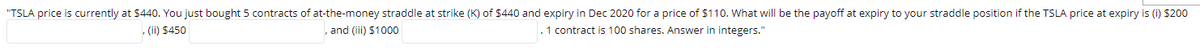

"TSLA price is currently at $440. You just bought 5 contracts of at-the-money straddle at strike (K) of $440 and expiry in Dec 2020 for a price of $110. What will be the payoff at expiry to your straddle position if the TSLA price at expiry is (i) $200 (ii) $450 and (iii) $1000 . 1 contract is 100 shares. Answer in integers."

Q: If a person has ATM fees each month of $22 for 8 years, what would be the total cost of those…

A: Monthly fees: $22Number of years: 8

Q: Nifty Dashboards just paid a dividend of Do = $1.28. Analysts expect the company's dividend to grow…

A: The Dividend Discount Model (DDM) is a method used to value a company's stock by estimating the…

Q: You are trying to decide between two mobile phone carriers. Carrier A requires you to pay $195 for…

A: When the lives of the assets are different, we need to find the EAA.EAA calculates the annualized…

Q: Portage Bay Enterprises has $4 million in excess cash, no debt, and is expected to have free cash…

A: Free cash flow is the operating cash flow available after the deduction of all expenses, debts and…

Q: Your company currently has $1,000 par, 6% coupon bonds with 10 years to maturity and a price of…

A: The coupon rate of a bond is the fixed interest rate that the issuer pays to the bondholders. It is…

Q: The balance on a credit card, that charges a 12% APR interest rate, over a 1 month period is given…

A: Finance Charge is the interest charged by credit card companies over an outstanding amount. Average…

Q: I need solution fast

A: The objective of the question is to forecast the net income for the year 2017 based on the given…

Q: Mr Jones is to receive a deferred annuity of £2500 which starts at the end of the third year from…

A: As per the guidelines if multiple questions are asked at once, then the solution for the first…

Q: Use the following to solve questions a. and b. with excel A house with price of $250,000 20% down…

A: To solve these questions, we would typically use Excel's financial functions to calculate the total…

Q: An investor uses £100,000 to buy 7-year bonds with a face value of £100. The bonds pay coupons…

A: Price of the bond refers to the present value of the future earnings and the maturity value at the…

Q: Joey's bar has been the only bar in town for many years. There is a new bar opening next month.…

A: The objective of the question is to identify the type of financial risk that Joey's bar is exposed…

Q: So($/€) Exchange Rate $ 1.45 = € 1.00 F360($/€) $ 1.48 = € 1.00 Interest Rate APR i$ 4% i€ 3% you…

A: Money has time value and due to which value of money will not be same tomorrow and value will change…

Q: The following table shows the prices of a sample of Treasury bonds, all of which have coupon rates…

A: The objective of the question is to calculate the interest rates for different maturity periods and…

Q: k algo 10-31 Cash Flows And NPV The Bruin's Den Outdoor Gear is considering a new 6-year project to…

A: The objective of this question is to calculate the Net Present Value (NPV) of a new project that The…

Q: Omega Enterprises issued 10 year 9% preference shares four years ago. The preference shares which…

A: Shares of stock refer to the financial instruments that are issued to raise capital from the public.…

Q: The efficient frontier represents a combination of which of the following? a. Only portfolios

A: The efficient frontier represents a combination of:a. Only portfoliosb. A portfolio of risky…

Q: An investor uses £70,000 to buy 6-year bonds with a face value of £100. The bonds pay coupons…

A: Answer for required: Current Value of Bond = = £90.62 N.P.V of Bond Investment =…

Q: The Johnsons have accumulated a nest egg of $50,000 that they intend to use as a down payment toward…

A: A mortgage refers to a covered loan borrowed for the purchase or maintenance of a property with the…

Q: You have the choice of receiving $80,000 now or $30,000 now and another $56,000 two years from now.…

A: The objective of the question is to determine which option is better in terms of today's dollar…

Q: Martin's Inc. is expected to pay annual dividends of $3.00, $3.50 and $4.00 a share over the next…

A: Dividend in year 1 = $3Dividend in year 2 = $3.50Dividend in year 3 = $4Growth rate = 3%Required…

Q: Navarre Energy Research specializes in developing and commercializing new products. It is organized…

A: Economic value added is a measurement of residual income/economic profit over and above of required…

Q: McGilla Golf has decided to sell a new line of golf clubs. The company would like to know the…

A: Selling price of new units = $810Variable cost = $370Marketing study costs = $230,000R&D costs =…

Q: Am. 112.

A: The objective of the question is to estimate the overhead costs for Bowen plc if it handles…

Q: Your parents have accumulated a $120,000 nest egg. They have been planning to use this money to pay…

A: Question 6: Funds available after the Nail SalonStart with the initial nest egg: $120,000Subtract…

Q: You are the loan department supervisor for a bank. This installment loan is being paid off early,…

A: An installment loan with a $4,600 principal balance is being paid off early after 33 payments out of…

Q: Given the dramatic decrease in a company's stock price last year, what would be the impact on the…

A: Stock price is the value of the company's stock in the market at a given time. Stock prices are…

Q: You have 20 years left for your retirement. You wish to accumulate a sum large enough by that time…

A: To solve this, we need to calculate the future value of an annuity (the amount you'll withdraw…

Q: [Ch 2] Use the following firm's balance sheet to answer the next three problems. All values in the…

A: The equity multiplier, also known as the leverage ratio, is a financial metric measuring the…

Q: A property gets following Cash flows: NO = 100,000 growing by 3% first I 1 year, 4% Second year,…

A: The objective of the question is to calculate the present value of the cash flows from the property.…

Q: 10) Suppose a coupon bond with 10 years remaining to maturity is reported to have a duration…

A: Years to maturity = 10Duration = 6.7 yearsInterest rate = 9%Decreased interest rate = 8.8%To find:…

Q: Bond valuation - Quarterly interest Calculate the value of a $1,000-par-value bond paying quarterly…

A: A bond is an instrument that provides the issuing organization access to debt capital from…

Q: CAPM Elements Risk-free rate (RF) Market risk premium (RPM) Happy Corp. stock's beta Required rate…

A: The capital asset pricing model aids analysts and investors in calculating the expected return on…

Q: The current price of XYZ stock is $103. The seven month forward price for XYZ stock is $106. Assume…

A: The objective of the question is to calculate the continuously compounded interest rate given the…

Q: You invest $10,000 at the end of each 5 years. If i=4%, What is the value of the account at EOY 5?…

A: At the end of year 5, the value of the account where $10,000 is invested every 5 years at an…

Q: Q1) A Zero-Coupon Bond with maturity in 5 years produces a gross yield of 2.2% p.a. effective and…

A: Given information:Redemption value (face value at maturity): £100Effective yield (gross yield): 2.2%…

Q: Complete the following table and draw a graph showing how bond price for each bond changes over time…

A: Overall, the relationship between bond prices and time remaining to maturity is influenced by the…

Q: Assume the returns from holding an asset are normally distributed. Also assume the average annual…

A:

Q: Fizzy Animators, Inc. currently makes all sales on credit and offers no cash discount. The firm is…

A: A marginal cash discount refers to a financial incentive offered by a seller to encourage customers…

Q: The real risk-free rate, r*, is 1.4%. Inflation is expected to average 1.2% a year for the next 4…

A: The objective of the question is to calculate the default risk premium of an 8-year corporate bond.…

Q: What is the value of a 5% coupon, annual pay bond that has 22 years remaining to maturity and a $1,…

A: A bond is a fixed-income security that offers the investor a defined set of periodic payments and…

Q: Suppose that you purchased a Ba rated $1000 annual coupon bond with an 8.9% coupon rate and a…

A: A bond is a fixed-income security that allows the investor access to the debt market through public…

Q: Consider the two (excess return) Index-model regression results for stocks A and B. The risk-free…

A: Market return = 11%Risk free rate = 4%To find Alpha, Information ratio, Sharpe ratio, and Treynor…

Q: A 25-year bond with a par value of 1,000 and 10% coupons payable quarterly is selling at 925.…

A: Maturity period25Payments per year4Annual coupon rate10%Par value1000Selling price925

Q: You buy a house of $450,000 today. You put a down payment of 20% and borrow a fixed-rate mortgage of…

A: You bought a house for $450,000 with a $90,000 down payment and a $360,000 mortgage at 4% for 15…

Q: a. Calculate the equity earnings, earnings per share, and return on shares for each operating income…

A: The earnings per share is the amount of profit a firm makes for each stock. In order to get EPS,…

Q: Real and nominal rates interest Zane Perelli currently has $96 that he can spend today on socks…

A: Real rate of interest defines the return in actual is earned by the investors through providing…

Q: Marissa Manufacturing is presented with the following two mutually exclusive projects. The required…

A: IRR refers to Internal Rate of Return.It is the return actually earned by the project.IRR Can be…

Q: Please only anser in Excel format, including lay out, formulas and screenshots. mary finds a job…

A: The time value of money is a concept in finance that takes into account the effect of compounding to…

Q: Interest rates on 3-year Treasury securities and 5-year Treasury securities are currently 4.5% and…

A: Treasury securities refer to the obligations of debt which are issued by the US Treasury department…

Q: You are the financial analyst for a tennis racket manufacturer. The company is considering using a…

A: NPV is defined as the sum of the present values of all future cash inflows less the sum of the…

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- If you are long 2 contracts on 1-year TSLA call option with strike price of $400, what will be your payoff at expiry if the TSLA price at that time is (i) $200 , (ii) $450 , and (iii) $1000 . 1 contract is 100 shares.Assume we are in July, 2023. In July of 2023, the share prices of company B are $80 per share. You believe they should be $30 per share, and are thus overvalued. December 2023 put options on a strike price of $60 per share are currently valued at $5. Each put contract is based on 100 shares. a.) What is your net dollar profit or loss as a holder of the put contract (based ona contract size of 100 shares) if we arrive at expiry in December and you are wrong and Company B shares are selling for $100?Assume we are in July, 2023. In July of 2023, the share prices of company B are $80 per share. You believe they should be $30 per share, and are thus overvalued. December 2023 put options on a strike price of $60 per share are currently valued at $5. Each put contract is based on 100 shares. a.) What is your net dollar profit or loss as a holder of the put contract (based ona contract size of 100 shares) if we arrive at expiry in December and you are wrong and Company B shares are selling for $100? (Show your working in full)

- You buy one, Jan 15, 2021 Alphabet Inc. (GOOG) put contract with strike price of $680 and pay a premium of $7. The put contract represents 100 shares of stock. What is the maximum net profit that you could gain from this strategy (be sure to include the cost of the option contract in your calculation)?On January 1, 2024, Adams-Meneke Corporation granted 15 million incentive stock options to division managers, each permitting holders to purchase one share of the company’s $1 par common shares within the next six years, but not before December 31, 2026 (the vesting date). The exercise price is the market price of the shares on the date of grant, currently $50 per share. The fair value of the options, estimated by an appropriate option pricing model, is $5 per option. Management’s policy is to estimate forfeitures. No forfeitures are anticipated. Ignore taxes. Required: Determine the total compensation cost pertaining to the options on January 1, 2024. Prepare the appropriate journal entry to record compensation expense on December 31, 2024. Unexpected turnover during 2025 caused an estimate of the forfeiture of 10% of the stock options. Prepare the appropriate journal entry(s) on December 31, 2025 and 2026 in response to the new estimate.On January 2, 2020, Ayayai Company purchases a call option for $310 on Merchant common stock. The call option gives Ayayai the option to buy 1,090 shares of Merchant at a strike price of $49 per share. The market price of a Merchant share is $49 on January 2, 2020 (the intrinsic value is therefore $0). On March 31, 2020, the market price for Merchant stock is $53 per share, and the time value of the option is $200. Prepare the journal entry to record the purchase of the call option on January 2, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 2, 2020 enter an account title to record the transaction on January 2, 2020 enter a debit amount enter a credit amount enter an account title to record the transaction on January 2, 2020 enter a debit…

- Please finish this problem from part e on: On July 1, 2020 an investor holds 50,000 shares of a certain company stock. The market price at this time is $30 per share. A) what is the current value of investor’s portfolio Value_________ The investor is interested in hedging against movements in the market over the next months (until Sep 2020) and decides to use the September 2020 Mini S&P 500 futures contract. The index futures price is currently 1,500[1] and one contract is for delivery of $50 times the index. B) What is the current value of one Mini S&P 500 futures contract? Value___________ C) The beta of the stock is 1.3. How can investor hedge his portfolio against market risk exposure by trading S&P 500 market index Trading strategy _____ D) The beta of the stock is 1.3. How can investor hedge his portfolio against market risk exposure using futures contract. Should he/she enter LONG or SHORT position. For how many futures contracts? SHORT or…On January 1, 2020, Jade Company granted 100 share options each to 500 employees, conditional upon the employees’ remaining in the entity’s employ during the vesting period. The share options vest at the end of a three-year period. On grant date, each share option has a fair value of P30. The par value per share is P100 and the option price is P120. On December 31, 2021, 30 employees have left and it is expected that on the basis of weighted average probability, a further 30 employees will leave before the of the three-year period. On December 31, 2022, only 20 employees actually left and all of the share options are exercised on such date. How much is the compensation expense that should be recognized for 2022?A . 500,000 B. 880,000 C. 380,000 D. 470,000On January 2, 2020, Jones Company purchases a call option for $300 on Merchant common stock. The call option gives Jones the option to buy 1,000 shares of Merchant at a strike price of $50 per share. The market price of a Merchant share is $50 on January 2, 2020 (the intrinsic value is therefore $0). On March 31, 2020, the market price for Merchant stock is $53 per share, and the time value of the option is $200. Instructions a. Prepare the journal entry to record the purchase of the call option on January 2, 2020. b. Prepare the journal entry(ies) to recognize the change in the fair value of the call option as of March 31, 2020. c. What was the effect on net income of entering into the derivative transaction for the period January 2 to March 31, 2020?

- On January 1, 2021, Adams-Meneke Corporation granted 25 million incentive stock options to division managers, each permitting holders to purchase one share of the company’s $1 par common shares within the next six years, but not before December 31, 2023 (the vesting date). The exercise price is the market price of the shares on the date of grant, currently $10 per share. The fair value of the options, estimated by an appropriate option pricing model, is $3 per option. Management’s policy is to estimate forfeitures. No forfeitures are anticipated. Ignore taxes.Required:1. Determine the total compensation cost pertaining to the options on January 1, 2021.2. Prepare the appropriate journal entry to record compensation expense on December 31, 2021.3. Unexpected turnover during 2022 caused an estimate of the forfeiture of 6% of the stock options. Prepare the appropriate journal entry(s) on December 31, 2022 and 2023 in response to the new estimate.On March 1, 2022, Jensen Corp. purchased a call option on shares of YTV stock. The contract was for 100 shares at a strike price of $120 per share, with an expiration date of May 31, 2022. The option contract premium was $30. On March 31, a market appraisal estimated the time value of the option to be $20. Jensen settled the option contract on May 10. Prices of YTV stock during the option period are provided below. March 1 March 31 May 10 Price of YTV stock: $120 $110 $115 At what amount would Jensen report as the value of the call option in its March 31, 2022 balance sheet? Call option account balance as off March 31 :On January 1, 2018, Adams-Meneke Corporation granted 25 million incentive stock options to division managers, each permitting holders to purchase one share of the company’s $1 par common shares within the next sixyears, but not before December 31, 2020 (the vesting date). The exercise price is the market price of the shareson the date of grant, currently $10 per share. The fair value of the options, estimated by an appropriate optionpricing model, is $3 per option. Management’s policy is to estimate forfeitures. No forfeitures are anticipated.Ignore taxes.Required:1. Determine the total compensation cost pertaining to the options on January 1, 2018.2. Prepare the appropriate journal entry to record compensation expense on December 31, 2018.3. Unexpected turnover during 2019 caused an estimate of the forfeiture of 6% of the stock options. Determinethe adjusted compensation cost, and prepare the appropriate journal entry(s) on December 31, 2019 and 2020.