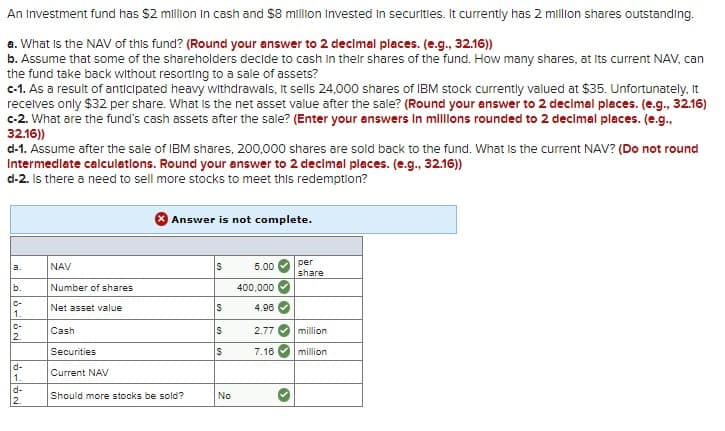

An Investment fund has $2 million in cash and $8 million Invested in securities. It currently has 2 million shares outstanding. a. What is the NAV of this fund? (Round your answer to 2 decimal places. (e.g., 32.16)) b. Assume that some of the shareholders decide to cash in their shares of the fund. How many shares, at its current NAV, can the fund take back without resorting to a sale of assets? c-1. As a result of anticipated heavy withdrawals, it sells 24,000 shares of IBM stock currently valued at $35. Unfortunately, It receives only $32 per share. What is the net asset value after the sale? (Round your answer to 2 decimal places. (e.g., 32.16) c-2. What are the fund's cash assets after the sale? (Enter your answers in millions rounded to 2 decimal places. (e.g., 32.16)) d-1. Assume after the sale of IBM shares, 200,000 shares are sold back to the fund. What is the current NAV? (Do not round Intermediate calculations. Round your answer to 2 decimal places. (e.g., 32.16)) d-2. Is there a need to sell more stocks to meet this redemption? Answer is not complete. a. NAV S 5.00 per share 66-62 b. Number of shares 400,000 C- Net asset value S 4.96 1. C- Cash S 2.77 million 2. Securities $ 7.16 million PLAN d- Current NAV 1. d- 2. Should more stocks be sold? No

An Investment fund has $2 million in cash and $8 million Invested in securities. It currently has 2 million shares outstanding. a. What is the NAV of this fund? (Round your answer to 2 decimal places. (e.g., 32.16)) b. Assume that some of the shareholders decide to cash in their shares of the fund. How many shares, at its current NAV, can the fund take back without resorting to a sale of assets? c-1. As a result of anticipated heavy withdrawals, it sells 24,000 shares of IBM stock currently valued at $35. Unfortunately, It receives only $32 per share. What is the net asset value after the sale? (Round your answer to 2 decimal places. (e.g., 32.16) c-2. What are the fund's cash assets after the sale? (Enter your answers in millions rounded to 2 decimal places. (e.g., 32.16)) d-1. Assume after the sale of IBM shares, 200,000 shares are sold back to the fund. What is the current NAV? (Do not round Intermediate calculations. Round your answer to 2 decimal places. (e.g., 32.16)) d-2. Is there a need to sell more stocks to meet this redemption? Answer is not complete. a. NAV S 5.00 per share 66-62 b. Number of shares 400,000 C- Net asset value S 4.96 1. C- Cash S 2.77 million 2. Securities $ 7.16 million PLAN d- Current NAV 1. d- 2. Should more stocks be sold? No

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 7FPE

Related questions

Question

Bhupatbhai

Transcribed Image Text:An Investment fund has $2 million in cash and $8 million Invested in securities. It currently has 2 million shares outstanding.

a. What is the NAV of this fund? (Round your answer to 2 decimal places. (e.g., 32.16))

b. Assume that some of the shareholders decide to cash in their shares of the fund. How many shares, at its current NAV, can

the fund take back without resorting to a sale of assets?

c-1. As a result of anticipated heavy withdrawals, it sells 24,000 shares of IBM stock currently valued at $35. Unfortunately, It

receives only $32 per share. What is the net asset value after the sale? (Round your answer to 2 decimal places. (e.g., 32.16)

c-2. What are the fund's cash assets after the sale? (Enter your answers in millions rounded to 2 decimal places. (e.g.,

32.16))

d-1. Assume after the sale of IBM shares, 200,000 shares are sold back to the fund. What is the current NAV? (Do not round

Intermediate calculations. Round your answer to 2 decimal places. (e.g., 32.16))

d-2. Is there a need to sell more stocks to meet this redemption?

Answer is not complete.

a.

NAV

S

5.00

per

share

66-62

b.

Number of shares

400,000

C-

Net asset value

S

4.96

1.

C-

Cash

S

2.77

million

2.

Securities

$

7.16

million

PLAN

d-

Current NAV

1.

d-

2.

Should more stocks be sold?

No

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning