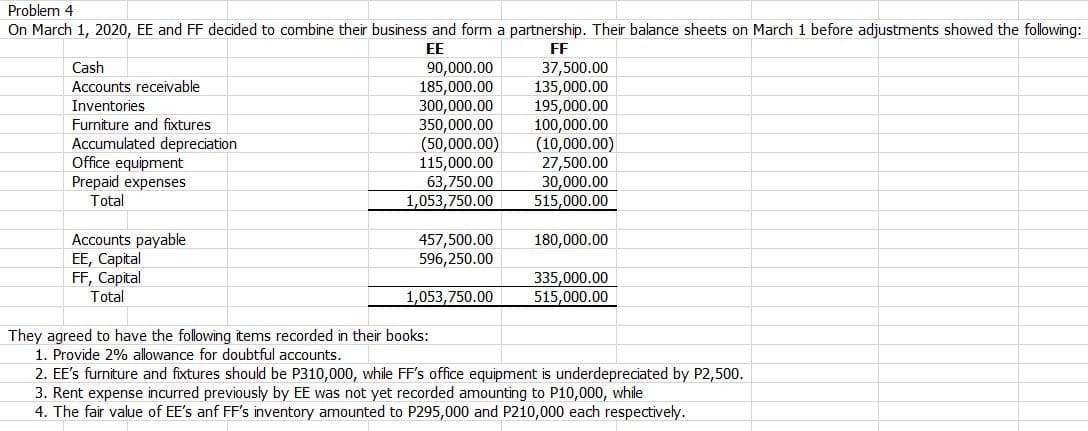

Problem 4 On March 1, 2020, EE and FF decided to combine their business and form a partnership. Their balance sheets on March 1 before adjustment EE FF Cash Accounts receivable 90,000.00 185,000.00 300,000.00 350,000.00 (50,000.00) 115,000.00 63,750.00 1,053,750.00 37,500.00 135,000.00 195,000.00 100,000.00 (10,000.00) 27,500.00 30,000.00 515,000.00 Inventories Furniture and fixtures Accumulated depreciation Office equipment Prepaid expenses Total Accounts payable EE, Capital FF, Capital Total 457,500.00 596,250.00 180,000.00 1,053,750.00 335,000.00 515,000.00 They agreed to have the following items recorded in their books: 1. Provide 2% allowance for doubtful accounts. 2. EE's furniture and fixtures should be P310,000, while FF's office equipment is underdepreciated by P2,500. 3. Rent expense incurred previously by EE was not yet recorded amounting to P10,000, while 4. The fair value of EE's anf FF's inventory amounted to P295,000 and P210,000 each respectively.

1. Compute the net (debit)/credit adjustment for EE anf FF.

EE FF EE FF

A. 28,700 ; 28,200 C. (8,700) ; 1,800

B. (28,700) ; (28,200) D. 8,700 ; (1,800)

2. Compute the total assets after the formation.

A. 1,607,650 C. 1,579,850

B. 1,570,850 D. 1,568,750

3. If the partners are to share

A. 400,000 C. 369,740

B. 391,700 D. 391,700

4. If If the partners are to share profits and losses in the ratio of 6:4 and their capital is top reflect this relationship with EE’s capital to be used as a basis, what is the capital of FF after the formation?

A. 400,000 C. 369,740

B. 391,700 D. 391,700

Trending now

This is a popular solution!

Step by step

Solved in 2 steps