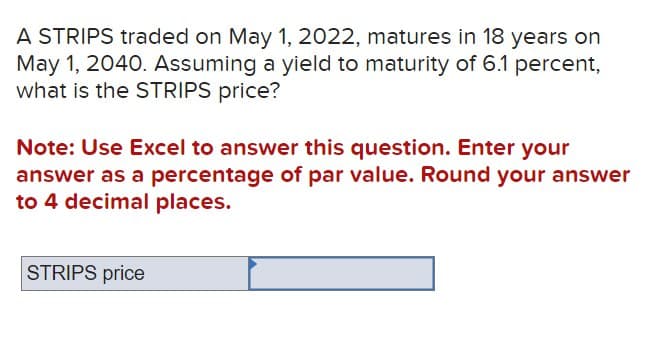

A STRIPS traded on May 1, 2022, matures in 18 years on May 1, 2040. Assuming a yield to maturity of 6.1 percent, what is the STRIPS price? Note: Use Excel to answer this question. Enter your answer as a percentage of par value. Round your answe to 4 decimal places. STRIPS price

Q: A suburban taxi company is considering buying taxis with diesel engines instead of gasoline engines.…

A: EUAC is the equivalent annual uniform cost which is equivalent to all cost that are applicable…

Q: Assume that you invested $400,000 in a stock that returned 6%, $300,000 invested in another that…

A: To calculate the overall return earned from the investments, you need to find the weighted average…

Q: Assume Gillette Corporation will pay an annual dividend of $0.61 one year from now. Analysts expect…

A: The value of the stock today is the sum of the present value of its future cash flows such as…

Q: [+] to determine the regular payment amount, rounded to the nearest dollar. Conside lowing pair of…

A: A loan to a borrower given by the bank/ financial institution which helpful to the borrower in…

Q: You have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ),…

A: NPV is defined as the sum of the present values of all future cash inflows less the sum of the…

Q: ased on Exhibit 9-9, or using a financial calculator, what would be the monthly mortgage payments…

A: Amortization refers to the process of gradually paying off a debt, typically a loan, through regular…

Q: Darcy holds a 200 day note from Brenda. This note was given by Brenda to Darcy since the former ow…

A:

Q: Project Analysis You are considering a new product launch. The project will cost $1.675 million,…

A: Net Present Value, is a financial measure utilized to gauge the profitability of an investment or…

Q: An investor invests 30% of his funds in risk free asset and the remaining 70% of funds in an index…

A: The objective of the question is to calculate the expected return and risk of a portfolio using the…

Q: IBM is planning to produce an expert system based on artificial intelligence and expects the…

A: Profitability index (PI) refers to a method which is used in the capital budgeting process to rank…

Q: Project A would cost $47,027.00 today and have the following other expected cash flows: $27,934.00…

A: Capital budgeting refers to the concept used for evaluating the viability of the project by the…

Q: You've collected the following information from your favorite financial website. 52-Week Price…

A: For Georgette, Incorporated,Dividend = 2.1452-week high price = 56.4152-week low price = 34.02The…

Q: All other things being equal, if a company issues a 1% stock dividend, what is the effect on the…

A: Dividends are a source of income for the shareholders of the company. These are paid to both…

Q: Intro IBM is planning to produce an expert system based on artificial intelligence and expects the…

A: Profitability index1.106Explanation:Step 1:We have to calculate the profitability index of the…

Q: ted. First cost, $ Equipment replaceme year 2, $ Annual operating cos Salvage value, $ Life, years…

A: Equivalent annual cost is that cost which includes the all cost including the cost of operating and…

Q: you purchase a bond with an invoice price of $1025. the bond has a coupon rate of 5.51 percent, it…

A: A bond is an instrument of debt on which coupons are paid by the issuer. Coupons may be paid in…

Q: Diversification will reduce risk is securities returns are negatively correlated. TRUE FALSE

A: Diversification can reduce risk if securities have negative correlations because when one security's…

Q: A stock sells for a price of $60. Next year's dividend will be $3 per share. If the ROE ("project…

A: Current stock price (P0) = $60Next year expected dividend (D1) = $3Project Return (ROE) = 10% or…

Q: You shorted a call option on Intuit stock with a strike price of $38. When you sold (wrote) the…

A: Shorting a call option involves selling (writing) a call option contract, which gives the buyer the…

Q: Katec Corporation borrowed $79000.00 at 3% compounded monthly for 13 years to buy a warehouse. Equal…

A: Amotization of loan is a systematic and regular repayment of loan in interest over a period of time.…

Q: If 1) the expected return for Mindy's Mending stock is 14.61 percent; 2) the dividend is expected to…

A: The current price of the stock can be obtained by adding the present value of a stock's future cash…

Q: Rare Agri-Products Ltd. is considering a new project with a projectedlife of seven (7) years. The…

A: The objective of the question is to evaluate the financial feasibility of a new project for Rare…

Q: Please show how to solve this in Excel using Excel formulas and please show the spreadsheet so I can…

A: A mortgage is the amount borrowed from lending institutions at a prevalent interest rate, it…

Q: Masulis Inc. is considering a project that has the following cash flow and WACC data. What is the…

A: Discounted Payback Period is the duration of time in which the present value of cash flows is equal…

Q: CH.8 STOCK MARKET, HW4, DUE IS ON MONDAY, MARCH 25, BEFORE 11AM Please show your calculation step by…

A: The objective of the question is to calculate the pretax capital gain yield, pretax dividend yield…

Q: After Tax Cost of a Bond's Interest payment: Calculate the after tax cost to a company in the 21%…

A: A bond is a capital market instrument that offers a fixed set of periodic payments throughout the…

Q: vvk.3 A bond has a $1,000 par value bond with a 4% annual coupon rate and it matures in 8 years.…

A: The objective of the question is to find the price of the bond given its par value, annual coupon…

Q: Bob Smith borrowed $800,000 on Jan 1, 2022. This amount, plus accrued interest at 12% compounded…

A: We have the amount borrowed ,rate of interest and term after whcih the same needs to be reapid. We…

Q: You are the financial analyst for a tennis racket manufacturer. The company is considering using a…

A: Life of project = 5 yearsDiscount rate = 14%Tax rate = 21%To find: NPV of the project under all 3…

Q: Jessie owns one share of stock of Lucky Hare and one share of stock of Glacial Tortoise. The total…

A: Total Combined Value of both shares = $595.77Lucky Hare StockExpected return (rL) = 10.60% or…

Q: uge to or loss of a dwelling and personal property of of g protects the beneficiary against the…

A: The objective of the question is to understand the various aspects of insurance and how it works. It…

Q: You have a 30-year Treasury of $1,000 face value that pays 4.4% coupons yearly and has 7.5 years…

A: The bond price is equal to the sum of the money required to purchase one today. This price accounts…

Q: IBM is planning to produce an expert system based on artificial intelligence and expects the…

A: YearCash Flow0-49000000110000000215000000320000000430000000Rate of return is 12%Project's…

Q: he concept of lean manufacturing includes, among other things, a desire to minimize net working…

A: NPV is the main capital budgeting based on the time value of money and can be obtained as the…

Q: You have bids to install solar panels on your roof from two companies: SunCo and PowerPlus. SunCo…

A: Equivalent Annual Cost refers to the annual maintenance cost of using and operating the machine to…

Q: Blooper Industries must replace its magnoosium purification system. Quick & Dirty Systems sells a…

A: Quick & Dirty system(Cheap System)Do it Right system (Expensive System)Cost$12.00$13.00Useful…

Q: Metallica Bearings, Incorporated, is a young start-up company. No dividends will be paid on the…

A: Expected Dividend 10 years from today (D10) = $12Constant growth rate after 10 years (g) = 6% or…

Q: The Fleming Manufacturing Company is considering a new investment. Financial projections for the…

A: We have been given initial investment, yearly sales and expenses , yealy working capital requirments…

Q: After visiting several automobile dealerships, Richard selects the used car he wants. He likes its…

A: In this as per guidelines, three question will be solved, for remaining repost question.

Q: Amanda borrowed $6,095 from her best friend, 11 months later, Amanda repaid her $7,005. Calculate…

A: The objective of the question is to calculate the effective annual interest rate for a loan that…

Q: 7. Mr. Murty, a retired govt. officer, has recently received his retirement benefits, viz. provident…

A: Solution is the given below Explanation:We first specify the decision variables and constraints,…

Q: You are the CFO of Ivanhoe, Inc., a retailer of the exercise machine Ivanhoe6 and related…

A: in this we have to calculate initial investment and present value of cash flow and find out net…

Q: The Bouchard Company's EPS was $6.50 in 2021, up from $4.42 in 2016. The company pays out 30% of its…

A: To apply the constant dividend growth model, 2 requirements have to be fulfilled:(1) The growth rate…

Q: If the interest rate is 5%, then the capitalized value of an investment that would be $ pays $8 per…

A: The capitalized value of an investment is the present value of the stream of income that the…

Q: Prepare an amortization schedule for a three-year loan of $63,000. The interest rate is 10 percent…

A: The problem case wants to create the loan amortization schedule for the loan that is to be repaid in…

Q: Crate stock is expected to pay dividends of $1 per share one year from today, and $1.5 per share in…

A: Option (4) $16.61Explanation:Given information, Dividend in one year (D1) = $1Dividend in year two…

Q: i) the root causes of the Greek predicaments; (ii) the costs and benefits of staying in the…

A: The scenario pertaining to nation G would not exist in any of the EU members that have embraced the…

Q: Chris Lavigne invested a total of $10,200 in the AIC Diversified Canada Mutual Fund. The management…

A: Management fees is the fees charged by mutual fund manager for managing the portfolio of securities…

Q: Your eccentric Aunt Claudia has left you $50,000 in BP shares plus $50,000 cash. Unfortunately, her…

A: Portfolio variance:Portfolio variance serves as a fundamental metric in investment analysis,…

Q: ces Suppose your firm is considering investing in a project with the cash flows shown below, that…

A: MIRR is stands for modified internal rate of return. It is one of the capital budgeting method to…

Step by step

Solved in 3 steps with 2 images

- A STRIPS traded on April 30, 2020, matures in 18 years on May 1, 2038. Assuming a yield to maturity of 6 percent, what is the STRIPS price? Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.Finance A STRIPS traded on April 30, 2020, matures in 18 years on May 1, 2038. Assuming a yield to maturity of 6 percent, what is the STRIPS price?A Treasury bill that settles on May 18, 2022, pays $100,000 on August 21, 2022. Assuming a discount rate of 3.87 percent, what are the price and bond equivalent yield? Use Excel to answer this question. Note: Round your price answer to 2 decimal places. Enter your yield answer as a percent rounded to 3 decimal places.

- On July 30, 2021, the following information was available to an investor: Yield on 10 Year TIPS: 0.58% Yield on 10-year Treasury notes: 2.31% What was the expected annual rate of inflation over the next 10 years as of June 30, 2020?8. On January 28, 2011 a T-bill was issued with a face value of $170000 and a maturity date of July 22, 2011. If it was purchased for $164862.17 on the date it was issued, what yield is the investor realizing?You placed $120,000 in your future trading account have just bought your first HSI June 2023 futures contract today @ 19,652, at market close the HSI June 2023 future closed at 19,534. Currently the initial margin for HSI is $101,944, the maintenance margin is $81,555. HSI futures is $50 per index point. What is you margin account balance as of market closed today? Please write out the detailed calculation steps

- Value on July 15, 2021, a bond paying an annual coupon of 0.25% with a face value of 1,000 euros and maturing on July 6, 2036, assuming a market yield of 0.05%.YIELD TO CALL It is now January 1, 2018, and you are considering the purchase of an outstanding bond that was issued on January 1, 2016. It has an 8% annual coupon and had a 30-year original maturity. (It matures on December 31, 2045.) There is 5 years of call pro-tection (until December 31, 2020), after which time it can be called at 108—that is, at 108% of par, or $1,080. Interest rates have declined since it was issued, and it is now selling at 119.12% of par, or $1,191.20. a. What is the yield to maturity? What is the yield to call? b. If you bought this bond, which return would you actually earn? Explain your reasoning. c. Suppose the bond had been selling at a discount rather than a premium. Would the yield to maturity have been the most likely return, or would the yield to call have been most likelSuppose that you purchase the t bill maturing on November 18 2023 for $9993.793. The T bill matures 133 days aftef the settlment date july 9 2023 and has a face value of $10000. What is the T bill asked discount yield?

- Assume that in 2020, a Liberty Seated half dollar issued in 1890 was sold for $197,000. What was the rate of return on this investment? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.The par value of 10% debenture is $1,000 with maturity is 3 years. What would be the price by general floating formula if interest rate is 12%, Use excel.On May 13, 2022, you purchased a 1000 USD par treasury note that matures on December 15, 2024. The coupon rate is 4% and price is 101. What is the accrued interest rate?