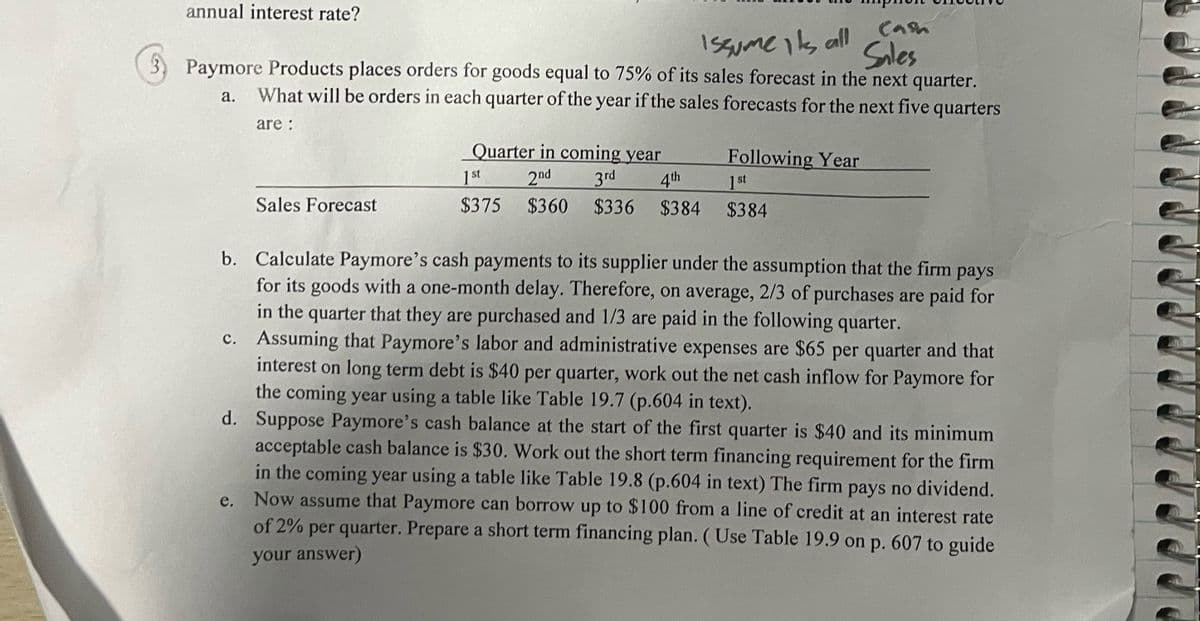

annual interest rate? a. are: Issume its all 3 Paymore Products places orders for goods equal to 75% of its sales forecast in the next quarter. Sales What will be orders in each quarter of the year if the sales forecasts for the next five quarters Cash Quarter in coming year Following Year 1st 2nd 3rd 4th 1st Sales Forecast $375 $360 $336 $384 $384 b. Calculate Paymore's cash payments to its supplier under the assumption that the firm pays for its goods with a one-month delay. Therefore, on average, 2/3 of purchases are paid for in the quarter that they are purchased and 1/3 are paid in the following quarter. c. Assuming that Paymore's labor and administrative expenses are $65 per quarter and that interest on long term debt is $40 per quarter, work out the net cash inflow for Paymore for the coming year using a table like Table 19.7 (p.604 in text). d. Suppose Paymore's cash balance at the start of the first quarter is $40 and its minimum acceptable cash balance is $30. Work out the short term financing requirement for the firm in the coming year using a table like Table 19.8 (p.604 in text) The firm pays no dividend. e. Now assume that Paymore can borrow up to $100 from a line of credit at an interest rate of 2% per quarter. Prepare a short term financing plan. (Use Table 19.9 on p. 607 to guide your answer)

annual interest rate? a. are: Issume its all 3 Paymore Products places orders for goods equal to 75% of its sales forecast in the next quarter. Sales What will be orders in each quarter of the year if the sales forecasts for the next five quarters Cash Quarter in coming year Following Year 1st 2nd 3rd 4th 1st Sales Forecast $375 $360 $336 $384 $384 b. Calculate Paymore's cash payments to its supplier under the assumption that the firm pays for its goods with a one-month delay. Therefore, on average, 2/3 of purchases are paid for in the quarter that they are purchased and 1/3 are paid in the following quarter. c. Assuming that Paymore's labor and administrative expenses are $65 per quarter and that interest on long term debt is $40 per quarter, work out the net cash inflow for Paymore for the coming year using a table like Table 19.7 (p.604 in text). d. Suppose Paymore's cash balance at the start of the first quarter is $40 and its minimum acceptable cash balance is $30. Work out the short term financing requirement for the firm in the coming year using a table like Table 19.8 (p.604 in text) The firm pays no dividend. e. Now assume that Paymore can borrow up to $100 from a line of credit at an interest rate of 2% per quarter. Prepare a short term financing plan. (Use Table 19.9 on p. 607 to guide your answer)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 4MC

Related questions

Question

Transcribed Image Text:annual interest rate?

a.

are:

Issume its all

3 Paymore Products places orders for goods equal to 75% of its sales forecast in the next quarter.

Sales

What will be orders in each quarter of the year if the sales forecasts for the next five quarters

Cash

Quarter in coming year

Following Year

1st

2nd

3rd

4th

1st

Sales Forecast

$375

$360

$336 $384

$384

b. Calculate Paymore's cash payments to its supplier under the assumption that the firm pays

for its goods with a one-month delay. Therefore, on average, 2/3 of purchases are paid for

in the quarter that they are purchased and 1/3 are paid in the following quarter.

c. Assuming that Paymore's labor and administrative expenses are $65 per quarter and that

interest on long term debt is $40 per quarter, work out the net cash inflow for Paymore for

the coming year using a table like Table 19.7 (p.604 in text).

d. Suppose Paymore's cash balance at the start of the first quarter is $40 and its minimum

acceptable cash balance is $30. Work out the short term financing requirement for the firm

in the coming year using a table like Table 19.8 (p.604 in text) The firm pays no dividend.

e. Now assume that Paymore can borrow up to $100 from a line of credit at an interest rate

of 2% per quarter. Prepare a short term financing plan. (Use Table 19.9 on p. 607 to guide

your answer)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 1 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT