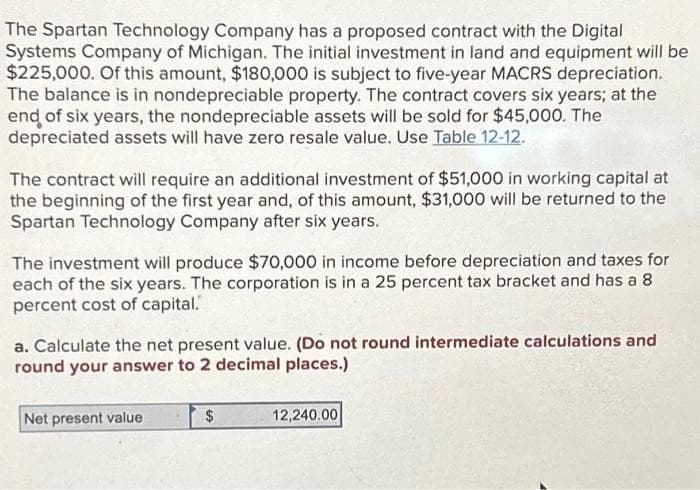

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will b $225,000. Of this amount, $180,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $45,000. The depreciated assets will have zero resale value. Use Table 12-12. The contract will require an additional investment of $51,000 in working capital at the beginning of the first year and, of this amount, $31,000 will be returned to the Spartan Technology Company after six years.

The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will b $225,000. Of this amount, $180,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $45,000. The depreciated assets will have zero resale value. Use Table 12-12. The contract will require an additional investment of $51,000 in working capital at the beginning of the first year and, of this amount, $31,000 will be returned to the Spartan Technology Company after six years.

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 8P

Related questions

Question

Nikul

Transcribed Image Text:The Spartan Technology Company has a proposed contract with the Digital

Systems Company of Michigan. The initial investment in land and equipment will be

$225,000. Of this amount, $180,000 is subject to five-year MACRS depreciation.

The balance is in nondepreciable property. The contract covers six years; at the

end of six years, the nondepreciable assets will be sold for $45,000. The

depreciated assets will have zero resale value. Use Table 12-12.

The contract will require an additional investment of $51,000 in working capital at

the beginning of the first year and, of this amount, $31,000 will be returned to the

Spartan Technology Company after six years.

The investment will produce $70,000 in income before depreciation and taxes for

each of the six years. The corporation is in a 25 percent tax bracket and has a 8

percent cost of capital.

a. Calculate the net present value. (Do not round intermediate calculations and

round your answer to 2 decimal places.)

Net present value

$

12,240.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning