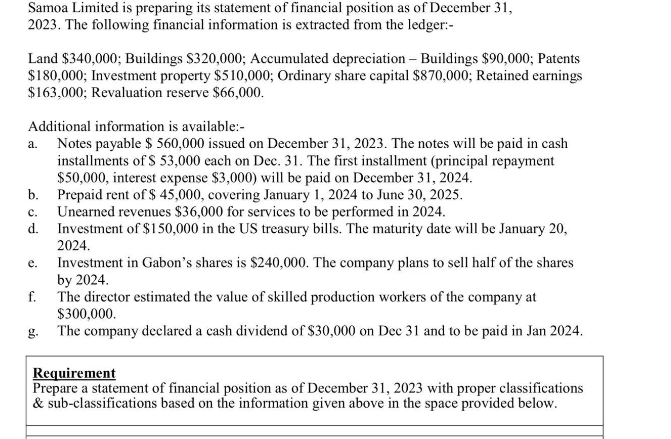

Samoa Limited is preparing its statement of financial position as of December 31, 2023. The following financial information is extracted from the ledger:- Land $340,000; Buildings $320,000; Accumulated depreciation - Buildings $90,000; Patents $180,000; Investment property $510,000; Ordinary share capital $870,000; Retained earnings $163,000; Revaluation reserve $66,000. Additional information is available:- a. Notes payable $560,000 issued on December 31, 2023. The notes will be paid in cash installments of $ 53,000 each on Dec. 31. The first installment (principal repayment $50,000, interest expense $3,000) will be paid on December 31, 2024. b. Prepaid rent of $ 45,000, covering January 1, 2024 to June 30, 2025. C. Unearned revenues $36,000 for services to be performed in 2024. d. Investment of $150,000 in the US treasury bills. The maturity date will be January 20, 2024. e. Investment in Gabon's shares is $240,000. The company plans to sell half of the shares by 2024. f. The director estimated the value of skilled production workers of the company at $300,000. g. The company declared a cash dividend of $30,000 on Dec 31 and to be paid in Jan 2024. Requirement Prepare a statement of financial position as of December 31, 2023 with proper classifications & sub-classifications based on the information given above in the space provided below.

Samoa Limited is preparing its statement of financial position as of December 31, 2023. The following financial information is extracted from the ledger:- Land $340,000; Buildings $320,000; Accumulated depreciation - Buildings $90,000; Patents $180,000; Investment property $510,000; Ordinary share capital $870,000; Retained earnings $163,000; Revaluation reserve $66,000. Additional information is available:- a. Notes payable $560,000 issued on December 31, 2023. The notes will be paid in cash installments of $ 53,000 each on Dec. 31. The first installment (principal repayment $50,000, interest expense $3,000) will be paid on December 31, 2024. b. Prepaid rent of $ 45,000, covering January 1, 2024 to June 30, 2025. C. Unearned revenues $36,000 for services to be performed in 2024. d. Investment of $150,000 in the US treasury bills. The maturity date will be January 20, 2024. e. Investment in Gabon's shares is $240,000. The company plans to sell half of the shares by 2024. f. The director estimated the value of skilled production workers of the company at $300,000. g. The company declared a cash dividend of $30,000 on Dec 31 and to be paid in Jan 2024. Requirement Prepare a statement of financial position as of December 31, 2023 with proper classifications & sub-classifications based on the information given above in the space provided below.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 6RE: Oz Corporation has the following assets at year-end: Patents (net), 26,000; Land, 50,000; Buildings,...

Related questions

Question

Transcribed Image Text:Samoa Limited is preparing its statement of financial position as of December 31,

2023. The following financial information is extracted from the ledger:-

Land $340,000; Buildings $320,000; Accumulated depreciation - Buildings $90,000; Patents

$180,000; Investment property $510,000; Ordinary share capital $870,000; Retained earnings

$163,000; Revaluation reserve $66,000.

Additional information is available:-

a.

Notes payable $560,000 issued on December 31, 2023. The notes will be paid in cash

installments of $ 53,000 each on Dec. 31. The first installment (principal repayment

$50,000, interest expense $3,000) will be paid on December 31, 2024.

b. Prepaid rent of $ 45,000, covering January 1, 2024 to June 30, 2025.

C.

d.

e.

f.

Unearned revenues $36,000 for services to be performed in 2024.

Investment of $150,000 in the US treasury bills. The maturity date will be January 20,

2024.

Investment in Gabon's shares is $240,000. The company plans to sell half of the shares

by 2024.

The director estimated the value of skilled production workers of the company at

$300,000.

g. The company declared a cash dividend of $30,000 on Dec 31 and to be paid in Jan 2024.

Requirement

Prepare a statement of financial position as of December 31, 2023 with proper classifications

& sub-classifications based on the information given above in the space provided below.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning