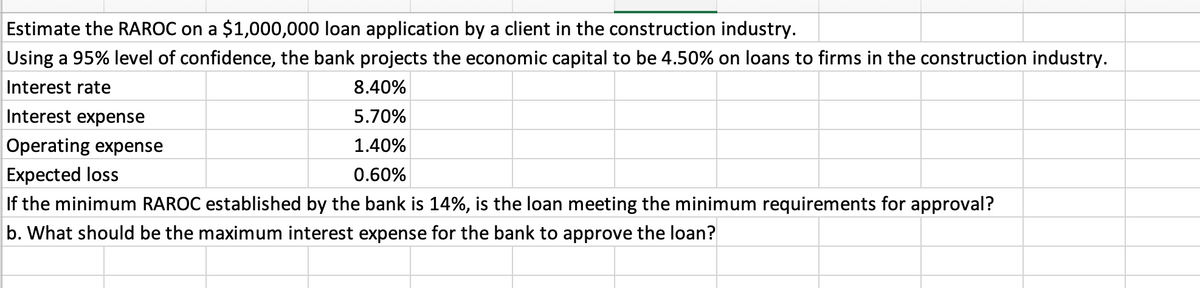

Estimate the RAROC on a $1,000,000 loan application by a client in the construction industry. Using a 95% level of confidence, the bank projects the economic capital to be 4.50% on loans to firms in the construction industry. Interest rate 8.40% 5.70% Interest expense Operating expense Expected loss 1.40% 0.60% If the minimum RAROC established by the bank is 14%, is the loan meeting the minimum requirements for approval? b. What should be the maximum interest expense for the bank to approve the loan?

Q: Currently, the number of outstanding shares issued by Ponggol Limited (“Ponggol”) is 25,000,000 and…

A: To calculate the weighted average cost of capital (WACC) for Ponggol Limited, we need to consider…

Q: Suppose you just bought an annuity with 12 annual payments of $15,700 at a discount rate of 11.75…

A: Annuity payment = $15,700Number of annuities = 12Discount rate = 11.75%

Q: Which of the following can be facilitated through your brokerage firm Providing investment…

A: The question is asking about the services that can be facilitated through a brokerage firm.…

Q: 9. What is the yield to maturity on a 4-year zero coupon bond with face value 100 and price equal to…

A: The objective of the question is to calculate the yield to maturity (YTM) on a 4-year zero coupon…

Q: An ovedraft interest of 15%per annum is negotiated on the overdrawn balance at the end of each…

A: The objective of this question is to calculate the interest on an overdraft of R235,256 at an annual…

Q: ReNew Corporation raises funds to build renewable energy systems by issuing 3-year bonds with a…

A: This question revolves around the concept of bond pricing, specifically how changes in market…

Q: You purchased a stock one year ago for $91.20. Today you sold the stock and realized a total return…

A: Total return = $30.8256Explanation:Step 1:Calculations:Total return=(End value-Beginning value +…

Q: A $345 000.00 mortgage is repaid in 19 years by making monthly payments of $ 2486.44. What is the…

A: The nominal annual rate of interest is the base interest rate for a loan or investment that is…

Q: i need the answer quickly

A: Preferred Stock refers to that type of stock that possesses equity and debt features. It is also…

Q: Question 4 (a) Consider a 3-year forward contract to buy a coupon-bearing bond thatwill mature…

A: a.Initial: Forward Price ≈ $90.903; b.18 Months Later: Forward Price ≈ $85.662.Explanation:Step…

Q: 9. Which factor(s) affect a bond rating? a. Likelihood of default b. Seniority of the bond c. The…

A: The first part of the question is asking about the factors that affect a bond rating. Bond rating is…

Q: Beyond Milk Co. has just invested $100 million into its business and forecasts that Its free cash…

A: The horizon value in financial valuation is the present value of all future cash flows beyond a…

Q: Waltz Corporation's 20-year bonds were issued 12 years ago. The bonds have a face value of $1,000…

A: Maturity period at the time of issue: 20 yearsNumber of years since the issue: 12 yearsCoupon rate:…

Q: Should the project be rejected and why?

A: The accounting return is comparing your earnings to your expenses. It is used to calculate the…

Q: A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a…

A: The Sharpe Ratio is a financial measure that analyzes the risk-adjusted performance of an investment…

Q: Problem 6-45 (LO. 3) Alex, who is single, conducts an activity in the current year that is…

A: To determine the amount of income Alex must report and the deductible expenses related to his hobby…

Q: Suppose you are going to receive $13,500 per year for five years. The appropriate interest rate is…

A: In an ordinary annuity, the cash flow occurs at the end of each period.Present value of ordinary…

Q: Light emitting diode (LEDs) light bulbs have become required in recent years, but do they make…

A: Break-even analysis is a financial calculation used to determine the point at which a business's…

Q: Currently, the spot exchange rate is $1.67 per £ and the three-month forward exchange rate is $1.69…

A: Spot rate = $1.67 per poundForward rate = $1.69 per pound3-month interest rate in US = 8%3-month…

Q: A 25-year bond with a par value of 1,000 and 10% coupons payable quarterly is selling at 925.…

A: Maturity period25Payments per year4Annual coupon rate10%Par value1000Selling price925

Q: Find the present value of the given annuity. $546 per month for 36 months at the rate of 3.9%…

A: Monthly payment = $546Number of months = 36Interest rate = 3.9%To find: Present value of the annuity

Q: Halliford Corporation expects to have earnings this coming year of $2.93 per share. Halliford plans…

A: Earnings this year = $2.93 per shareExpected return = 20.7%Cost of equity capital = 8.5%To find: The…

Q: A 3.20 percent coupon municipal bond has 10 years left to maturity and has a price quote of 96.45.…

A: Par value$5,000.00Coupon rate3.20%Years to maturity10Price quote96.45%Compounding frequency2Years to…

Q: Annual contributions of $1,000 will be made to a TFSA for 25 years. The contributor expects…

A: The objective of the question is to calculate the future value of an annuity (TFSA) under two…

Q: Nifty Dashboards just paid a dividend of Do = $1.28. Analysts expect the company's dividend to grow…

A: The Dividend Discount Model (DDM) is a method used to value a company's stock by estimating the…

Q: Baird Golf has decided to sell a new line of golf clubs. The clubs will sell for $715 per set and…

A: Cost of asset30100000Estimated life7Depreciation4300000Working capital investment1400000Working…

Q: Andouille Spices, Incorporated, has the following mutually exclusive projects available. The company…

A: When the acceptance of an investment alternative automatically results in the rejection of the rest…

Q: Consider a 25-year bond with a face value of $1,000 that has a coupon rate of 5.9%, with semiannual…

A: A bond is a fixed income security offering a defined set of periodic payments to the investor till…

Q: Suppose Johnson & Johnson and the Walgreen Company have the expected returns and volatilities shown…

A: The portfolio return can be found by multiplying the expected return for each with their individual…

Q: Horror Movies Co.'s preferred stock pays a dividend of $5.05 per quarter, and it sells for $103.00…

A: Effective annual rate of return is the interest rate paid on a loan that is adjusted for compounding…

Q: Consider the following two mutually exclusive projects: Year 0 1 2 3 Cash Flow (X) -$30,000 13,700…

A: > Given data:YearCashflow(X)Cashflow(Y)0-30000-30000113700156002142001220031340013300

Q: Suppose on May 31, 2022, the DJIA opened at 33,224.59. The divisor at that time was 0.15244. In June…

A: UNH price change = $511.78 * 0.05 = $ 25.59 (rounded to 2 decimal places) New UNH price =…

Q: You bought a house with price of $250,000. Your LTV (loan-to-value ratio) is 80%. You choose the…

A: Mortgage Amortization Schedule with Early Payment (Excel Spreadsheet)This spreadsheet calculates…

Q: How much money must you invest now at 4.1% interest compounded continuously in order to have $10,000…

A: In case of continuous compound,Future value = Present value x e ^(r x t)whereFuture value = amount…

Q: Given the dramatic decrease in a company's stock price last year, what would be the impact on the…

A: Stock price is the value of the company's stock in the market at a given time. Stock prices are…

Q: Total assets R1 162 000 Total equity R1 200 000 Net profit margin Sales 19.65% R1 890 000 Current…

A: The objective of the question is to calculate the Return on Assets (ROA) of KwaZulu Limited using…

Q: 1 Year Plan ☐ Projected Income ☐ Savings Goal ☐ Monthly Budget Bank Accounts and Lines of Credit…

A: Financial planning is very important in life because money is limited but wishes are many so one can…

Q: 3. (a) Debt is 20% of assets for an organization. Total assets are$10,000. The tax rate is 40%. The…

A: (a) Debt at 20% of AssetsCalculate Debt and Equity:Debt = 20% * $10,000 = $2,000Equity = $10,000 -…

Q: am. 112.

A: The objective of the question is to estimate the overhead costs for Bowen plc if it handles…

Q: Rare Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The…

A: The cost of capital that will be used for discounting the cash flows after tax can be referred as…

Q: a. Compute the rate of return on an equally weighted index of the three defense stocks for the year…

A: The equally weighted index functions similarly to a group in which all members have an equal voice.…

Q: The current debate about what corporate objectives should be

A: The current debate with respect to corporate objectives encompasses a wide range of perspectives,…

Q: Given the information below for HooYah! Corporation, compute the expected share price at the end of…

A: The stock price using the P/E ratio and EPS can be found by using the following formula:Similarly,…

Q: Gregory is an analyst at a wealth management firm. One of his clients holds a $7,500 portfolio that…

A: Portfolio:A portfolio is an investment in 2 or more assets to diversify risk. The efficient…

Q: Parents decided to set aside money for their child's higher education. The objective is to provide…

A:

Q: Wolfson Corporation has decided to purchase a new machine that costs $4 million. The machine will be…

A: NAL is the net present value of entering into a lease instead of buying an asset using borrowed…

Q: Suppose the 1-year and 2-year OIS rates are 2% and 4%, respectively. Consider an OIS swap with two…

A: 1-year OIS rate = 2%2-year OIS rate = 4%Fixed rate of the swap = 3%Principal = $1,000,000

Q: A 7-year project is expected to provide annual sales of $221,000 with costs of $97,500. The…

A: Worst-case scenario is determined as part of sensitivity analysis. As per this, the revenue and…

Q: Please help with question #2. The based country is Trinidad and the countries trading to is…

A: Main Foreign Currencies and Foreign Exchange Risk MitigationMain Foreign Currencies:Australian…

Q: You bought a house with price of $250,000. Your LTV (loan-to-value ratio) is 80%. You choose the…

A: Certainly! Let's break down each part of your question:a. Loan Amount:The loan amount is calculated…

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- Effective Cost of Short-Term Credit Yonge Corporation must arrange financing for its working capital requirements for the coming year. Yonge can: (a) borrow from its bank on a simple interest basis (interest payable at the end of the loan) for 1 year at a 12% nominal rate; (b) borrow on a 3-month, but renewable on rate with 12 end-of-month payments; or (d) obtain the needed funds by no longer taking discounts and thus increasing its accounts payable. Yonge buys on terms of 1/15, net 60. What is the effective annual cost (not the nominal cost) of the least expensive type of credit, assuming 360 days per year?Oldhat Financial starts its first day of operations with$11 million in capital. A total of $120 million incheckable deposits are received. The bank makes a$30 million commercial loan and another $40 million in mortgages with the following terms: 200 standard,30-year, fixed-rate mortgages with a nominal annualrate of 5.25%, each for $200,000.Assume that required reserves are 8%.a. What does the bank balance sheet look like?b. How well capitalized is the bank?c. Calculate the risk-weighted assets and risk-weightedcapital ratio after Oldhat’s first dayXXX, Inc. finances tis seasonal working capital need with short-term bank loans. Management plans to borrow $65,000 for a year. The bank has offered the company a 3.5 percent discounted loan with a 1.5 percent origination fee. What are the interest payment and the origination fee requiered by the loan? What is the rate of interest charged by the bank?

- A bank is planning to make a loan of sh.5,000,000 to a firm in the steel industry. It expects to charge a servicing fee of 50 basis points. The loan has a maturity of 8 years with a duration of 7.5 years. The cost of funds (the RAROC benchmark) for the bank is 10 percent. Assume the bank has estimated the maximum change in the risk premium on the steel manufacturing sector to be approximately 4.2 percent, based on two years of historical data. The current market interest rate for loans in this sector is 12 percent. Required: Using the RAROC model, determine whether the bank should make the loan Kindly calculate without excel.A bank is planning to make a loan of sh.5,000,000 to a firm in the steel industry. It expects to charge a servicing fee of 50 basis points. The loan has a maturity of 8 years with a duration of 7.5 years. The cost of funds (the RAROC benchmark) for the bank is 10 percent. Assume the bank has estimated the maximum change in the risk premium on the steel manufacturing sector to be approximately 4.2 percent, based on two years of historical data. The current market interest rate for loans in this sector is 12 percent. Required: Using the RAROC model, determine whether the bank should make the loan.Suppose that you have generated the estimates listed below from a pro forma analysis for a company that had requested a three year loan. The loan is a $1.5 million term loan with the equal annual payments of principals. The P&I payments are due at the end of each year with the annual interest rate = Prime rate + 1.5%. Yr.1 Yr. 2 Yr. 3 Capital expenditure 250,000 125,000 75,000 Cash dividends 140,000 140,000 140,000 Cash flow from operations before interest expense 750,000 780,000 800,000 Assuming the Prime rate = 7.5% each year. What will be the interest payment at year 3? a). 25,000 b). 50,000 c). 45,000 d). 53,000 e). 10,000

- a) A commercial bank is planning to give a loan of $3,000,000 to a firm. The bank expects to charge an up-front fee of 0.15% and a service fee of 0.04%. The loan has a maturity of 10 years. The cost of funds (and the RAROC benchmark) for the commercial bank is 12%. The commercial bank has estimated the risk premium on the loan to be approximately 0.20%, based on three years of historical data. The current market interest rate for loans in this sector is 12.15%. The 99th (extreme case) loss rate for borrowers of this type has historically run at 4%, and the dollar proportion of loans of this type that cannot be recaptured on default has historically been 85%. The 'bank's Return on Equity (ROE) ratio is 13%. Using the risk-adjusted return on capital (RAROC) model, should the commercial bank make the loan? Please show each step of your calculation.Oldhat Financial starts its first day of operations with â$12 million in capital. A total of â$140 million in checkable deposits are received. The bank makes a â$25 million commercial loan and another â$60 million inâ mortgages, with the followingâ terms: 200 standard 30â-year, âfixed-rate mortgages with a nominal annual rate ofâ 5.25%, each for â$300, 000. Assume that required reserves are 8â%.(a) What does the bank balance sheet look like?(b) How well capitalized is the bank?The XYZ customer service branch maintains a disbursement account which is funded by the main office. The branch needs funds for daily disbursements of P40,000 and a minimum balance of P20,000. The cost to transfer funds from the main office to the branch averages P300. The return on money marketable securities is 5%. XYZ Corporation agreed with its major supplier a credit term of 3/30, n/75. Using 360 days in a year, what would the compound annualize cost of this payable?

- Van Buren Resources Inc. is considering borrowing $100,000 for 182 days from its bank. Van Buren will pay $6,000 of interest at maturity, and it will repay the $100,000 of principal at maturity. a. Calculate the loan’s annual financing cost. b. Calculate the loan’s annual percentage rate. c. What is the reason for the difference in your answers to Parts a and b?A bank is planning to make a loan of $25,000,000 to a firm in the steel industry. It expects to charge a servicing fee of 50 basis points. The loan has a maturity of 8 years and a duration of 7.5 years. The cost of funds (the RAROC benchmark) for the bank is 10 percent. Assume the bank has estimated the maximum change in the risk premium on the steel manufacturing sector to be approximately 4.2 percent, based on two years of historical data. The current market interest rate for loans in this sector is 12 percent. a. What should be the duration in order for this loan to be approved? b. Assuming that duration cannot be changed, how much additional interest and fee income would be necessary to make the loan acceptable? c. Given the proposed income stream and the negotiated duration, what adjustment in the risk premium would be necessary to make the loan acceptable?A $2 million, five-year loan to a BBB-rated corporation in the computer parts industry. MC Bancorp charges a servicing fee of 75 basis points. The duration on the loan is 4.5 years. The cost of funds for the bank (the RAROC benchmark) is 8 percent. Based on four years of historical data, the bank has estimated the maximum change in the risk premium on the computer parts industry to be approximately 5.5 percent. The current market rate for loans in this industry is 10 percent. DLN = RAROC= Should the bank make the loan? *Someone reviewed this and claimed they needed more information to answer the question. That is not the case, the question is perfectly solvable with just this information. If you "Anonymous user" do not know how to solve it, please pass it on to someone else.