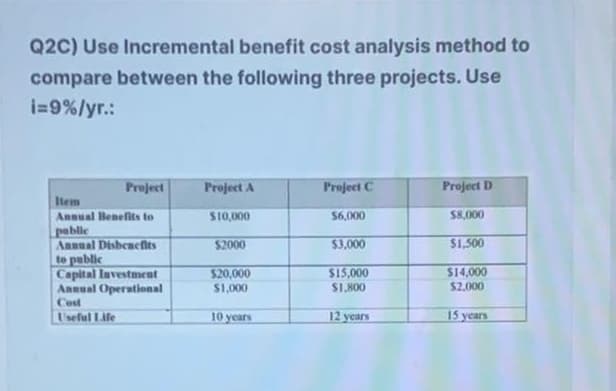

Q2C) Use Incremental benefit cost analysis method to compare between the following three projects. Use i=9%/yr.: Project Project A Project C Project D Item Annual Benefits to $10,000 $6,000 $8,000 pablic Annual Disbenefits $2000 $3,000 $1,500 to public Capital Investment $20,000 $15,000 $14,000 Annual Operational $1,000 $1,800 $2.000 Cost Useful Life 10 years 12 years 15 years

Q: None

A: Absolutely, let's delve deeper into forecasting next year's sales using the average approach in…

Q: A stock has an expected return of 10%, its beta is 0.9, and the risk-free rate is 5%. Calculate the…

A:

Q: Company Express S. A. asks you to construct cash flows for following three (3) investment projects,…

A: Certainly! Let's break down the calculation of cash flows for Project 1 in detail, step by step. 1.…

Q: None

A: Pro Forma Employee Stock Option (ESO) Obligation on Dec 31, 2019Unfortunately, we cannot directly…

Q: About Dividend Discount Model (DDM) and stock valuation, which statement is NOT CORRECT? In DDM,…

A: The Dividend Discount Model operates under the tenet that a stock's value is equal to the present…

Q: Consider the following information on two stocks: P(State) Stock A Stock B Boom 20% 30% 20% Normal…

A: Step 1: Let's answer it by using Excel: Step 2: Working notes: Step 3:Therefore, the answer…

Q: Year 1 2 Revenues $ 60,000 40,000 Saved 3 4 Thereafter 30,000 10,000 0 Expenses are expected to be…

A: The NPV of the project, calculated using a discount rate of 10%, is about -$39,422.39, showing a…

Q: If we consider the effect of taxes, then the degree of operating leverage can be written as:…

A: a. we'll calculate the Operating Cash Flow (OCF) at the base-case level of…

Q: Suppose a firm has had the following historic sales figures. What would be the forecast for next…

A: Let's examine each stage in greater detail: 1. Fill in the Excel spreadsheet's input field with the…

Q: Vijay

A: Let's take a closer look at the computations of the portfolio's expected return and variance. a. The…

Q: The bid ask bounce (a) Is where prices rise after good news (b) Is the difference between the…

A: The difference between a dealer's willing price to buy (the bid price) and their willing price to…

Q: What is the current CD (certificate of deposit rate) from your financial institution (bank) for a CD…

A: These rates are subject to change based on market conditions and the policies of our institution.…

Q: Based on the preceding spreadsheet, prepare a statement of owner's equity for Paoli Consulting. If a…

A: The statement requires additional details to be filled out accurately. However, I can guide you…

Q: Quiz 12 - Stocks Stocks 1. A stock is expected to paid a dividend of f $2.9 you just sold it for…

A: The stock's return is a measure of the overall gain (or loss) an investor realizes from holding the…

Q: None

A: Income Tax Burden for Toto Inc.Here's the breakdown of the income tax burden for Toto Inc. in each…

Q: Los Angeles bureau chief. Dirks urged Blundell to write a story on the fraud allegations. Blundell…

A: Securities exchange act:The Securities Exchange Act of 1934, a pivotal legislation in American…

Q: None

A: Step 1:Income Replacement: Estimate the present value of the income that the working spouse would…

Q: Required: Use the financial statements of Heifer Sports Incorporated to find the information below…

A: Heifer Sports Incorporated Financial Analysis (2023)a. Inventory Turnover Ratio:Inventory Turnover…

Q: Better Mousetraps has developed a new trap. It can go into production for an initial investment in…

A: Part 2: Explanation:Step 1: Calculate the initial investment:Initial equipment cost = $6.3…

Q: Consider the following information on two stocks: P(State) Stock A Stock B Boom 20% 30% 20% Normal…

A: Certainly! Let's break down the steps to calculate the standard deviation of the portfolio:1.…

Q: Suppose the spot and six-month forward rates on the Norwegian krone are Kr 5.77 and Kr 5.92,…

A: Forward Rate (Kr/$) = Spot Rate (Kr/$) x [1 + rate(Kr) x N/360]/ [1 + rate($) x N/360] => Forward…

Q: 11 The University of Miami bookstore stocks textbooks in preparation for sales each semester. It…

A: Step 1: Analyze the Given InformationTextbook cost: $82Selling price of a textbook: $112Net refund…

Q: Baghiben

A: 1. Initial NPV Calculation: Initial Investment in Equipment: = $5.7 million Salvage Value…

Q: When the required returns on all stocks are graphed against their corresponding betas, Question…

A: The objective of the question is to identify the financial concept that is represented when the…

Q: In a survey of 400400 likely voters, 216216 responded that they would vote for the incumbent and…

A: Part 4: To find the p-value for the test \( H_0: p = 0.5 \) versus \( H_1: p > 0.5 \), we need to…

Q: You just graduated and started your new job. Your starting salary is $80,000/year. Your employer's…

A: d)Time period (n) =40 yearsRate of interest (I) =8% p.aAnnual Contribution = $8000Total amount at…

Q: View Policies Current Attempt in Progress Nancy Jackson has $185,000 to invest. She wants to be able…

A: Nancy Jackson's financial goal involves ensuring a perpetual income stream while safeguarding her…

Q: You may attempt this question 2 more times for credit An airline is considering a project of…

A: Answer to Part 1:To calculate the net present value (NPV) of the project, we need to discount the…

Q: 2. Initial Cost, $ Tabulate the incremental cash flow for the alternatives shown below. Machine B…

A: The incremental cash flow table displays the additional expenses associated with selecting Machine B…

Q: Lakonishok equipment has an investment opportunity in Europe. The project cost 14,750,000 in europe…

A: Step 1: Convert Euro Cash Flows to U.S. DollarsGiven the spot exchange rate is $0.83 per Euro, the…

Q: You are attempting to value a call option with an exercise price of $108 and one year to expiration.…

A: To value the call option using the two-state stock price model, we can calculate the expected payoff…

Q: Nikul

A: Calculation of Short-Term Interest MonthAmountInterest %Monthly Interest…

Q: Nikul

A: Step 1:Excel:Note: I don't know why this is incorrect but if you answer a different amount the…

Q: Lakoniskok equipment has an investment opportunity

A: Investment refers to the allocation of resources, typically money or capital, with the expectation…

Q: 1) In a one-period binomial model, assume that the current stock price is $100, and that it will…

A: 1) One-Month Call Option PricingGiven:Current Stock Price (S) = $100Upward Price (Su) = $130Downward…

Q: None

A: Based on the given graph, only Team 2 increased their sales every year, whereas Team 1 and and Team…

Q: Are the answers to A & B correct? Could I get some help on the multiple choice (B&C)?

A: Let us discuss the computations and factors that are involved in more depth. 1. NPV and IRR…

Q: Needs Complete solution don't use chat gpt or ai i definitely upvote you.

A: Let's dissect the issue and go over the computations one by one. 1. Determine the loan's original…

Q: Corporate Finance In Reddit’s IPO, shares were issued at $34, and increased 48% that day, closing at…

A: The objective of the question is to understand whether the founders of Reddit would be upset at the…

Q: A collection of financial assets and securities is referred to as a portfolio. Most individuals and…

A: The objective of the question is to calculate the expected return on Andre's stock portfolio. The…

Q: am. 112.

A: The objective of this question is to calculate the value of a stock today based on the Gordon Growth…

Q: You pay $1,000 today for the following series of monthly cash flows: 150 0 200 15 300 300 0 100 100…

A: Present Value of Each Cash Flow: We'll use the formula for the Present Value (PV) of a future cash…

Q: Your investment portfolio has 9,000 shares of Ball Hawks, which has an expected return of 9.60…

A: Investment in Ball Hawks is = (No of shares * Price)Investment in Ball Hawks is =…

Q: None

A: Let's examine the computation in greater depth. First, ascertain the cash flows.There will be a…

Q: Six years ago the Templeton Company issued 25-year bonds with a 15% annual coupon rate at their…

A: Step 1:PV-1000 FV1090(1000*109%)PMT150(1000*15%)NPER6 YTC16.00% Rate (6.150,-1000,1090) Step 2:III)…

Q: Consider the following information: Rate of Return if State Occurs Probability of State State of…

A: Formula

Q: None

A: Step 1:Net present value method of NPV is very useful method of capital budgeting. It tells us what…

Q: None

A: Step 1: Given Value for Calculation Initial Investment = $12,000Cash Flow for Year 1 = $1750Cash…

Q: Alpha Industries is considering a project with an initial cost of $8.1 million. The project will…

A: Step 1: Given Value for Calculation Initial Cost = i = $8.1 millionCash Flow = cf = $1.46…

Q: Q: Three years ago the USD/RUB exchange rate was 77.37 and today the exchange rate now sits at…

A: The objective of the question is to understand the changes in the exchange rate between the Russian…

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?Determine the best alternatives for a government project with the following data: PROJECT A B C ANNUAL BENEFIT P250,000.00 P320,000.00 P350,000.00 ANNUAL COSTS P100,000.00 P135,000.00 p180,000.00 B/C RATIO 2.5 2.37 1.94 What is the best Project and its incremental ratio? a. A = 1.2 b. A = 2 c. B = 2.0 d. B = 1.18Determine the B/C ratio for the following project.First Cost = P100, 000Project life, years = 5Salvage value = P10, 000Annual benefits = P60, 000Annual O and M = P22, 000Interest rate= 15%

- The following information relates to two projects of which you have to select one to invest in.Both projects have an initial cost of $400,000 and only one can be undertaken.Project X YExpected profits $ $Year 1 160,000 60,000Year 2 160,000 100,000Year 3 80,000 180,000Year 4 40,000 240,000Estimated resale value atthe end of year 4 80,000 80,000i) Profit is calculated after deducting straight line depreciationii) The cost of capital is 16%Required:a) For both projects, calculate the following:i) The payback period to one decimal place ii) The accounting rate of return using average investments iii) The net present value iv) Advise the board which project in your opinion should be undertaken, givingreasons for your decision.time value of money practice example: Please show calcualtions/steps (excell or other format): a) Calculate PB, DPB, NPV, IRR and PI for the following project: - discount rate of 12% - initial investment = 750,000 - ncf yr 1 = 150,000 - ncf yr 2 = 300,000 - ncf yr 3 = 400,000 - ncf yr 4 = 250,000 - ncf yr 5 = 100,000Cooney Co. is evaluating the following mutually exclusive projects. The manager has determined that the appropriate discount rate is 6.2% for all the recommended projects. Rank order the projects based on the profitability index. Year Project A Project B Project C 0 (35,000) (65,000) (86,000) 1 - 40,000 44,000 2 - 22,000 44,000 3 55,000 22,000 35,000

- Calculate PB, DPB, NPV, IRR and PI for the following project with a discount rate of 12% - initial investment = 750,000, ncf yr 1 = 150,000, ncf yr 2 = 300,000, ncf yr 3 = 400,000, ncf yr 4 = 250,000, ncf yr 5 = 100,000Perform financial analysis for a project using the format discussed in the course. Assume the projected costs and benefits for this project are spread over four years as follows: Estimated costs are $130,000 in Year 1 and $15,000 each year in Years 2, 3, 4, and 5. Estimated benefits are $0 in Year 1 and $90,000 each year in Years 2, 3, 4, and 5. Use an 8% discount rate. Use the NPV template provided (modify to suit your answer) and clearly display the NPV, ROI, and year in which payback occurs. Write a paragraph explaining whether you would recommend investing in this project based on your financial analysis. Explain your answer referring to the NPV, ROI, and payback for this project.Please show calcualtions: a) Calculate the NPV and IRR for the following project with a discount rate of 10% - ncf yr 0 = -250,000, ncf yr 1 = 200,000, ncf yr 2 = 350,000, ncf yr 3 = 300,000, ncf yr 4 = 300,000, ncf yr 5 = -50,000

- You must decide firm which of the proposed projects should be accepted for the upcoming year since only $6 million is available. Which projects should be accepted? Project Cost (millions) NPV (millions) A 3.25 0.80 B 1.75 0.52 C 4.5 0.69 D 3.75 0.95 E 1.25 0.25 F 0.50 0.25If the opportunity cost of capital of 4%, Following information relate to the cash flow of below three projects proposals. Project Year: 0 1 2 3 X -$40,000 +20,000 +18,000 +25,000 Y -$65,000 +15,000 +30,000 +35,000 Z -70000 25,000 25,000 30,000 ِِA.If the discount rate 4%, which project will be acceptable under the discount payback period? B. With help of scientific calculator or excel program, calculate the IRR for project X and Y?You are evaluating three mutually exclusive public-works projects with the respective costs and benefits included in the table below. The useful life of each of the projects is 30 years and MARR is 12% annually. Should any of the projects be selected? (Hint: use incremental B-C Analysis) A B C Capital Investment $10,500,000 $12,000,000 $14,000,000 Annual Operating and Maintenance Costs $850,000 $925,000 $930,000 Market Value $1,350,000 $1,950,000 $2,100,000 Annual Benefit $2,250,000 $2,565,000 $2,700,000