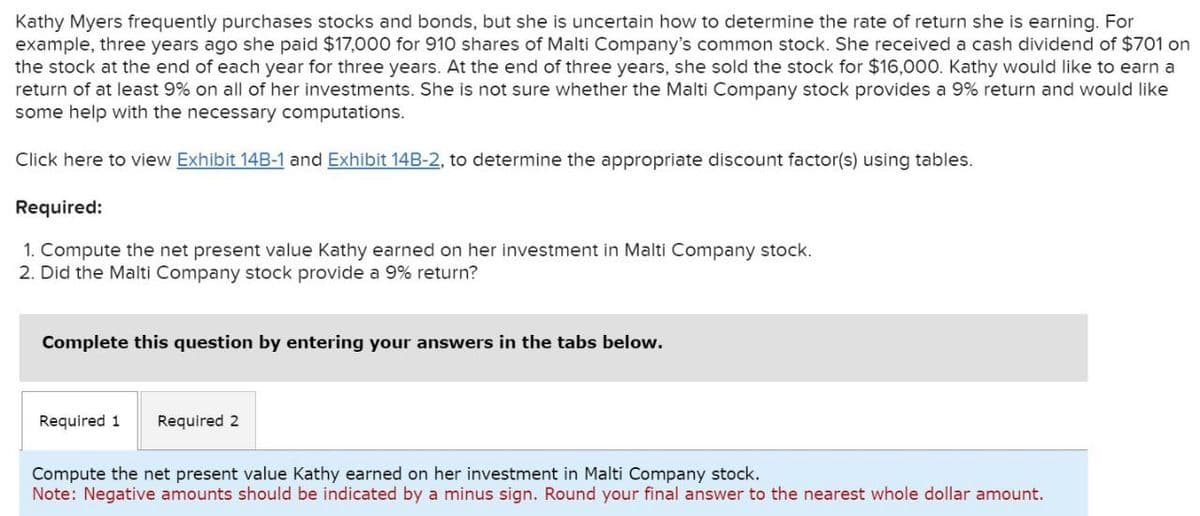

Kathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of return she is earning. For example, three years ago she paid $17,000 for 910 shares of Malti Company's common stock. She received a cash dividend of $701 on the stock at the end of each year for three years. At the end of three years, she sold the stock for $16,000. Kathy would like to earn a return of at least 9% on all of her investments. She is not sure whether the Malti Company stock provides a 9% return and would like some help with the necessary computations. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value Kathy earned on her investment in Malti Company stock. 2. Did the Malti Company stock provide a 9% return? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the net present value Kathy earned on her investment in Malti Company stock. Note: Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount.

Kathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of return she is earning. For example, three years ago she paid $17,000 for 910 shares of Malti Company's common stock. She received a cash dividend of $701 on the stock at the end of each year for three years. At the end of three years, she sold the stock for $16,000. Kathy would like to earn a return of at least 9% on all of her investments. She is not sure whether the Malti Company stock provides a 9% return and would like some help with the necessary computations. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value Kathy earned on her investment in Malti Company stock. 2. Did the Malti Company stock provide a 9% return? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the net present value Kathy earned on her investment in Malti Company stock. Note: Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount.

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 62P

Related questions

Question

Transcribed Image Text:Kathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of return she is earning. For

example, three years ago she paid $17,000 for 910 shares of Malti Company's common stock. She received a cash dividend of $701 on

the stock at the end of each year for three years. At the end of three years, she sold the stock for $16,000. Kathy would like to earn a

return of at least 9% on all of her investments. She is not sure whether the Malti Company stock provides a 9% return and would like

some help with the necessary computations.

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables.

Required:

1. Compute the net present value Kathy earned on her investment in Malti Company stock.

2. Did the Malti Company stock provide a 9% return?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Compute the net present value Kathy earned on her investment in Malti Company stock.

Note: Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT