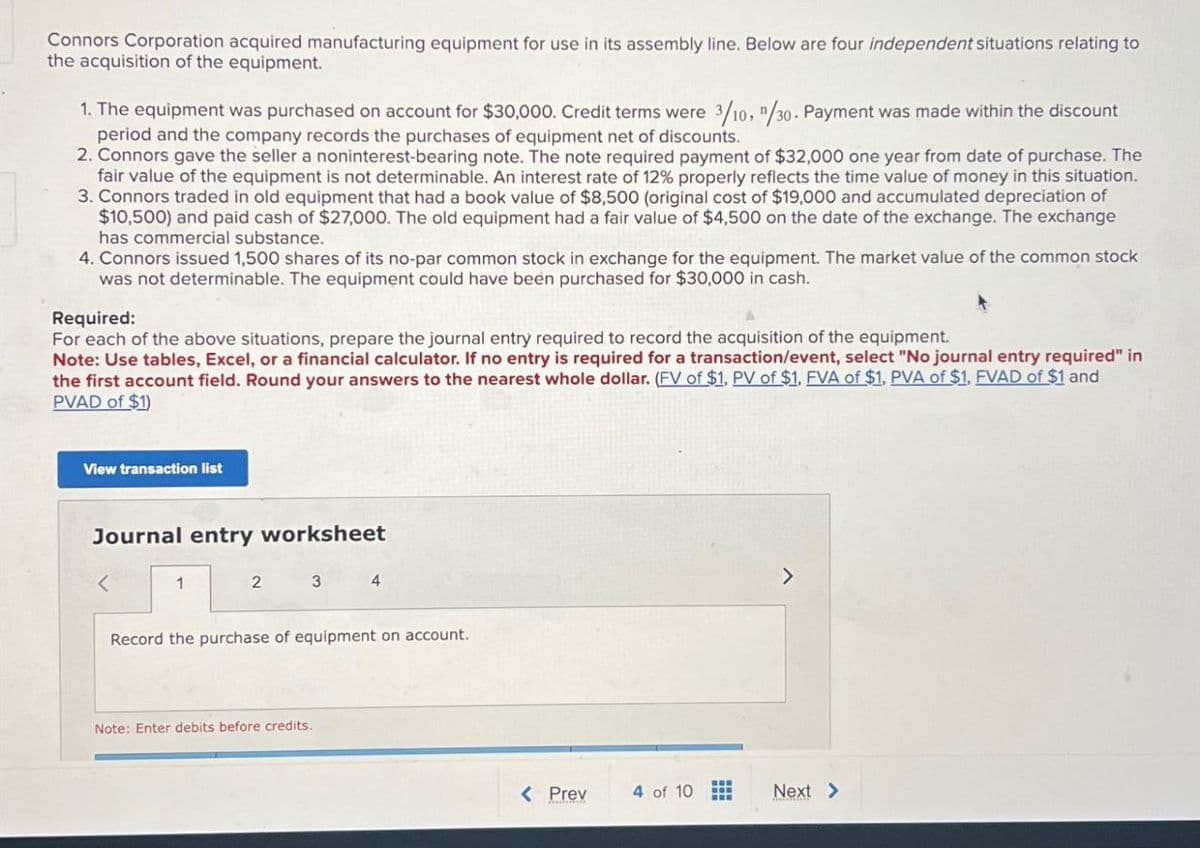

Connors Corporation acquired manufacturing equipment for use in its assembly line. Below are four independent situations relating to the acquisition of the equipment. 1. The equipment was purchased on account for $30,000. Credit terms were 3/10, 1/30. Payment was made within the discount period and the company records the purchases of equipment net of discounts. 2. Connors gave the seller a noninterest-bearing note. The note required payment of $32,000 one year from date of purchase. The fair value of the equipment is not determinable. An interest rate of 12% properly reflects the time value of money in this situation. 3. Connors traded in old equipment that had a book value of $8,500 (original cost of $19,000 and accumulated depreciation of $10,500) and paid cash of $27,000. The old equipment had a fair value of $4,500 on the date of the exchange. The exchange has commercial substance. 4. Connors issued 1,500 shares of its no-par common stock in exchange for the equipment. The market value of the common stock was not determinable. The equipment could have been purchased for $30,000 in cash.

Connors Corporation acquired manufacturing equipment for use in its assembly line. Below are four independent situations relating to the acquisition of the equipment. 1. The equipment was purchased on account for $30,000. Credit terms were 3/10, 1/30. Payment was made within the discount period and the company records the purchases of equipment net of discounts. 2. Connors gave the seller a noninterest-bearing note. The note required payment of $32,000 one year from date of purchase. The fair value of the equipment is not determinable. An interest rate of 12% properly reflects the time value of money in this situation. 3. Connors traded in old equipment that had a book value of $8,500 (original cost of $19,000 and accumulated depreciation of $10,500) and paid cash of $27,000. The old equipment had a fair value of $4,500 on the date of the exchange. The exchange has commercial substance. 4. Connors issued 1,500 shares of its no-par common stock in exchange for the equipment. The market value of the common stock was not determinable. The equipment could have been purchased for $30,000 in cash.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5PA: Jada Company had the following transactions during the year: Purchased a machine for $500,000 using...

Related questions

Question

Transcribed Image Text:Connors Corporation acquired manufacturing equipment for use in its assembly line. Below are four independent situations relating to

the acquisition of the equipment.

1. The equipment was purchased on account for $30,000. Credit terms were 3/10, 1/30. Payment was made within the discount

period and the company records the purchases of equipment net of discounts.

2. Connors gave the seller a noninterest-bearing note. The note required payment of $32,000 one year from date of purchase. The

fair value of the equipment is not determinable. An interest rate of 12% properly reflects the time value of money in this situation.

3. Connors traded in old equipment that had a book value of $8,500 (original cost of $19,000 and accumulated depreciation of

$10,500) and paid cash of $27,000. The old equipment had a fair value of $4,500 on the date of the exchange. The exchange

has commercial substance.

4. Connors issued 1,500 shares of its no-par common stock in exchange for the equipment. The market value of the common stock

was not determinable. The equipment could have been purchased for $30,000 in cash.

Required:

For each of the above situations, prepare the journal entry required to record the acquisition of the equipment.

Note: Use tables, Excel, or a financial calculator. If no entry is required for a transaction/event, select "No journal entry required" in

the first account field. Round your answers to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and

PVAD of $1)

View transaction list

Journal entry worksheet

1

2

3

4

Record the purchase of equipment on account.

Note: Enter debits before credits.

>

< Prev

4 of 10

Next >

Auditifs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College