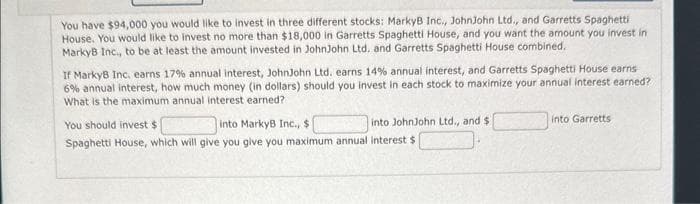

You have $94,000 you would like to invest in three different stocks: MarkyB Inc., JohnJohn Ltd., and Garretts Spaghetti House. You would like to invest no more than $18,000 in Garretts Spaghetti House, and you want the amount you invest in MarkyB Inc., to be at least the amount invested in JohnJohn Ltd. and Garretts Spaghetti House combined. If MarkyB Inc. earns 17% annual interest, JohnJohn Ltd. earns 14% annual interest, and Garretts Spaghetti House earns 6% annual interest, how much money (in dollars) should you invest in each stock to maximize your annual interest earned? What is the maximum annual interest earned? You should invest $ into MarkyB Inc., $ into JohnJohn Ltd., and $ Spaghetti House, which will give you give you maximum annual interest $ into Garretts

You have $94,000 you would like to invest in three different stocks: MarkyB Inc., JohnJohn Ltd., and Garretts Spaghetti House. You would like to invest no more than $18,000 in Garretts Spaghetti House, and you want the amount you invest in MarkyB Inc., to be at least the amount invested in JohnJohn Ltd. and Garretts Spaghetti House combined. If MarkyB Inc. earns 17% annual interest, JohnJohn Ltd. earns 14% annual interest, and Garretts Spaghetti House earns 6% annual interest, how much money (in dollars) should you invest in each stock to maximize your annual interest earned? What is the maximum annual interest earned? You should invest $ into MarkyB Inc., $ into JohnJohn Ltd., and $ Spaghetti House, which will give you give you maximum annual interest $ into Garretts

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 4P

Related questions

Question

Plz correct solution.

Transcribed Image Text:You have $94,000 you would like to invest in three different stocks: MarkyB Inc., JohnJohn Ltd., and Garretts Spaghetti

House. You would like to invest no more than $18,000 in Garretts Spaghetti House, and you want the amount you invest in

MarkyB Inc., to be at least the amount invested in JohnJohn Ltd. and Garretts Spaghetti House combined.

If MarkyB Inc. earns 17% annual interest, JohnJohn Ltd. earns 14% annual interest, and Garretts Spaghetti House earns

6% annual interest, how much money (in dollars) should you invest in each stock to maximize your annual interest earned?

What is the maximum annual interest earned?

You should invest $

into MarkyB Inc., $

into JohnJohn Ltd., and $

Spaghetti House, which will give you give you maximum annual interest $

into Garretts

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning