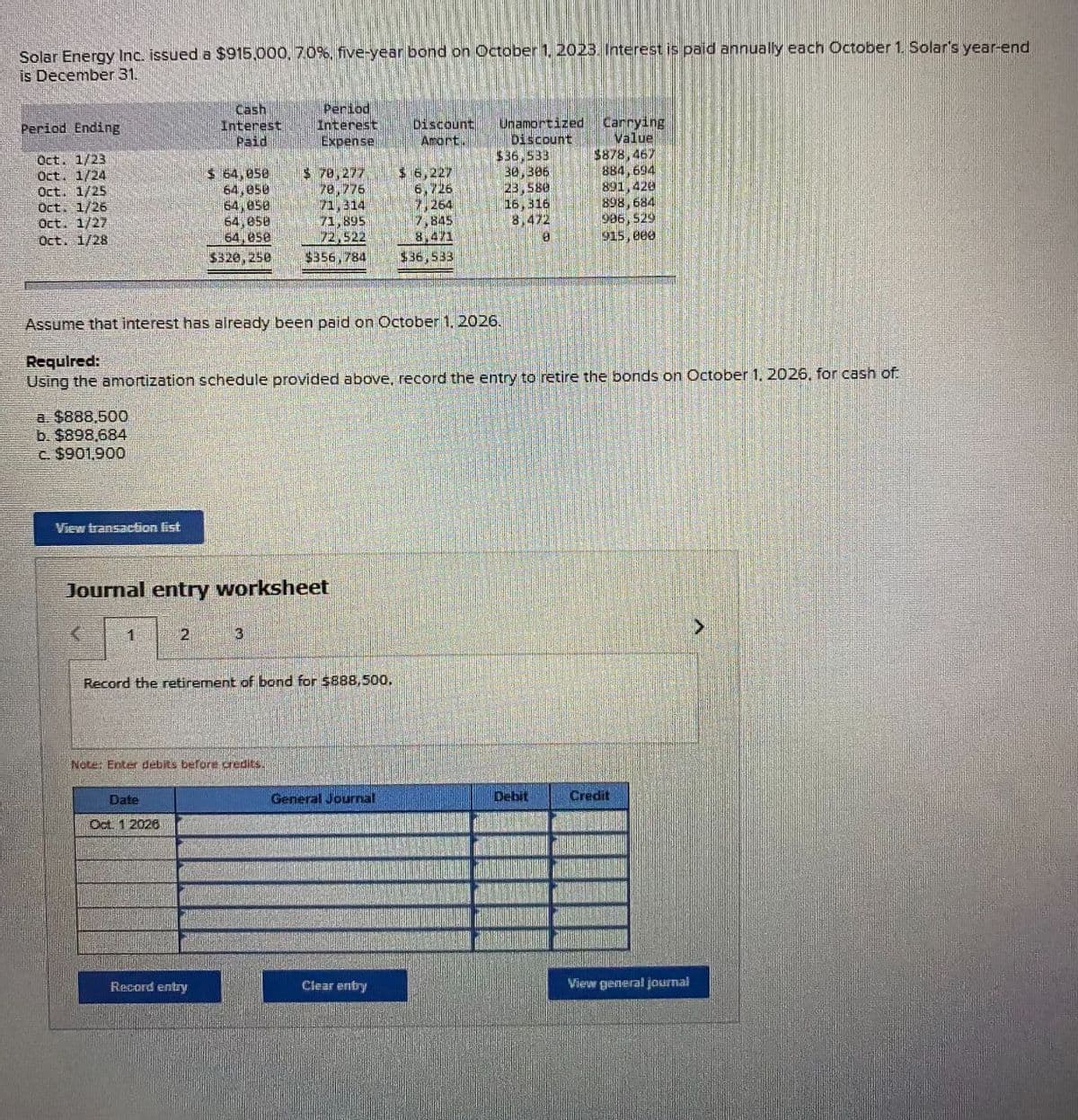

Solar Energy Inc. issued a $915,000, 7.0%, five-year bond on October 1, 2023. Interest is paid annually each October 1. Solar's year-end is December 31. Period Ending Cash Interest Paid Period Interest Expense Discount Amort Unamortized Carrying Discount Value Oct. 1/23 $36,533 $878,467 Oct. 1/24 Oct. 1/25 $ 64,050 64,050 $ 70,277 $ 6,227 30,306 884,694 78,776 6,726 23,580 891,420 Oct. 1/26 64,050 71,314 17.264 16,316 898,684 Oct. 1/27 64,058 71,895 7,845 8,472 Oct. 1/28 64,050 72,522 8,471 996, 529 915,000 $320,250 $356,784 $36,533 Assume that interest has already been paid on October 1, 2026. Required: Using the amortization schedule provided above, record the entry to retire the bonds on October 1, 2026, for cash of: a. $888,500 b. $898,684 c. $901,900 View transaction list Journal entry worksheet 1 2 3 Record the retirement of bond for $888,500. Note: Enter debits before credits. Date Oct. 1 2026 General Journal Debit Credit Record entry Clear entry View general journal

Solar Energy Inc. issued a $915,000, 7.0%, five-year bond on October 1, 2023. Interest is paid annually each October 1. Solar's year-end is December 31. Period Ending Cash Interest Paid Period Interest Expense Discount Amort Unamortized Carrying Discount Value Oct. 1/23 $36,533 $878,467 Oct. 1/24 Oct. 1/25 $ 64,050 64,050 $ 70,277 $ 6,227 30,306 884,694 78,776 6,726 23,580 891,420 Oct. 1/26 64,050 71,314 17.264 16,316 898,684 Oct. 1/27 64,058 71,895 7,845 8,472 Oct. 1/28 64,050 72,522 8,471 996, 529 915,000 $320,250 $356,784 $36,533 Assume that interest has already been paid on October 1, 2026. Required: Using the amortization schedule provided above, record the entry to retire the bonds on October 1, 2026, for cash of: a. $888,500 b. $898,684 c. $901,900 View transaction list Journal entry worksheet 1 2 3 Record the retirement of bond for $888,500. Note: Enter debits before credits. Date Oct. 1 2026 General Journal Debit Credit Record entry Clear entry View general journal

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 6PA: Aggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1,...

Related questions

Question

Transcribed Image Text:Solar Energy Inc. issued a $915,000, 7.0%, five-year bond on October 1, 2023. Interest is paid annually each October 1. Solar's year-end

is December 31.

Period Ending

Cash

Interest

Paid

Period

Interest

Expense

Discount

Amort

Unamortized Carrying

Discount

Value

Oct. 1/23

$36,533

$878,467

Oct. 1/24

Oct. 1/25

$ 64,050

64,050

$ 70,277

$ 6,227

30,306

884,694

78,776

6,726

23,580

891,420

Oct. 1/26

64,050

71,314

17.264

16,316

898,684

Oct. 1/27

64,058

71,895

7,845

8,472

Oct. 1/28

64,050

72,522

8,471

996, 529

915,000

$320,250

$356,784

$36,533

Assume that interest has already been paid on October 1, 2026.

Required:

Using the amortization schedule provided above, record the entry to retire the bonds on October 1, 2026, for cash of:

a. $888,500

b. $898,684

c. $901,900

View transaction list

Journal entry worksheet

1

2

3

Record the retirement of bond for $888,500.

Note: Enter debits before credits.

Date

Oct. 1 2026

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT