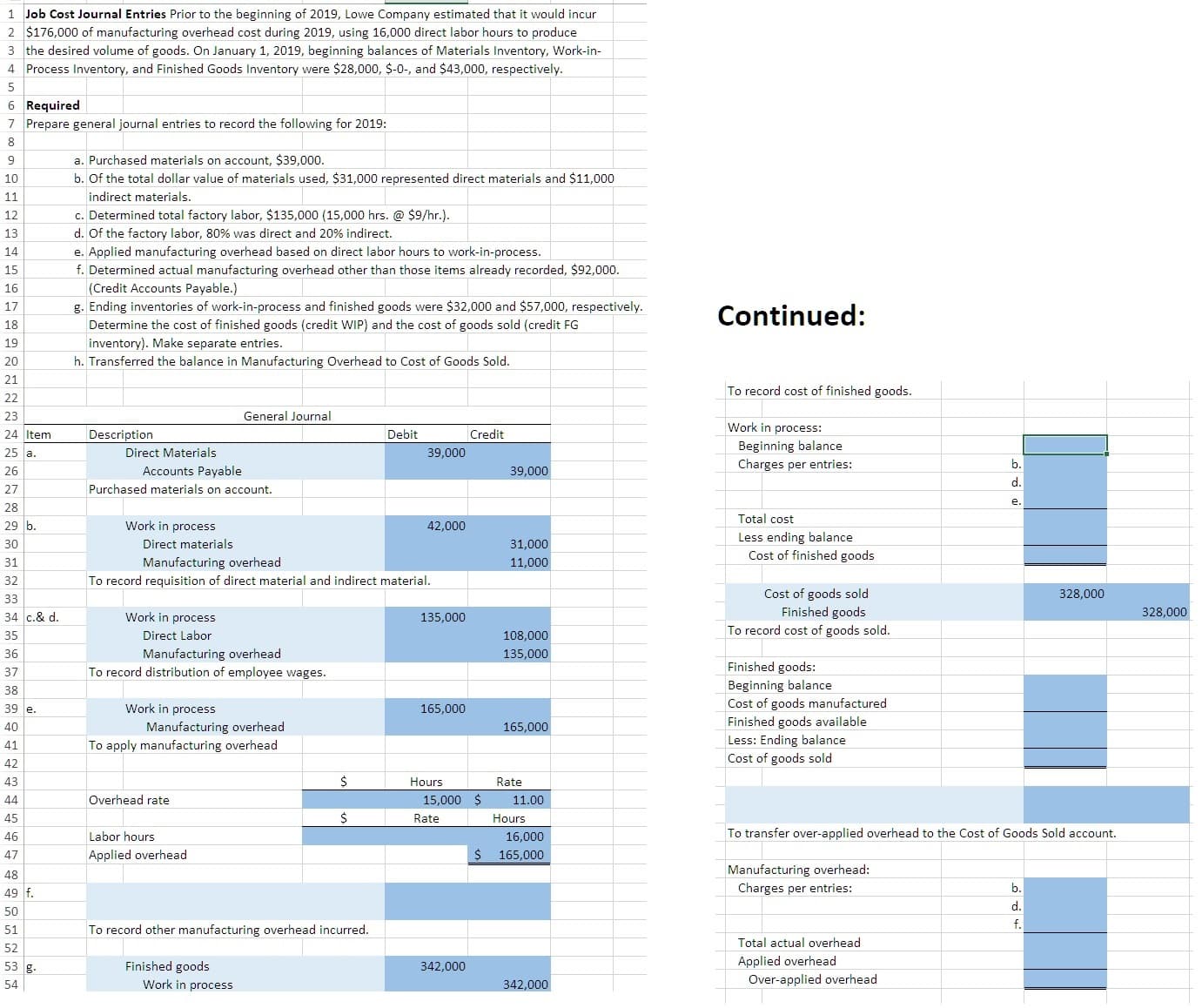

1 Job Cost Journal Entries Prior to the beginning of 2019, Lowe Company estimated that it would incur 2 $176,000 of manufacturing overhead cost during 2019, using 16,000 direct labor hours to produce 3 the desired volume of goods. On January 1, 2019, beginning balances of Materials Inventory, Work-in- 4 Process Inventory, and Finished Goods Inventory were $28,000, S-0-, and $43,000, respectively. 5 Required Prepare general journal entries to record the following for 2019: 6 7 a. Purchased materials on account, $39,000. b. Of the total dollar value of materials used, $31,000 represented direct materials and $11,000 10 indirect materials. 11 c. Determined total factory labor, $135,000 (15,000 hrs. @ $9/hr.) 12 d. Of the factory labor, 80 % was direct and 20 % indirect. 13 e. Applied manufacturing overhead based on direct labor hours to work-in-process. f. Determined actual manufacturing overhead other than those items already recorded, $92,000. 14 15 (Credit Accounts Payable.) g. Ending inventories of work-in-process and finished goods were $32,000 and $57,000, respectively. 16 17 Continued: Determine the cost of finished goods (credit WIP) and the cost of goods sold (credit FG inventory). Make separate entries. h. Transferred the balance in Manufacturing Overhead to Cost of Goods Sold. 18 19 20 21 To record cost of finished goods. 22 23 General Journal Work in process: 24 Item Debit Credit Description Beginning balance Charges per entries: 25 a Direct Materials 39,000 b. Accounts Payable Purchased materials on account 39,000 26 27 28 Total cost Work in process 29 b 42,000 Less ending balance Cost of finished goods Direct materials 30 31,000 Manufacturing overhead 31 11,000 To record requisition of direct material and indirect material. 32 Cost of goods sold Finished goods 328,000 33 328,000 34 c.& d Work in process 135,000 To record cost of goods sold. Direct Labor 35 108,000 Manufacturing overhead To record distribution of employee wages. 36 135,000 Finished goods: 37 Beginning balance Cost of goods manufactured Finished goods available Less: Ending balance Cost of goods sold 38 Work in process 39 e 165,000 Manufacturing overhead To apply manufacturing overhead 165,000 40 41 42 43 Hours Rate Overhead rate 15,000 $ 44 11.00 45 Rate Hours To transfer over-applied overhead to the Cost of Goods Sold account. Labor hours 16,000 46 47 Applied overhead 165,000 Manufacturing overhead: Charges per entries: 48 b 49 f. d. 50 f. To record other manufacturing overhead incurred. 51 Total actual overhead 52 Applied overhead Finished goods 53 g. 342,000 Over-applied overhead Work in process 342,000 54

1 Job Cost Journal Entries Prior to the beginning of 2019, Lowe Company estimated that it would incur 2 $176,000 of manufacturing overhead cost during 2019, using 16,000 direct labor hours to produce 3 the desired volume of goods. On January 1, 2019, beginning balances of Materials Inventory, Work-in- 4 Process Inventory, and Finished Goods Inventory were $28,000, S-0-, and $43,000, respectively. 5 Required Prepare general journal entries to record the following for 2019: 6 7 a. Purchased materials on account, $39,000. b. Of the total dollar value of materials used, $31,000 represented direct materials and $11,000 10 indirect materials. 11 c. Determined total factory labor, $135,000 (15,000 hrs. @ $9/hr.) 12 d. Of the factory labor, 80 % was direct and 20 % indirect. 13 e. Applied manufacturing overhead based on direct labor hours to work-in-process. f. Determined actual manufacturing overhead other than those items already recorded, $92,000. 14 15 (Credit Accounts Payable.) g. Ending inventories of work-in-process and finished goods were $32,000 and $57,000, respectively. 16 17 Continued: Determine the cost of finished goods (credit WIP) and the cost of goods sold (credit FG inventory). Make separate entries. h. Transferred the balance in Manufacturing Overhead to Cost of Goods Sold. 18 19 20 21 To record cost of finished goods. 22 23 General Journal Work in process: 24 Item Debit Credit Description Beginning balance Charges per entries: 25 a Direct Materials 39,000 b. Accounts Payable Purchased materials on account 39,000 26 27 28 Total cost Work in process 29 b 42,000 Less ending balance Cost of finished goods Direct materials 30 31,000 Manufacturing overhead 31 11,000 To record requisition of direct material and indirect material. 32 Cost of goods sold Finished goods 328,000 33 328,000 34 c.& d Work in process 135,000 To record cost of goods sold. Direct Labor 35 108,000 Manufacturing overhead To record distribution of employee wages. 36 135,000 Finished goods: 37 Beginning balance Cost of goods manufactured Finished goods available Less: Ending balance Cost of goods sold 38 Work in process 39 e 165,000 Manufacturing overhead To apply manufacturing overhead 165,000 40 41 42 43 Hours Rate Overhead rate 15,000 $ 44 11.00 45 Rate Hours To transfer over-applied overhead to the Cost of Goods Sold account. Labor hours 16,000 46 47 Applied overhead 165,000 Manufacturing overhead: Charges per entries: 48 b 49 f. d. 50 f. To record other manufacturing overhead incurred. 51 Total actual overhead 52 Applied overhead Finished goods 53 g. 342,000 Over-applied overhead Work in process 342,000 54

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter2: Job Order Costing

Section: Chapter Questions

Problem 4BE: Applying factory overhead Bergan Company estimates that total factory overhead costs will be 620,000...

Related questions

Question

100%

Can somebody check my work on the attached image that I have done so far? Additionally, I am having trouble filling out what to enter into the blank light and blue boxes (where applicable, for

Thanks!

Transcribed Image Text:1 Job Cost Journal Entries Prior to the beginning of 2019, Lowe Company estimated that it would incur

2 $176,000 of manufacturing overhead cost during 2019, using 16,000 direct labor hours to produce

3 the desired volume of goods. On January 1, 2019, beginning balances of Materials Inventory, Work-in-

4 Process Inventory, and Finished Goods Inventory were $28,000, S-0-, and $43,000, respectively.

5

Required

Prepare general journal entries to record the following for 2019:

6

7

a. Purchased materials on account, $39,000.

b. Of the total dollar value of materials used, $31,000 represented direct materials and $11,000

10

indirect materials.

11

c. Determined total factory labor, $135,000 (15,000 hrs. @ $9/hr.)

12

d. Of the factory labor, 80 % was direct and 20 % indirect.

13

e. Applied manufacturing overhead based on direct labor hours to work-in-process.

f. Determined actual manufacturing overhead other than those items already recorded, $92,000.

14

15

(Credit Accounts Payable.)

g. Ending inventories of work-in-process and finished goods were $32,000 and $57,000, respectively.

16

17

Continued:

Determine the cost of finished goods (credit WIP) and the cost of goods sold (credit FG

inventory). Make separate entries.

h. Transferred the balance in Manufacturing Overhead to Cost of Goods Sold.

18

19

20

21

To record cost of finished goods.

22

23

General Journal

Work in process:

24 Item

Debit

Credit

Description

Beginning balance

Charges per entries:

25 a

Direct Materials

39,000

b.

Accounts Payable

Purchased materials on account

39,000

26

27

28

Total cost

Work in process

29 b

42,000

Less ending balance

Cost of finished goods

Direct materials

30

31,000

Manufacturing overhead

31

11,000

To record requisition of direct material and indirect material.

32

Cost of goods sold

Finished goods

328,000

33

328,000

34 c.& d

Work in process

135,000

To record cost of goods sold.

Direct Labor

35

108,000

Manufacturing overhead

To record distribution of employee wages.

36

135,000

Finished goods:

37

Beginning balance

Cost of goods manufactured

Finished goods available

Less: Ending balance

Cost of goods sold

38

Work in process

39 e

165,000

Manufacturing overhead

To apply manufacturing overhead

165,000

40

41

42

43

Hours

Rate

Overhead rate

15,000 $

44

11.00

45

Rate

Hours

To transfer over-applied overhead to the Cost of Goods Sold account.

Labor hours

16,000

46

47

Applied overhead

165,000

Manufacturing overhead:

Charges per entries:

48

b

49 f.

d.

50

f.

To record other manufacturing overhead incurred.

51

Total actual overhead

52

Applied overhead

Finished goods

53 g.

342,000

Over-applied overhead

Work in process

342,000

54

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning