What is depreciation? How do you calculate depreciation in small business?

Expert Answer

Depreciation:

Depreciation refers to the reduction in the monetary value of a fixed asset due to its wear and tear or obsolescence. It is a method of distributing the cost of the fixed assets over its estimated useful life. Some of the examples of fixed assets are furniture, building, office equipment, machinery etc.

Depreciation in small business can be calculated by using straight line method and double declining balance method

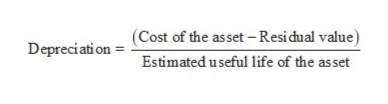

Straight-line Under the straight-line method of depreciation, the same amount of depreciation is allocated every year over the estimated useful life of an asset. The formula to calculate the depreciation cost of the asset using the residual value is shown as below:

Double-declining-balance method:

It is an accelerated method of depreciation under which the depreciation declines in each successive year until the value of asset becomes zero. Under this method, the book value (original cost less accumulated depreciation) of the long-term asset is decreased by a fixed rate. It is double the rate of the straight-line depreciation.