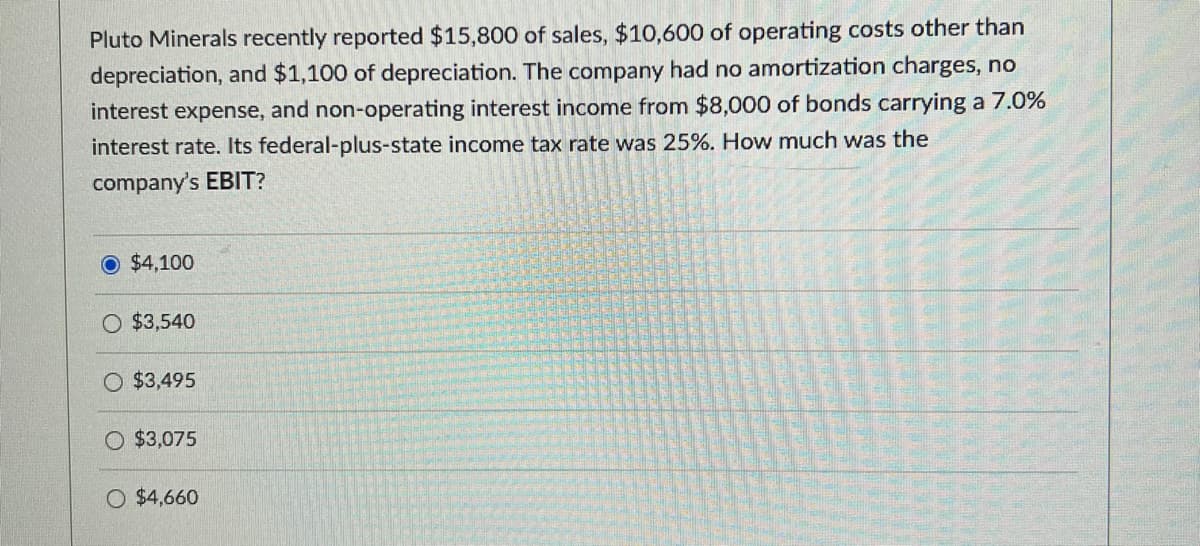

Pluto Minerals recently reported $15,800 of sales, $10,600 of operating costs other than depreciation, and $1,100 of depreciation. The company had no amortization charges, no interest expense, and non-operating interest income from $8,000 of bonds carrying a 7.0% interest rate. Its federal-plus-state income tax rate was 25%. How much was the company's EBIT?

Q: A 3.750 percent TIPS has an original reference CPI of 180.0. If the current CPI is 206.3, what is…

A: TIPS stands for Treasury Inflation-Protected Securities. These are government-issued bonds designed…

Q: Dizzy Inc. wishes to issue new bonds but is uncertain how the market would set the yield to…

A: Compound = Semiannually = 2Time = t = 20 * 2 = 40Semiannually Coupon Rate = c = 3.5%Face Value = fv…

Q: You have been managing a $5 million portfolio that has a beta of 1.2 and a required rate of return…

A: Rate of return- Return is the profit that we earn when we drive investment. It represents the reward…

Q: Suppose your expectations regarding the stock market are as follows: State of the Economy Boom…

A: Mean provides a central point around which data points tend to cluster. This makes it a useful…

Q: When, if ever, will the geometric average return exceed the arithmetic average return for a given…

A: In finance the geometric average return is a way to figure out the rate of return, on an investment…

Q: Bond value and time-Changing required returns Personal Finance Problem Lynn Parsons is considering…

A: Since you have posted multiple questions with multiple sub parts, we will provide the solution only…

Q: 180-day commercial paper can be bought at a 5.80 percent discount yield. What are the bond…

A: The effective annual rate is a crucial concept in finance that is used to describe the true annual…

Q: calculate the Economic Value Added for company XYZ Ltd:

A: Economic value added is the equivalent of calculating a company's profit margin against its cost of…

Q: Vaughn Inc. has been using the services of San Bernadino Brokerage Company (SBBC) for the past six…

A: The geometric mean is a measure of central tendency that calculates the average rate of return of a…

Q: Vandelay Industries is considering the purchase of a new machine for the production of latex.…

A: The net present value is the difference between the PV of all cash flows and the initial…

Q: Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to…

A: Residual income is the income attributable to the shareholders minus the opportunity cost of…

Q: Remember, the expected value of a probability distribution is a statistical measure of the average…

A: The objective of this question is to calculate the expected returns for the individual stocks in…

Q: Volbeat Corporation has bonds on the market with 12.5 years to maturity, a YTM of 8 percent, and a…

A: Bond valuation is the process of determining the fair or intrinsic value of a bond, which represents…

Q: Don't use chatgpt, I will 5 upvotes Accounts receivable changes with bad debts A firm is evaluating…

A: The objective of the question is to determine whether the firm should change its credit policy based…

Q: What is the standard deviation of the rate of return on your client's portfolio? (Round your…

A: The standard deviation of risky investment = 33%Standard deviation of security = 0%

Q: A cart of groceries today costs about $132 and decreases 2.4% a year due to deflation. Create a…

A: Future value is the value of a sum of money at a future time point. Deflation is a phenomenon in…

Q: Projected Income ☐ Savings Goal ☐ Monthly Budget ☐ Bank Accounts and Lines of Credit First/Small…

A: Making a one-year financial plan is a calculated move toward managing your money so that you can…

Q: Determine the price of a $220,000 bond issue under each of the following independent assumptions:…

A: Issue price of bond means the price at which the bond is issued. It can be issued at par, premium or…

Q: Halliford Corporation expects to have earnings this coming year of $2.93 per share. Halliford plans…

A: Earnings this year = $2.93 per shareExpected return = 20.7%Cost of equity capital = 8.5%To find: The…

Q: Tamarisk Corporation issues $630,000 of 9% bonds, due in 9 years, with interest payable…

A: Variables in the question:Face value=$630,000 Coupon rate=9% (payable semiannually) N=9 yearsMarket…

Q: Given the information below for HooYah! Corporation, compute the expected share price at the end of…

A: The P/E Ratio is a valuation metric that evaluates a company by comparing its current stock price…

Q: Company Figures at the end of the current Financial Year Hardlow plc GRT plc Xiang IKO Inc Aurore…

A: Turnover per share will be calculated by dividing the turnover amount by the number of shares…

Q: Please give Answer with correct and incorrect option explanation

A: The objective of the question is to calculate the sale price of a Treasury bond that Jay plans to…

Q: Returns Year Y 1 15% 20% 2 18 30 3 9 15 4 -9 -16 5 10 20 Using the returns shown above, calculate…

A: Average returns refer to the returns that the investor can expect to earn if they invest in the…

Q: Suppose you just bought an annuity with 12 annual payments of $15,700 at a discount rate of 11.75…

A: Present value is the discounted value of the cash flows generated by the investment over the period…

Q: The firm X has sales of $420,000, a tax rate of 32%, the payout ratio of 35%, and a net profit…

A: Retained earnings is the accumulated net income of a company after paying out its dividends. A…

Q: You invest $200 per month in a savings plan that pays an APR of 4.5%. What is the total amount of…

A: Investment per month = $200APR = 4.5%,Monthly rate = APR/12 = 4.5/12 = 0.375%Monthly rate =…

Q: A leading AI technology firm ATOOL, is publicly traded on the US stock market with shares currently…

A: CFFA = $6,470Explanation:Cash Flow from Assets (CFFA)CFFA = EBIT + Depreciation - Capital…

Q: delta corporation obtained a $45, 000 loan at a rate of prime +1.15% on July 18. Fixed payments of…

A: The objective of the question is to calculate the outstanding loan balance of Delta Corporation…

Q: A firm wishes to maintain an sustainable growth rate of 10 percent and a dividend payout ratio of 56…

A: The Sustainable Growth Rate (SGR) is a measure used in finance and business to determine the maximum…

Q: Assume you are now 21 years old and will start working as soon as you graduate from college. You…

A: Annuity payments:Annuity payments represent a series of periodic disbursements made by an insurance…

Q: MM with Corporate Taxes Companies U and L are identical in every respect except that U is unlevered…

A: As per the MM approach proposition (with taxes), the value of the firm for unlevered firm and the…

Q: Laura saves $22 at the end of each week and deposits the money in an account paying 8% compounded…

A: Future Value : It is the value of a current asset at particular future date at a assumed growth…

Q: Company Name Ticker Instructions at bottom Average Median Brinker Bloomin' Brands Domino's Pizza…

A: The objective of this question is to analyze the financial performance of various restaurant…

Q: You invest $200 per month in a savings plan that pays an APR of 4.5%. What is the total amount of…

A: Here,Monthly Savings is $200Interest Rate (r) is 4.5%Time Period (n) is 28 yearsCompounding Period…

Q: After deciding to acquire a new car, you realize you can either lease the car or purchase it with a…

A: The PV of purchase implies the cost of the car today less the PV of resale value after 2 years.The…

Q: Suppose a 10-year, $1,000 bond with a coupon rate of 8.8% and semiannual coupons is trading for…

A: Bonds can be regarded as debt instruments that are being traded in the financial market where the…

Q: Unida Systems has 46 million shares outstanding trading for $12 per share. In addition, Unida has…

A: Number of shares outstanding = 46 millionPrice per share = $12Total Equity = 46 million × $12 = $552…

Q: You have found the following stock quote for RJW Enterprises, Incorporated, in the financial pages…

A: Here,Dividend is $1.70Dividend Yield is 3.0%PE Ratio is 18Net Change in Price is -0.43

Q: Bayside Fishing Supply Co.is acquiring Fishing Lure Specialists for $25,250 in cash. Bayside Fishing…

A: Synergy in acquisition refers to the idea that the combined value and performance of two companies,…

Q: If the simple CAPM is valid, is the situation shown below possible? Portfolio Expected Return Beta A…

A: According to Capital Asset Pricing Model (CAPM), expected return is the function of Risk-free rate,…

Q: Give answer with calculation and explanation, Provide Correct and Incorrect option explanation

A: The objective of this question is to find out how long it will take for the customer to pay off his…

Q: Manshuk

A: The objective of this question is to calculate the price that Yuri will pay for the Treasury bond…

Q: You set up a space absorption profile for 10,000 SF of vacant space, each lease will comprise of…

A: FormulaVacancy loss = Vacant space * Rent RateThe Calculation for Leases Signed Before May 1,…

Q: We project unit sales for a new household-use laser-guided cockroach search and destroy system as…

A: The net present value refers to the capital budgeting metric which evaluates the current worth of…

Q: Your firm spends $469,000 per year in regular maintenance of its equipment. Due to the economic…

A: IRR refers to the internal rate of return at which the net present value is zero. It is the…

Q: Tuas Limited (“Tuas”) is considering to replace its existing air-conditioning system with an energy…

A: Cash Flow Analysis for New Cooling SystemYear 0Initial Investment in Spare Parts: -$12,000Civil…

Q: Professor Wendy Smith has been offered the following opportunity: A law firm would like to retain…

A: Capital budgeting refers to the concept used by investors for making decisions related to the…

Q: A property gets following Cash flows: NO, 5th year is constant with 2% the r = 12%. = 100,000…

A: The objective of the question is to calculate the present value of the property considering the…

Q: Consider the following three cash flow series: End of Year Cash Flow Series A Cash Flow Series B…

A: End of yearCash flow series ACash flow series BCash flow series…

Step by step

Solved in 3 steps with 1 images

- The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?Meric Mining Inc. recently reported $14,700 of sales, $7,600 of operating costs other than depreciation, and $1,100 of depreciation. The company had no amortization charges, it had outstanding $6,700 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 30%. How much was the firm's net income after taxes? Meric uses the same depreciation expense for tax and stockholder reporting purposes. Group of answer choices $3,320.84 $3,711.53 $3,906.88 $3,995.53 $4,102.22Last year Tiemann Technologies reported $10,300 of sales, $6,450 of operating costs other than depreciation, and $1,400 of depreciation. The company had no amortization charges, it had $4,800 of bonds that carry a 6.0% interest rate, and its federal-plus-state income tax rate was 35%. This year's data are expected to remain unchanged except for one item, depreciation, which is expected to increase by $700. By how much will net after-tax income change as a result of the change in depreciation? The company uses the same depreciation calculations for tax and stockholder reporting purposes. Group of answer choices -455.00 -432.25 -500.50 -477.75 -409.50

- A company recently reported $12,500 of sales, $7,250 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's taxable income, or earnings before taxes (EBT)? Show your answer using the income statement structure.Brown Office Supplies recently reported $15,500 of sales, $8,250 of operating costs other than depreciation, and $1,750 of depreciation. It had $9,000 of bonds outstanding that carry a 7.0% interest rate, and its federal-plus-state income tax rate was 25%. How much was the firm's earnings before taxes (EBT)?Emery Mining Inc. recently reported $125,000 of sales, $75,500 of operating costs other than depreciation, and $10,200 of depreciation. The company had $16,500 of outstanding bonds that carry a 7.25% interest rate, and its federal-plus-state income tax rate was 35%. How much was the firm's net income? The firm uses the same depreciation expense for tax and stockholder reporting purposes.

- Frederickson Office Supplies recently reported $10,000 of sales, $7,250 of operating costs other than depreciation and $1,250 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate and its federal-plus-state income tax rate was 40%. How much was the firm's taxable income, or earnings before taxes? a. $1,300 b. $1,100 c. $900 d. $1,200A Company recently reported $15,500 of sales, $8,250 of operating costs other than depreciation, and $1,750 of depreciation. It had $9,000 of bonds outstanding that carry a 7.0% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's Operating Income (earnings before interest and taxes - EBIT)?Companies generate income from their "regular" operations and from other sources like interest earned on the securities they hold, which is called non-operating income. Lindley Textiles recently reported $70,000 of sales, $7,250 of operating costs other than depreciation, and $1,000 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate, and its federal-plus-state income tax rate was 25%. How much was Lindley's operating income, or EBIT? Select the correct answer. a. $61,750 b. $63,419 c. $62,585 d. $60,916 e. $64,254

- Last year, Stewart-Stern Inc. reported $11,250 of sales, $4,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had $2,500 of bonds outstanding that carry a 7.00% interest rate, and its federal-plus-state income tax rate was 25.00%. During last year, the firm had expenditures on fixed assets and net operating working capital that totaled $1,600. These expenditures were necessary for it to sustain operations and generate future sales and cash flows. This year's data are expected to remain unchanged except for one item, depreciation, which is expected to increase by $900. By how much will the depreciation change cause (1) the firm's net income and (2) its free cash flow to change? Note that the company uses the same depreciation for tax and stockholder reporting purposes. Do not round the intermediate calculationsCompanies generate income from their "regular" operations and from other sources like interest earned on the securities they hold, which is called non-operating income. Lindley Textiles recently reported $12,500 of sales, $7,250 of operating costs other than depreciation, and $1,000 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate, and its federal-plus-state income tax rate was 40%. How much was Lindley's operating income, or EBIT?Last year ABC Corp had $10 million in operating income (EBIT). Its depreciation expense was $4 million, its interest expense was $3 million, and its corporate tax rate was 37.6%. At year-end, it had $22 million in current assets, $3 million in accounts payable, $1 million in accurals, $2 million in notes payable, and $15 million in net plant and equipment. Rattner had no other current liabilities. Assume that Rattner’s only noncash item was depreciations a.What was the company’s net income? b.What was its net operating working capital (NOWC)? c.What was its net operating capital (NWC)? d.ABC Corp had $12 million in net plant and equipment the prior year. Its net operating working has remained constant over time. What is the company’s free cash flow (FCF) for the year that just ended? e.ABC Corp has 1,000,000 common shares outstanding and the common stock amount on the balance sheet is $10 million. The company has not issued or repurchased common stock during the year. Last…