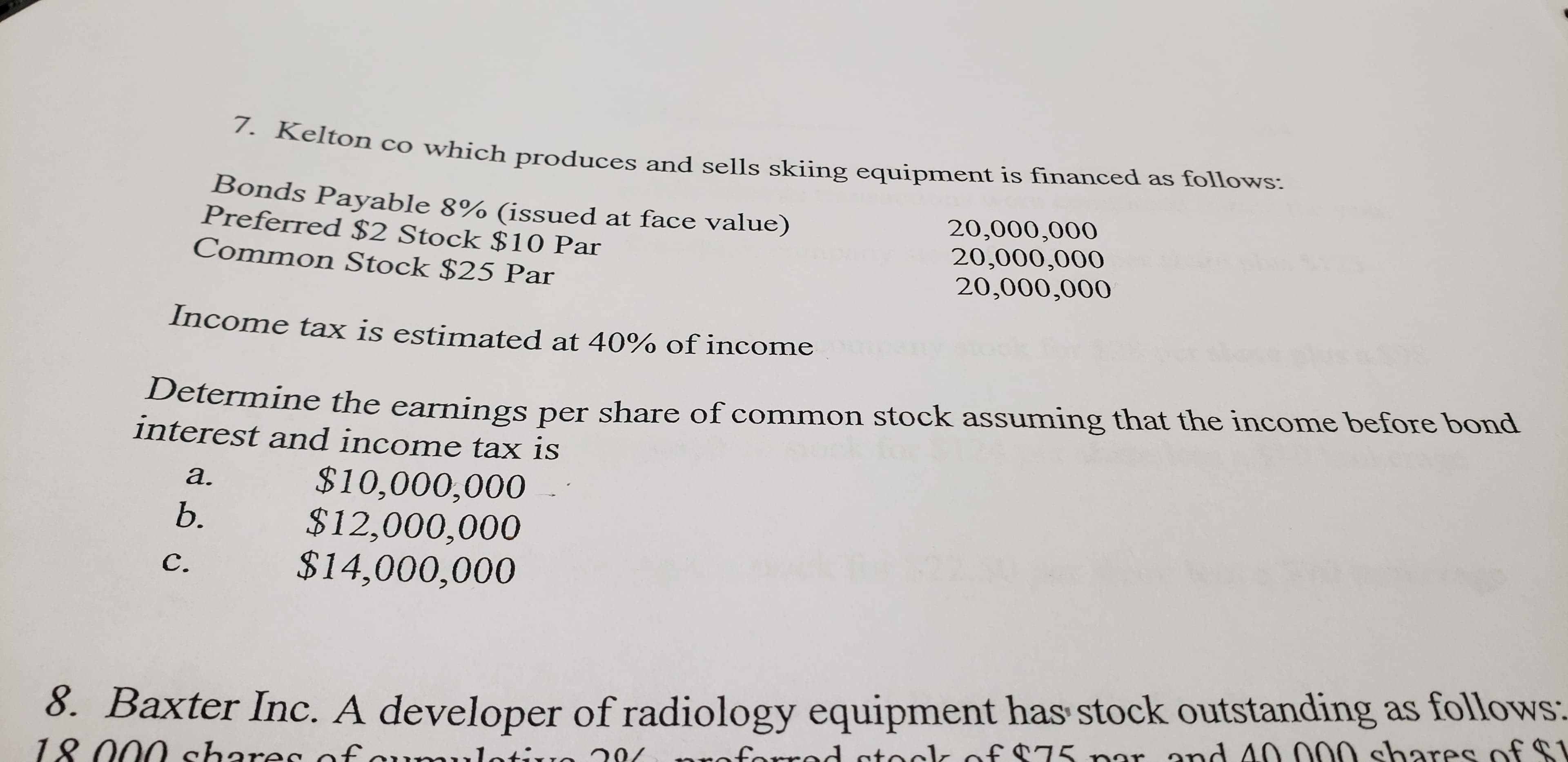

. Kelton co which produces and sells skiing equipment is financed as follows: Bonds Payable 8% (issued at face value) Preferred $2 Stock $10 Par Common Stock $25 Par 20,000,000 20,000,000 20,000,000 Income tax is estimated at 40% of income Determine the earnings per share of common stock assuming that the income before bond interest and income tax is $10,000,000 $12,000,000 $14,000,000 a. b. C. 8. Baxter Inc. A developer of radiology equipment has stock outstanding as follows: 18.000 shares of forred ctock of $75 par and 40 000 shares of $1

. Kelton co which produces and sells skiing equipment is financed as follows: Bonds Payable 8% (issued at face value) Preferred $2 Stock $10 Par Common Stock $25 Par 20,000,000 20,000,000 20,000,000 Income tax is estimated at 40% of income Determine the earnings per share of common stock assuming that the income before bond interest and income tax is $10,000,000 $12,000,000 $14,000,000 a. b. C. 8. Baxter Inc. A developer of radiology equipment has stock outstanding as follows: 18.000 shares of forred ctock of $75 par and 40 000 shares of $1

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Long-term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 1E: Domanico Co., which produces and sells biking equipment, is financed as follows: Income tax is...

Related questions

Question

Transcribed Image Text:. Kelton co which produces and sells skiing equipment is financed as follows:

Bonds Payable 8% (issued at face value)

Preferred $2 Stock $10 Par

Common Stock $25 Par

20,000,000

20,000,000

20,000,000

Income tax is estimated at 40% of income

Determine the earnings per share of common stock assuming that the income before bond

interest and income tax is

$10,000,000

$12,000,000

$14,000,000

a.

b.

C.

8. Baxter Inc. A developer of radiology equipment has stock outstanding as follows:

18.000 shares of

forred ctock of $75 par and 40 000 shares of $1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College