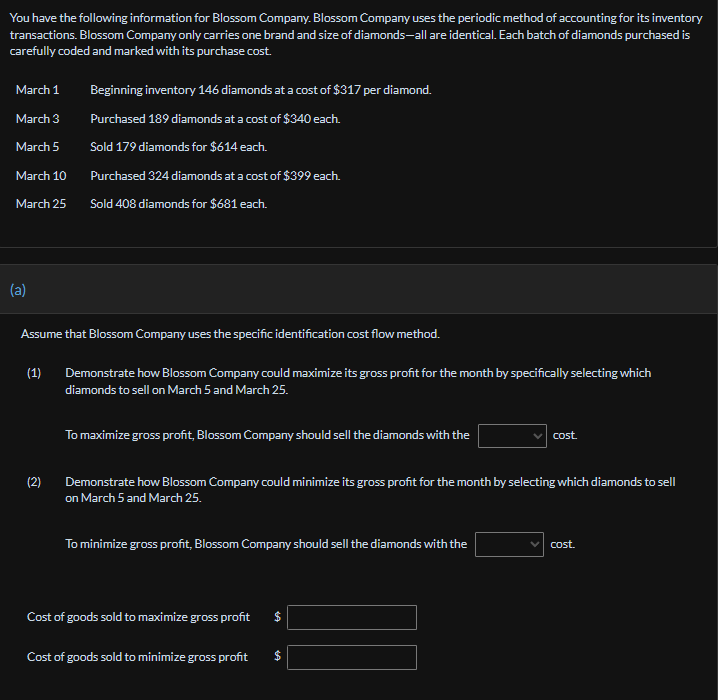

You have the following information for Blossom Company. Blossom Company uses the periodic method of accounting for its inventory transactions. Blossom Company only carries one brand and size of diamonds-all are identical. Each batch of diamonds purchased is carefully coded and marked with its purchase cost. March 1 Beginning inventory 146 diamonds at a cost of $317 per diamond. March 3 Purchased 189 diamonds at a cost of $340 each. March 5 Sold 179 diamonds for $614 each. March 10 Purchased 324 diamonds at a cost of $399 each. March 25 Sold 408 diamonds for $681 each. (a) Assume that Blossom Company uses the specific identification cost flow method. (1) Demonstrate how Blossom Company could maximize its gross profit for the month by specifically selecting which diamonds to sell on March 5 and March 25. (2) To maximize gross profit, Blossom Company should sell the diamonds with the cost. Demonstrate how Blossom Company could minimize its gross profit for the month by selecting which diamonds to sell on March 5 and March 25. To minimize gross profit, Blossom Company should sell the diamonds with the cost. Cost of goods sold to maximize gross profit $ Cost of goods sold to minimize gross profit $

You have the following information for Blossom Company. Blossom Company uses the periodic method of accounting for its inventory transactions. Blossom Company only carries one brand and size of diamonds-all are identical. Each batch of diamonds purchased is carefully coded and marked with its purchase cost. March 1 Beginning inventory 146 diamonds at a cost of $317 per diamond. March 3 Purchased 189 diamonds at a cost of $340 each. March 5 Sold 179 diamonds for $614 each. March 10 Purchased 324 diamonds at a cost of $399 each. March 25 Sold 408 diamonds for $681 each. (a) Assume that Blossom Company uses the specific identification cost flow method. (1) Demonstrate how Blossom Company could maximize its gross profit for the month by specifically selecting which diamonds to sell on March 5 and March 25. (2) To maximize gross profit, Blossom Company should sell the diamonds with the cost. Demonstrate how Blossom Company could minimize its gross profit for the month by selecting which diamonds to sell on March 5 and March 25. To minimize gross profit, Blossom Company should sell the diamonds with the cost. Cost of goods sold to maximize gross profit $ Cost of goods sold to minimize gross profit $

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 51E: Inventory Costing Methods On June 1, Welding Products Company had a beginning inventory of 210 cases...

Related questions

Question

Transcribed Image Text:You have the following information for Blossom Company. Blossom Company uses the periodic method of accounting for its inventory

transactions. Blossom Company only carries one brand and size of diamonds-all are identical. Each batch of diamonds purchased is

carefully coded and marked with its purchase cost.

March 1

Beginning inventory 146 diamonds at a cost of $317 per diamond.

March 3

Purchased 189 diamonds at a cost of $340 each.

March 5

Sold 179 diamonds for $614 each.

March 10

Purchased 324 diamonds at a cost of $399 each.

March 25

Sold 408 diamonds for $681 each.

(a)

Assume that Blossom Company uses the specific identification cost flow method.

(1)

Demonstrate how Blossom Company could maximize its gross profit for the month by specifically selecting which

diamonds to sell on March 5 and March 25.

(2)

To maximize gross profit, Blossom Company should sell the diamonds with the

cost.

Demonstrate how Blossom Company could minimize its gross profit for the month by selecting which diamonds to sell

on March 5 and March 25.

To minimize gross profit, Blossom Company should sell the diamonds with the

cost.

Cost of goods sold to maximize gross profit

$

Cost of goods sold to minimize gross profit

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning