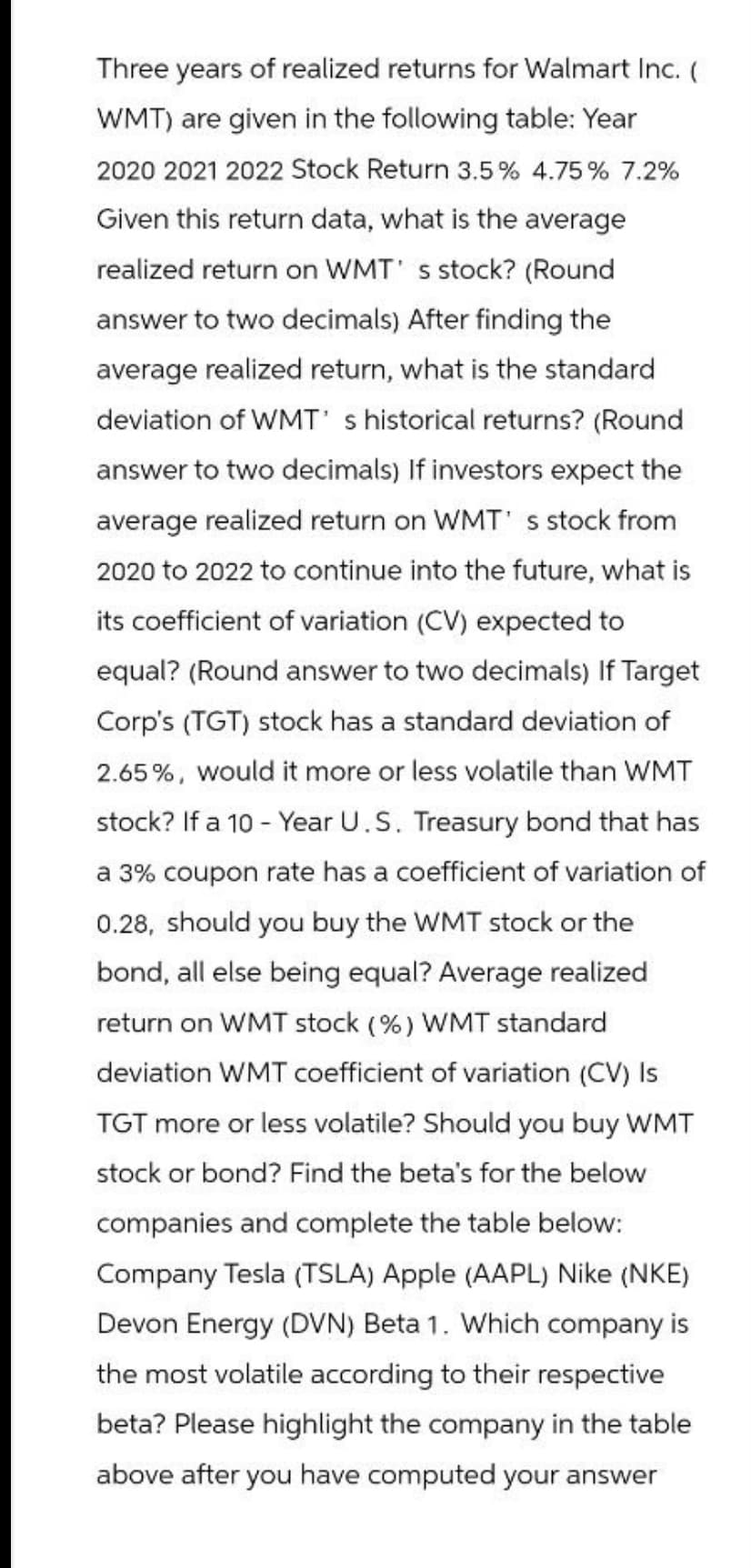

Three years of realized returns for Walmart Inc. ( WMT) are given in the following table: Year 2020 2021 2022 Stock Return 3.5% 4.75% 7.2% Given this return data, what is the average realized return on WMT' s stock? (Round answer to two decimals) After finding the average realized return, what is the standard deviation of WMT's historical returns? (Round answer to two decimals) If investors expect the average realized return on WMT's stock from 2020 to 2022 to continue into the future, what is its coefficient of variation (CV) expected to equal? (Round answer to two decimals) If Target Corp's (TGT) stock has a standard deviation of 2.65%, would it more or less volatile than WMT stock? If a 10-Year U.S. Treasury bond that has a 3% coupon rate has a coefficient of variation of 0.28, should you buy the WMT stock or the bond, all else being equal? Average realized return on WMT stock (%) WMT standard deviation WMT coefficient of variation (CV) Is TGT more or less volatile? Should you buy WMT stock or bond? Find the beta's for the below companies and complete the table below: Company Tesla (TSLA) Apple (AAPL) Nike (NKE) Devon Energy (DVN) Beta 1. Which company is the most volatile according to their respective beta? Please highlight the company in the table above after you have computed your answer

Three years of realized returns for Walmart Inc. ( WMT) are given in the following table: Year 2020 2021 2022 Stock Return 3.5% 4.75% 7.2% Given this return data, what is the average realized return on WMT' s stock? (Round answer to two decimals) After finding the average realized return, what is the standard deviation of WMT's historical returns? (Round answer to two decimals) If investors expect the average realized return on WMT's stock from 2020 to 2022 to continue into the future, what is its coefficient of variation (CV) expected to equal? (Round answer to two decimals) If Target Corp's (TGT) stock has a standard deviation of 2.65%, would it more or less volatile than WMT stock? If a 10-Year U.S. Treasury bond that has a 3% coupon rate has a coefficient of variation of 0.28, should you buy the WMT stock or the bond, all else being equal? Average realized return on WMT stock (%) WMT standard deviation WMT coefficient of variation (CV) Is TGT more or less volatile? Should you buy WMT stock or bond? Find the beta's for the below companies and complete the table below: Company Tesla (TSLA) Apple (AAPL) Nike (NKE) Devon Energy (DVN) Beta 1. Which company is the most volatile according to their respective beta? Please highlight the company in the table above after you have computed your answer

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.1: Measures Of Center

Problem 9PPS

Related questions

Question

Transcribed Image Text:Three years of realized returns for Walmart Inc. (

WMT) are given in the following table: Year

2020 2021 2022 Stock Return 3.5% 4.75% 7.2%

Given this return data, what is the average

realized return on WMT' s stock? (Round

answer to two decimals) After finding the

average realized return, what is the standard

deviation of WMT's historical returns? (Round

answer to two decimals) If investors expect the

average realized return on WMT's stock from

2020 to 2022 to continue into the future, what is

its coefficient of variation (CV) expected to

equal? (Round answer to two decimals) If Target

Corp's (TGT) stock has a standard deviation of

2.65%, would it more or less volatile than WMT

stock? If a 10-Year U.S. Treasury bond that has

a 3% coupon rate has a coefficient of variation of

0.28, should you buy the WMT stock or the

bond, all else being equal? Average realized

return on WMT stock (%) WMT standard

deviation WMT coefficient of variation (CV) Is

TGT more or less volatile? Should you buy WMT

stock or bond? Find the beta's for the below

companies and complete the table below:

Company Tesla (TSLA) Apple (AAPL) Nike (NKE)

Devon Energy (DVN) Beta 1. Which company is

the most volatile according to their respective

beta? Please highlight the company in the table

above after you have computed your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 7 steps with 5 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill