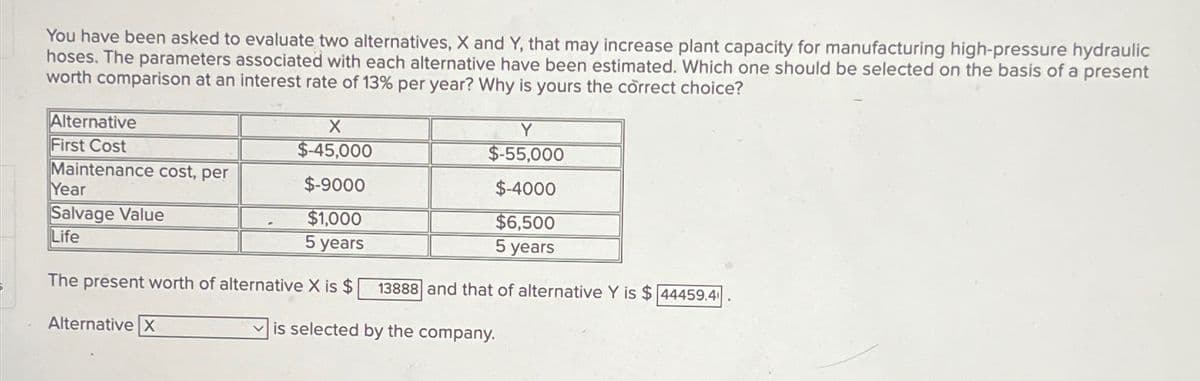

You have been asked to evaluate two alternatives, X and Y, that may increase plant capacity for manufacturing high-pressure hydraulic hoses. The parameters associated with each alternative have been estimated. Which one should be selected on the basis of a present worth comparison at an interest rate of 13% per year? Why is yours the correct choice? Alternative First Cost X $-45,000 Maintenance cost, per $-9000 $1,000 5 years Year Salvage Value Life Y $-55,000 $4000 $6,500 5 years The present worth of alternative X is $ 13888 and that of alternative Y is $ 44459.4 Alternative X is selected by the company

You have been asked to evaluate two alternatives, X and Y, that may increase plant capacity for manufacturing high-pressure hydraulic hoses. The parameters associated with each alternative have been estimated. Which one should be selected on the basis of a present worth comparison at an interest rate of 13% per year? Why is yours the correct choice? Alternative First Cost X $-45,000 Maintenance cost, per $-9000 $1,000 5 years Year Salvage Value Life Y $-55,000 $4000 $6,500 5 years The present worth of alternative X is $ 13888 and that of alternative Y is $ 44459.4 Alternative X is selected by the company

Chapter14: Capital Structure Management In Practice

Section14.A: Breakeven Analysis

Problem 8P

Related questions

Question

Transcribed Image Text:You have been asked to evaluate two alternatives, X and Y, that may increase plant capacity for manufacturing high-pressure hydraulic

hoses. The parameters associated with each alternative have been estimated. Which one should be selected on the basis of a present

worth comparison at an interest rate of 13% per year? Why is yours the correct choice?

Alternative

First Cost

X

$-45,000

Maintenance cost, per

$-9000

Year

Salvage Value

$1,000

Life

5 years

Y

$-55,000

$-4000

$6,500

5 years

The present worth of alternative X is $ 13888 and that of alternative Y is $ 44459.4

Alternative X

is selected by the company.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College