FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

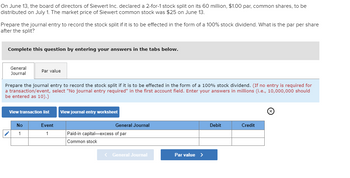

Transcribed Image Text:On June 13, the board of directors of Siewert Inc. declared a 2-for-1 stock split on its 60 million, $1.00 par, common shares, to be

distributed on July 1. The market price of Siewert common stock was $25 on June 13.

Prepare the journal entry to record the stock split if it is to be effected in the form of a 100% stock dividend. What is the par per share

after the split?

Complete this question by entering your answers in the tabs below.

General

Journal

Par value

Prepare the journal entry to record the stock split if it is to be effected in the form of a 100% stock dividend. (If no entry is required for

a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should

be entered as 10).)

View transaction list

View journal entry worksheet

No

Event

General Journal

1

1

Paid-in capital-excess of par

Common stock

< General Journal

Par value >

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please do not give solution in image format ?arrow_forwardOn June 13, the board of directors of Siewert Incorporated declared a 2-for-1 stock split on its 80 million, $2.00 par, common shares, to be distributed on July 1. The market price of Siewert common stock was $29 on June 13. Prepare a journal entry that summarizes the declaration and distribution of the stock split if it is to be effected in the form of a 100% stock dividend. What is the par per share after the split? Plz don't copy answer plzarrow_forwardOn July 4, Great Student Company completed a 4 for 1 stock split when outstanding shares were 40,000, par value was $2, and the market value was $10. What is the market value after the split? What is par value after the split? 05 How many shares are outstanding after the split? 200,000 Make the journal entry.arrow_forward

- .arrow_forwardA corporation that had 28,000 shares of common stock outstanding declared a 4-for-1 stock split. a. What will be the number of shares outstanding after the split? shares b. If the common stock had a market price of $92 per share before the stock split, what would be an approximate market price per share after the split? per share c. Journalize the entry for the stock split. If no entry is required, type "No Entry Required" and leave the amount boxes blank. Debit Credit Accountarrow_forwardGadubhaiarrow_forward

- Tamarisk, Inc. has 50,000 shares of $10 par value common stock outstanding. It declares a 15% stock dividend on December 1 when the market price per share is $16. The dividend shares are issued on December 31. Prepare the entries for the declaration and issuance of the stock dividend. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Creditarrow_forwardOn June 13, the board of directors of Siewert Inc. declared a 2-for-1 stock split on its 100 million, $5.00 par, common shares, to be distributed on July 1. The market price of Siewert common stock was $31 on June 13. Prepare the journal entry to record the stock split if it is to be effected in the form of a 100% stock dividend. What is the par per share after the split? Complete this question by entering your answers in the tabs below. General Journal Par value Prepare the journal entry to record the stock split if it is to be effected in the form of a 100% stock dividend. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) View transaction list Journal entry worksheet 1 Record the stock split effected in the form of a 100% stock dividend. 4>arrow_forwardOn October 31, the stockholders' equity section of Blossom Corporation's balance sheet consists of common stock $659,200 and retained earnings $877,000. Blossom is considering the following two courses of action: (1) declaring a 5% stock dividend on the 82.400 $8 par value shares outstanding or (2) effecting a 2-for-1 stock split that will reduce par value to $4 per share. The current market price is $15 per share. Prepare a tabular summary of the effects of the alternative actions on the company's stockholders' equity and outstanding shares. Stockholders' equity Paid-in capital Retained earnings Total stockholders equity $ Outstanding shares Before Action $ $ After Stock Dividend $ After Stock Splitarrow_forward

- On June 30, the board of directors of Sandals, Inc., declares and pays a 100% stock dividend on its 18,000, $1 par, common shares. The market price of Sandals common stock is $23 on June 30. Record the stock dividend. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardOn OCT 31, the stockholders' equity section of MCompany's balance sheet consists of common stock $648,000 and retained earnings $400,000. MCompany is considering the following two courses of action: (1) declaring a 5% stock dividend on the 81,000 $8 par value shares outstanding or (2) effecting a 2-for-1 stock split that will reduce par value to $4 per share. The current market price is $17 per share. Instructions Prepare a tabular summary of the effects of the alternative actions on the company's stockholders' equity and outstanding shares. Use these column headings: Before Action, After Stock Dividend, and After Stock Split. Before Action Stockholders' equity: Paid-in Capital Retained Earnings Total Stockholders Equity $ 1,048,000 $ 648,000 400,000 81,000 After Stock Dividend After Stock Split Outstanding Shares (1) By choosing stock dividend, you will be distributing 5% additional shares over the 81,000 shares "before the action". The "paid-in capital" of the stock dividend is…arrow_forwardPlease help mearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education