Rent Expense $9,000 per month Depreciation Expense $3,500 per month Insurance Expense $1,250 per month Miscellaneous Expense 4% of sales, paid as incurred Commissions Expense 10% of sales Salaries Expense $8,000 per month Dec Sales $75,000 Jan $80,000 Feb $95,000 March $110,000 Commissions and salaries expenses are paid 50% in the month to which they are incurred and the balance in the next month. Rent and miscellaneous expenses are p when they occur. Insurance is prepaid at the beginning of the quarter. Calculate cash payments for the selling and administrative expenses for the first quarter of the n OA. $38,150 OB. $54,750 OC. $31,700

Rent Expense $9,000 per month Depreciation Expense $3,500 per month Insurance Expense $1,250 per month Miscellaneous Expense 4% of sales, paid as incurred Commissions Expense 10% of sales Salaries Expense $8,000 per month Dec Sales $75,000 Jan $80,000 Feb $95,000 March $110,000 Commissions and salaries expenses are paid 50% in the month to which they are incurred and the balance in the next month. Rent and miscellaneous expenses are p when they occur. Insurance is prepaid at the beginning of the quarter. Calculate cash payments for the selling and administrative expenses for the first quarter of the n OA. $38,150 OB. $54,750 OC. $31,700

Chapter7: Budgeting

Section: Chapter Questions

Problem 3PB: TIB makes custom guitars and prepared the following sales budget for the second quarter It also has...

Related questions

Question

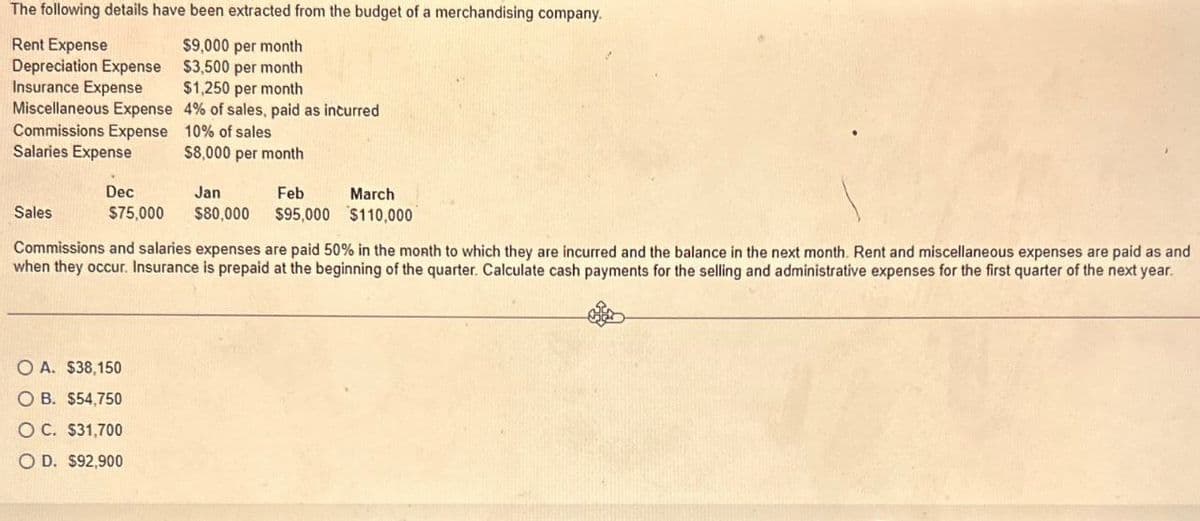

Transcribed Image Text:The following details have been extracted from the budget of a merchandising company.

Rent Expense

$9,000 per month

Depreciation Expense

$3,500 per month

$1,250 per month

Insurance Expense

Miscellaneous Expense 4% of sales, paid as incurred

Commissions Expense 10% of sales

Salaries Expense

$8,000 per month

Sales

Dec

$75,000

Jan

$80,000

Feb

March

$95,000 $110,000

Commissions and salaries expenses are paid 50% in the month to which they are incurred and the balance in the next month. Rent and miscellaneous expenses are paid as and

when they occur. Insurance is prepaid at the beginning of the quarter. Calculate cash payments for the selling and administrative expenses for the first quarter of the next year.

OA. $38,150

OB. $54,750

O C. $31,700

O D. $92,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning