FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

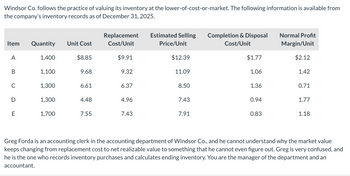

Transcribed Image Text:Windsor Co. follows the practice of valuing its inventory at the lower-of-cost-or-market. The following information is available from

the company's inventory records as of December 31, 2025.

Replacement

Item

Quantity

Unit Cost

Cost/Unit

Estimated Selling

Price/Unit

Completion & Disposal

Cost/Unit

Normal Profit

Margin/Unit

A

1,400

$8.85

$9.91

$12.39

$1.77

$2.12

B

1,100

9.68

9.32

11.09

1.06

1.42

C

1,300

6.61

6.37

8.50

1.36

0.71

D

1,300

4.48

4.96

7.43

0.94

1.77

1,700

7.55

7.43

7.91

0.83

1.18

Greg Forda is an accounting clerk in the accounting department of Windsor Co., and he cannot understand why the market value

keeps changing from replacement cost to net realizable value to something that he cannot even figure out. Greg is very confused, and

he is the one who records inventory purchases and calculates ending inventory. You are the manager of the department and an

accountant.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Crane Ltd. had the following items in inventory as at December 31, 2024: Item No. Quantity Unit Cost NRV དྷྭ སྒྲ སཱུ སྦ 340 $4.00 $4.30 370 3.00 2.90 380 8.00 9.00 400 7.00 6.80 Assume that Crane uses a perpetual inventory system. Fill in the table below for the lower of cost and net realizable value per unit, the inventory dollar amount at the lower of cost and net realizable value, and the dollar amount of the inventory at cost. ntity Unit Cost NRV Unit LC & NRV 340 $4.00 $4.30 S 370 3.00 2.90 Dollar LC & NRV 4.00 $ 2.90 1360 1073 380 8.00 9.00 8.00 3040 400 7.00 6.80 6.80 2720 Dollar Cost 1360 1110 3040 2800 $ 8193 $ 8310 Prepare any necessary adjusting entry at December 31, 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry) Account Titles Debit Creditarrow_forwardAs of 12-31-15, Acme Company has three different inventory items on hand. Data on the three items follows: Item Quantity on hand Unit cost (Acme uses LIFO) Replacement cost Normal profit Expected selling price Estimated disposal costs A 75 $405 $625 $750 $1,500 $100 B 24 $310 $300 $230 $400 $25 C 51 $775 $800 $300 $1,000 $250 Using the lower-of-cost-or-market approach applied on an individual-item basis, determine if Acme needs to make an entry to write her inventory down. If so, prepare the entry Acme should makearrow_forwardValuing Inventory at Lower-of-Cost-or-Market Management of Tarry Company takes the position that under the lower-of-cost-or-market rule, the two items below are reported in ending inventory at $119,520 (total). Inventory cost is reported using LIFO. • Edgers: 2,160 in inventory; cost is $22 each; replacement cost is $16 each; estimated sale price is $30 each; estimated distribution cost is $3 each; and normal profit is 10% of sale price. • Hedge clippers: 1,440 in inventory; cost is $50 each; replacement cost is $36 each; estimated sale price is $90 each; estimated distribution cost is $28 each; and normal profit is 20% of sale price. a. Compute your inventory valuation by item and in total for the Tarry Company inventory reported above. Inventory valuation for edgers $ Inventory valuation for hedge clippers Total inventory valuation b. Prepare the entry, if any, to report inventory at the lower-of-cost-or-market. Assume that all adjustments directly impact cost of goods sold and…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education