Chapter ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fnewconnect.mheducation xam 3-Chapter 15, 16, and 17 Saved 15 The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars): Pretax accounting income: Pretax accounting income included: Overweight fines (not deductible for tax purposes 2 2 9279-42 Skippe $ 160 8 80 119 Depreciation expense Depreciation in the tax return The applicable tax rate is 25%. There are no other temporary or permanent differences. Franklin's taxable income ($ in millions) is: Multiple Choice Type here to search W $121 G Y H < Prev 15 of 38 Next > F8 Z 74°F Clear F9 F10 F119 F12 PrtScr Insert Delete

Chapter ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fnewconnect.mheducation xam 3-Chapter 15, 16, and 17 Saved 15 The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars): Pretax accounting income: Pretax accounting income included: Overweight fines (not deductible for tax purposes 2 2 9279-42 Skippe $ 160 8 80 119 Depreciation expense Depreciation in the tax return The applicable tax rate is 25%. There are no other temporary or permanent differences. Franklin's taxable income ($ in millions) is: Multiple Choice Type here to search W $121 G Y H < Prev 15 of 38 Next > F8 Z 74°F Clear F9 F10 F119 F12 PrtScr Insert Delete

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 3.1ADM

Related questions

Question

Transcribed Image Text:Chapter

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fnewconnect.mheducation

xam 3-Chapter 15, 16, and 17

Saved

15

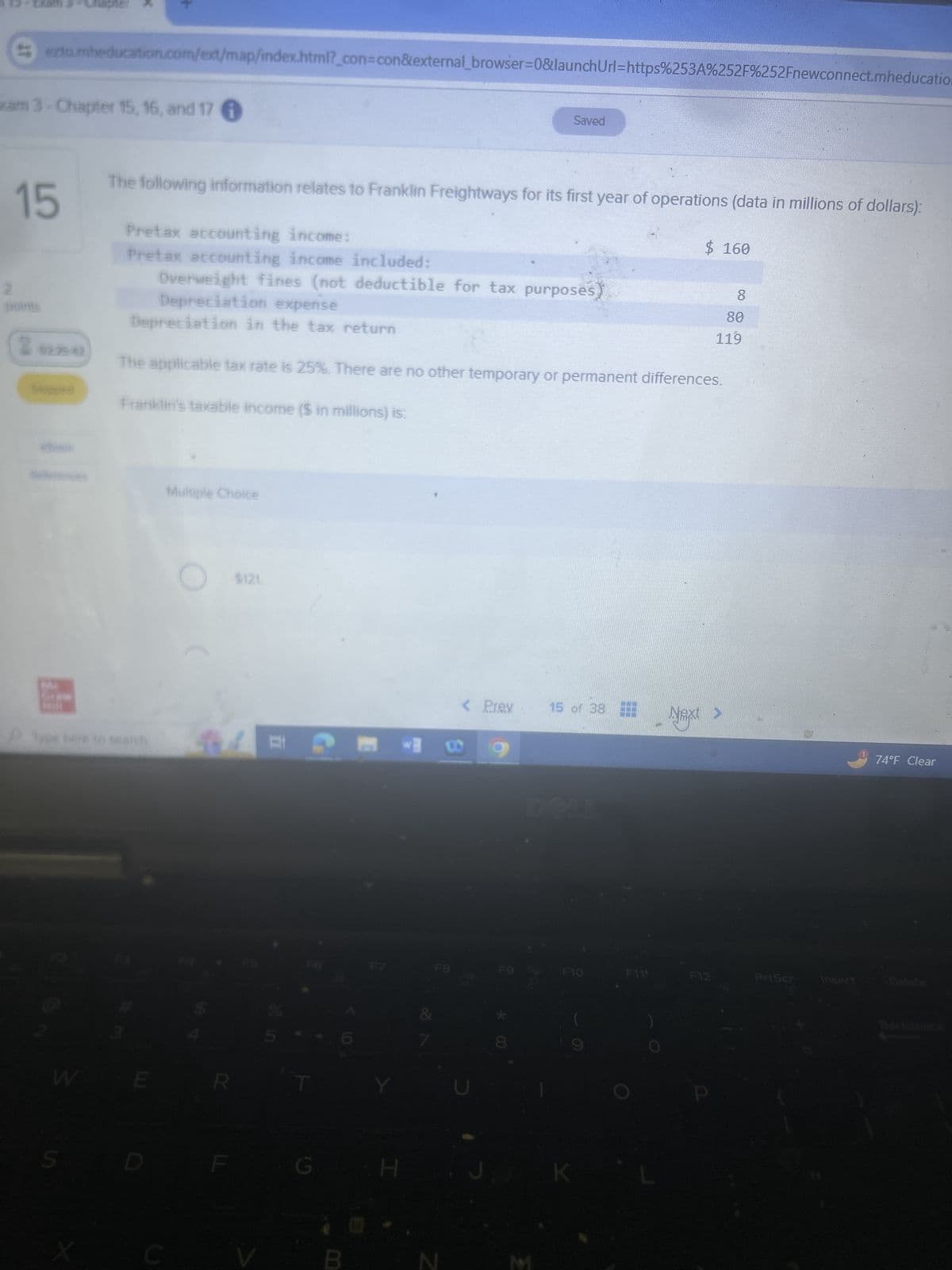

The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars):

Pretax accounting income:

Pretax accounting income included:

Overweight fines (not deductible for tax purposes

2

2

9279-42

Skippe

$ 160

8

80

119

Depreciation expense

Depreciation in the tax return

The applicable tax rate is 25%. There are no other temporary or permanent differences.

Franklin's taxable income ($ in millions) is:

Multiple Choice

Type here to search

W

$121

G

Y

H

< Prev

15 of 38

Next >

F8

Z

74°F Clear

F9

F10

F119

F12

PrtScr

Insert

Delete

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning