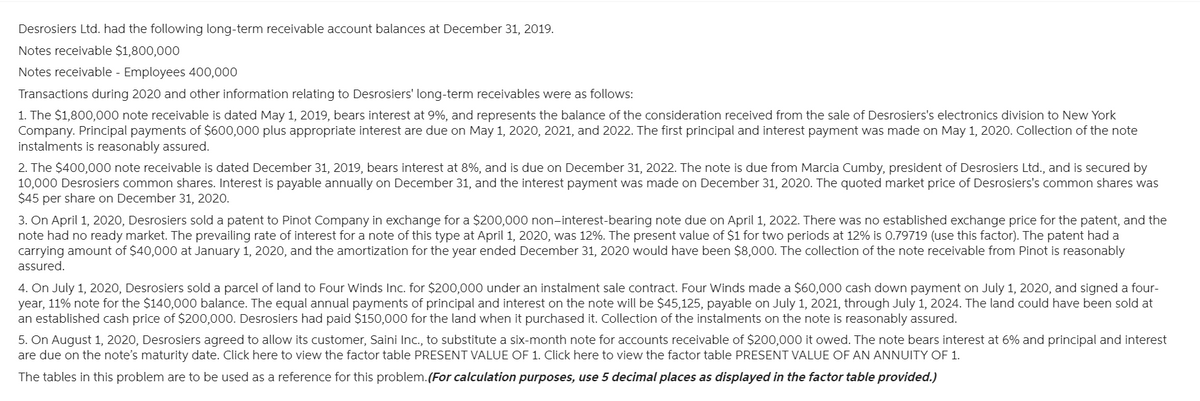

Desrosiers Ltd. had the following long-term receivable account balances at December 31, 2019. Notes receivable $1,800,000 Notes receivable - Employees 400,000 Transactions during 2020 and other information relating to Desrosiers' long-term receivables were as follows: 1. The $1,800,000 note receivable is dated May 1, 2019, bears interest at 9%, and represents the balance of the consideration received from the sale of Desrosiers's electronics division to New York Company. Principal payments of $600,000 plus appropriate interest are due on May 1, 2020, 2021, and 2022. The first principal and interest payment was made on May 1, 2020. Collection of the note instalments is reasonably assured. 2. The $400,000 note receivable is dated December 31, 2019, bears interest at 8%, and is due on December 31, 2022. The note is due from Marcia Cumby, president of Desrosiers Ltd., and is secured by 10,000 Desrosiers common shares. Interest is payable annually on December 31, and the interest payment was made on December 31, 2020. The quoted market price of Desrosiers's common shares was $45 per share on December 31, 2020. 3. On April 1, 2020, Desrosiers sold a patent to Pinot Company in exchange for a $200,000 non-interest-bearing note due on April 1, 2022. There was no established exchange price for the patent, and the note had no ready market. The prevailing rate of interest for a note of this type at April 1, 2020, was 12%. The present value of $1 for two periods at 12% is 0.79719 (use this factor). The patent had a carrying amount of $40,000 at January 1, 2020, and the amortization for the year ended December 31, 2020 would have been $8,000. The collection of the note receivable from Pinot is reasonably assured. 4. On July 1, 2020, Desrosiers sold a parcel of land to Four Winds Inc. for $200,000 under an instalment sale contract. Four Winds made a $60,000 cash down payment on July 1, 2020, and signed a four- year, 11% note for the $140,000 balance. The equal annual payments of principal and interest on the note will be $45,125, payable on July 1, 2021, through July 1, 2024. The land could have been sold at an established cash price of $200,000. Desrosiers had paid $150,000 for the land when it purchased it. Collection of the instalments on the note is reasonably assured. 5. On August 1, 2020, Desrosiers agreed to allow its customer, Saini Inc., to substitute a six-month note for accounts receivable of $200,000 it owed. The note bears interest at 6% and principal and interest are due on the note's maturity date. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. The tables in this problem are to be used as a reference for this problem.(For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

Desrosiers Ltd. had the following long-term receivable account balances at December 31, 2019. Notes receivable $1,800,000 Notes receivable - Employees 400,000 Transactions during 2020 and other information relating to Desrosiers' long-term receivables were as follows: 1. The $1,800,000 note receivable is dated May 1, 2019, bears interest at 9%, and represents the balance of the consideration received from the sale of Desrosiers's electronics division to New York Company. Principal payments of $600,000 plus appropriate interest are due on May 1, 2020, 2021, and 2022. The first principal and interest payment was made on May 1, 2020. Collection of the note instalments is reasonably assured. 2. The $400,000 note receivable is dated December 31, 2019, bears interest at 8%, and is due on December 31, 2022. The note is due from Marcia Cumby, president of Desrosiers Ltd., and is secured by 10,000 Desrosiers common shares. Interest is payable annually on December 31, and the interest payment was made on December 31, 2020. The quoted market price of Desrosiers's common shares was $45 per share on December 31, 2020. 3. On April 1, 2020, Desrosiers sold a patent to Pinot Company in exchange for a $200,000 non-interest-bearing note due on April 1, 2022. There was no established exchange price for the patent, and the note had no ready market. The prevailing rate of interest for a note of this type at April 1, 2020, was 12%. The present value of $1 for two periods at 12% is 0.79719 (use this factor). The patent had a carrying amount of $40,000 at January 1, 2020, and the amortization for the year ended December 31, 2020 would have been $8,000. The collection of the note receivable from Pinot is reasonably assured. 4. On July 1, 2020, Desrosiers sold a parcel of land to Four Winds Inc. for $200,000 under an instalment sale contract. Four Winds made a $60,000 cash down payment on July 1, 2020, and signed a four- year, 11% note for the $140,000 balance. The equal annual payments of principal and interest on the note will be $45,125, payable on July 1, 2021, through July 1, 2024. The land could have been sold at an established cash price of $200,000. Desrosiers had paid $150,000 for the land when it purchased it. Collection of the instalments on the note is reasonably assured. 5. On August 1, 2020, Desrosiers agreed to allow its customer, Saini Inc., to substitute a six-month note for accounts receivable of $200,000 it owed. The note bears interest at 6% and principal and interest are due on the note's maturity date. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. The tables in this problem are to be used as a reference for this problem.(For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

Transcribed Image Text:Desrosiers Ltd. had the following long-term receivable account balances at December 31, 2019.

Notes receivable $1,800,000

Notes receivable - Employees 400,000

Transactions during 2020 and other information relating to Desrosiers' long-term receivables were as follows:

1. The $1,800,000 note receivable is dated May 1, 2019, bears interest at 9%, and represents the balance of the consideration received from the sale of Desrosiers's electronics division to New York

Company. Principal payments of $600,000 plus appropriate interest are due on May 1, 2020, 2021, and 2022. The first principal and interest payment was made on May 1, 2020. Collection of the note

instalments is reasonably assured.

2. The $400,000 note receivable is dated December 31, 2019, bears interest at 8%, and is due on December 31, 2022. The note is due from Marcia Cumby, president of Desrosiers Ltd., and is secured by

10,000 Desrosiers common shares. Interest is payable annually on December 31, and the interest payment was made on December 31, 2020. The quoted market price of Desrosiers's common shares was

$45 per share on December 31, 2020.

3. On April 1, 2020, Desrosiers sold a patent to Pinot Company in exchange for a $200,000 non-interest-bearing note due on April 1, 2022. There was no established exchange price for the patent, and the

note had no ready market. The prevailing rate of interest for a note of this type at April 1, 2020, was 12%. The present value of $1 for two periods at 12% is 0.79719 (use this factor). The patent had a

carrying amount of $40,000 at January 1, 2020, and the amortization for the year ended December 31, 2020 would have been $8,000. The collection of the note receivable from Pinot is reasonably

assured.

4. On July 1, 2020, Desrosiers sold a parcel of land to Four Winds Inc. for $200,000 under an instalment sale contract. Four Winds made a $60,000 cash down payment on July 1, 2020, and signed a four-

year, 11% note for the $140,000 balance. The equal annual payments of principal and interest on the note will be $45,125, payable on July 1, 2021, through July 1, 2024. The land could have been sold at

an established cash price of $200,000. Desrosiers had paid $150,000 for the land when it purchased it. Collection of the instalments on the note is reasonably assured.

5. On August 1, 2020, Desrosiers agreed to allow its customer, Saini Inc., to substitute a six-month note for accounts receivable of $200,000 it owed. The note bears interest at 6% and principal and interest

are due on the note's maturity date. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1.

The tables in this problem are to be used as a reference for this problem. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

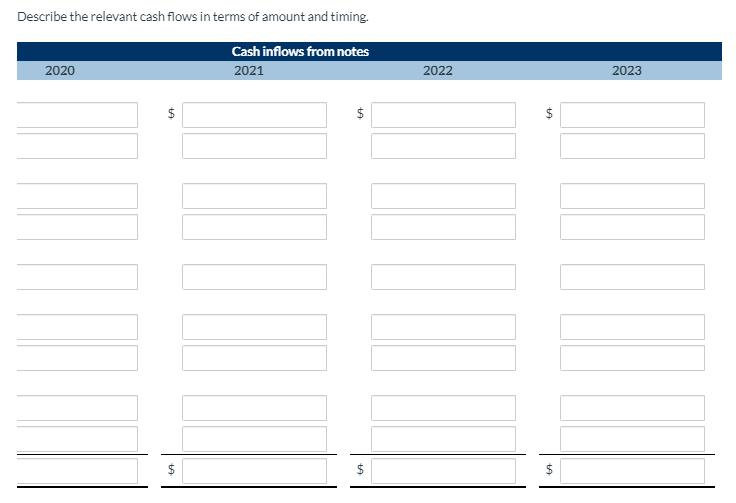

Transcribed Image Text:Describe the relevant cash flows in terms of amount and timing.

Cash inflows from notes

2020

$

2021

$

+A

2022

$

+A

$

2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT