The current exchange rate is $2 per pound. At the end of the year the pound depreciates against the dollar. Calculate the investor’s return in both dollar and pound what if the exchange rate is $2.00, and $2.20?Cheng has a 80,000 foreign currency receivable due in 60 days. What is the appropriate action for Cheng to take today if it wishes to hedge its foreign exchange exposure. a. Enter into a FX spot contract today, purchasing foreign currency and selling US dollars b. Sell an FX option today to a Bank, giving the Bank the right but not the obligation to sell to Roberts 50,000 foreign currency and buy US dollars in 60 days. c. Enter into an FX forward today buying foreign currency and selling US dollars for settlement in 60 days d. Enter into an FX forward today buying US dollars and selling foreign currency for settlement in 60 days. e. Buy an FX option today giving Roberts the right but not the obligation to buy 50,000 foreign currency and sell US dollars in 60 daysT Khan is a U.S.-based investor. Mr. Khan does not believe that the international Fisher effect (IFE) holds. Current one-year interest rates in Singapore are 12 percent, while one-year interest rates in the United States are 8 percent. Khan converts $800,000 to Singapore dollars and invests them in Singapore money market security. One year later, he converts the Singapore dollars back to U.S. dollars. The current spot rate of the Singapore dollar is $.7220. According to the IFE, what should the spot rate of the Singapore dollar in one-year be?