1 OWv2 Onlin X m/ilm/takeAssignment/takeAssignment Main.do?invoker-assignments&takeAssignmentSessionLocator=assignment-take8inprogres eBook Calculator Print Item Change in Sales Mix and Contribution Margin Head Pops Inc. manufactures two models of solar-powered, noise-canceling headphones: Sun Sound and Ear Bling models. The company is operating at less than full capacity. Market research indicates that 21,700 additional Sun Sound and 23,700 additional Ear Bling headphones could be sold. The operating income by unit of product is as follows: Ear Bling Sun Sound Headphones Headphones Sales price $38.40 $59.90 Variable cost of goods sold (21.50) (33.50) Manufacturing margin $16.90 $26.40 Variable selling and administrative expenses (7.70) (12.00) Contribution margin $9.20 $14.40 (3.50) (5.40) Fixed manufacturing costs $5.70 $9.00 Operating income Prepare an analysis indicating the increase or decrease in total profitability if 21,700 additional Sun Sound and 23,700 additional Ear Bling headphones are produced and sold, assuming that there is sufficient capacity for the additional production. Round your per unit answers to two decimal place. Head Pops Inc. 2:23 PM O 11/5/2019 hp и ПЕ v2 |Onlin X LE Im/takeAssignment/takeAssignment Main.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inprogres (5.40) Fixed manufacturing costs (3.50) $5.70 $9.00 Operating income Prepare an analysis indicating the increase or decrease in total profitability if 21,700 additional Sun Sound and 23,700 additional Ear Bling headphones are produced and sold, assuming that there is sufficient capacity for the additional production. Round your per unit answers to two decimal place. Head Pops Inc. Analysis Ear Bling Headphones Sun Sound Headphones Unit volume increase $ x Contribution margin per unit $ $ Increase in profitability Previous Check My Work 6 more Check My Work uses remaining. Submit Assignment for Grading Save and Exit 2:23 PM O W 11/5/2019 hp

1 OWv2 Onlin X m/ilm/takeAssignment/takeAssignment Main.do?invoker-assignments&takeAssignmentSessionLocator=assignment-take8inprogres eBook Calculator Print Item Change in Sales Mix and Contribution Margin Head Pops Inc. manufactures two models of solar-powered, noise-canceling headphones: Sun Sound and Ear Bling models. The company is operating at less than full capacity. Market research indicates that 21,700 additional Sun Sound and 23,700 additional Ear Bling headphones could be sold. The operating income by unit of product is as follows: Ear Bling Sun Sound Headphones Headphones Sales price $38.40 $59.90 Variable cost of goods sold (21.50) (33.50) Manufacturing margin $16.90 $26.40 Variable selling and administrative expenses (7.70) (12.00) Contribution margin $9.20 $14.40 (3.50) (5.40) Fixed manufacturing costs $5.70 $9.00 Operating income Prepare an analysis indicating the increase or decrease in total profitability if 21,700 additional Sun Sound and 23,700 additional Ear Bling headphones are produced and sold, assuming that there is sufficient capacity for the additional production. Round your per unit answers to two decimal place. Head Pops Inc. 2:23 PM O 11/5/2019 hp и ПЕ v2 |Onlin X LE Im/takeAssignment/takeAssignment Main.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inprogres (5.40) Fixed manufacturing costs (3.50) $5.70 $9.00 Operating income Prepare an analysis indicating the increase or decrease in total profitability if 21,700 additional Sun Sound and 23,700 additional Ear Bling headphones are produced and sold, assuming that there is sufficient capacity for the additional production. Round your per unit answers to two decimal place. Head Pops Inc. Analysis Ear Bling Headphones Sun Sound Headphones Unit volume increase $ x Contribution margin per unit $ $ Increase in profitability Previous Check My Work 6 more Check My Work uses remaining. Submit Assignment for Grading Save and Exit 2:23 PM O W 11/5/2019 hp

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

What is the unit volume increase ?

What is the x contribution margin per unit ?

what is the Increase in profitability?

Transcribed Image Text:1

OWv2 Onlin X

m/ilm/takeAssignment/takeAssignment Main.do?invoker-assignments&takeAssignmentSessionLocator=assignment-take8inprogres

eBook

Calculator

Print Item

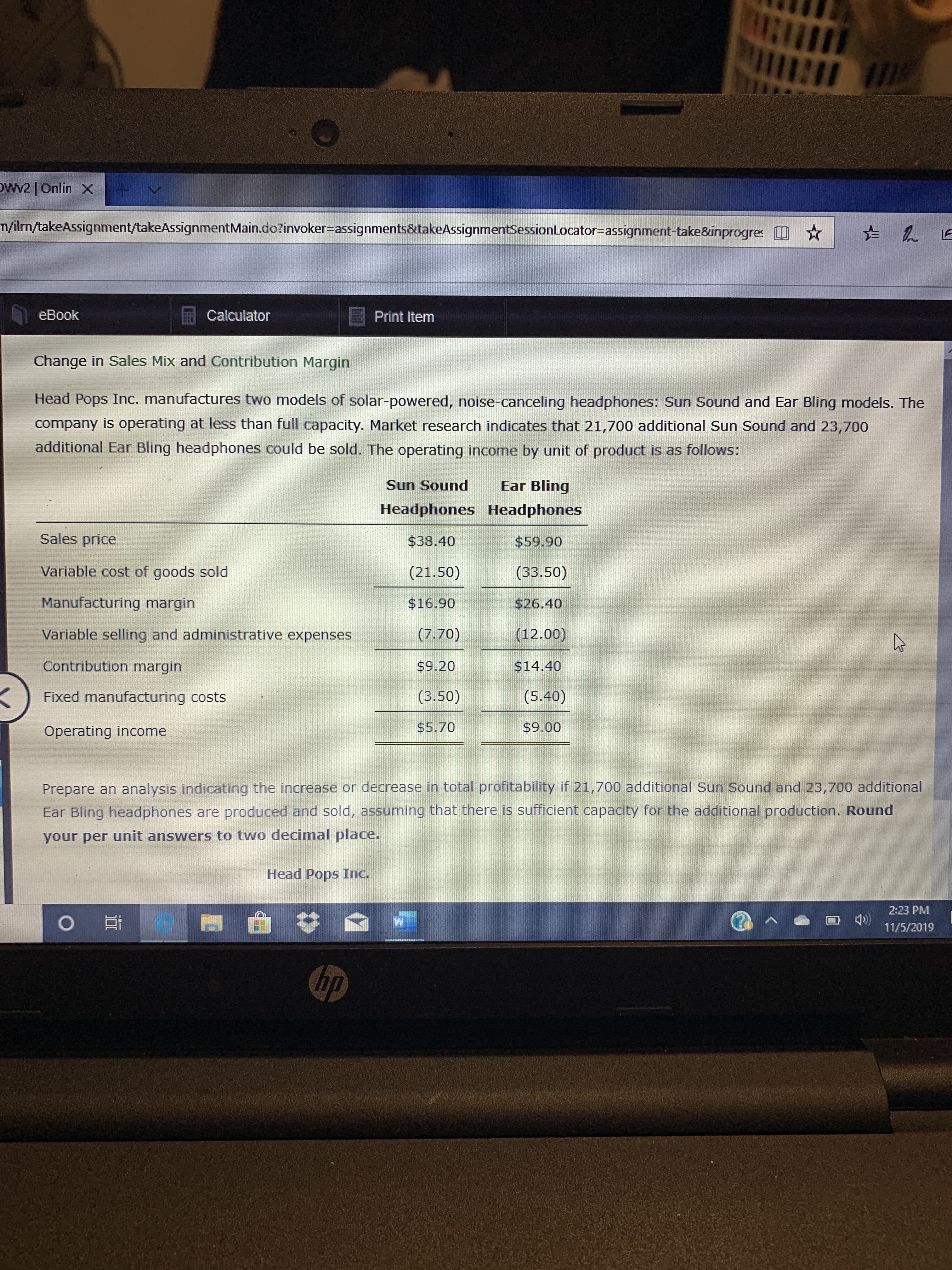

Change in Sales Mix and Contribution Margin

Head Pops Inc. manufactures two models of solar-powered, noise-canceling headphones: Sun Sound and Ear Bling models. The

company is operating at less than full capacity. Market research indicates that 21,700 additional Sun Sound and 23,700

additional Ear Bling headphones could be sold. The operating income by unit of product is as follows:

Ear Bling

Sun Sound

Headphones Headphones

Sales price

$38.40

$59.90

Variable cost of goods sold

(21.50)

(33.50)

Manufacturing margin

$16.90

$26.40

Variable selling and administrative expenses

(7.70)

(12.00)

Contribution margin

$9.20

$14.40

(3.50)

(5.40)

Fixed manufacturing costs

$5.70

$9.00

Operating income

Prepare an analysis indicating the increase or decrease in total profitability if 21,700 additional Sun Sound and 23,700 additional

Ear Bling headphones are produced and sold, assuming that there is sufficient capacity for the additional production. Round

your per unit answers to two decimal place.

Head Pops Inc.

2:23 PM

O

11/5/2019

hp

Transcribed Image Text:и ПЕ

v2 |Onlin X

LE

Im/takeAssignment/takeAssignment Main.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inprogres

(5.40)

Fixed manufacturing costs

(3.50)

$5.70

$9.00

Operating income

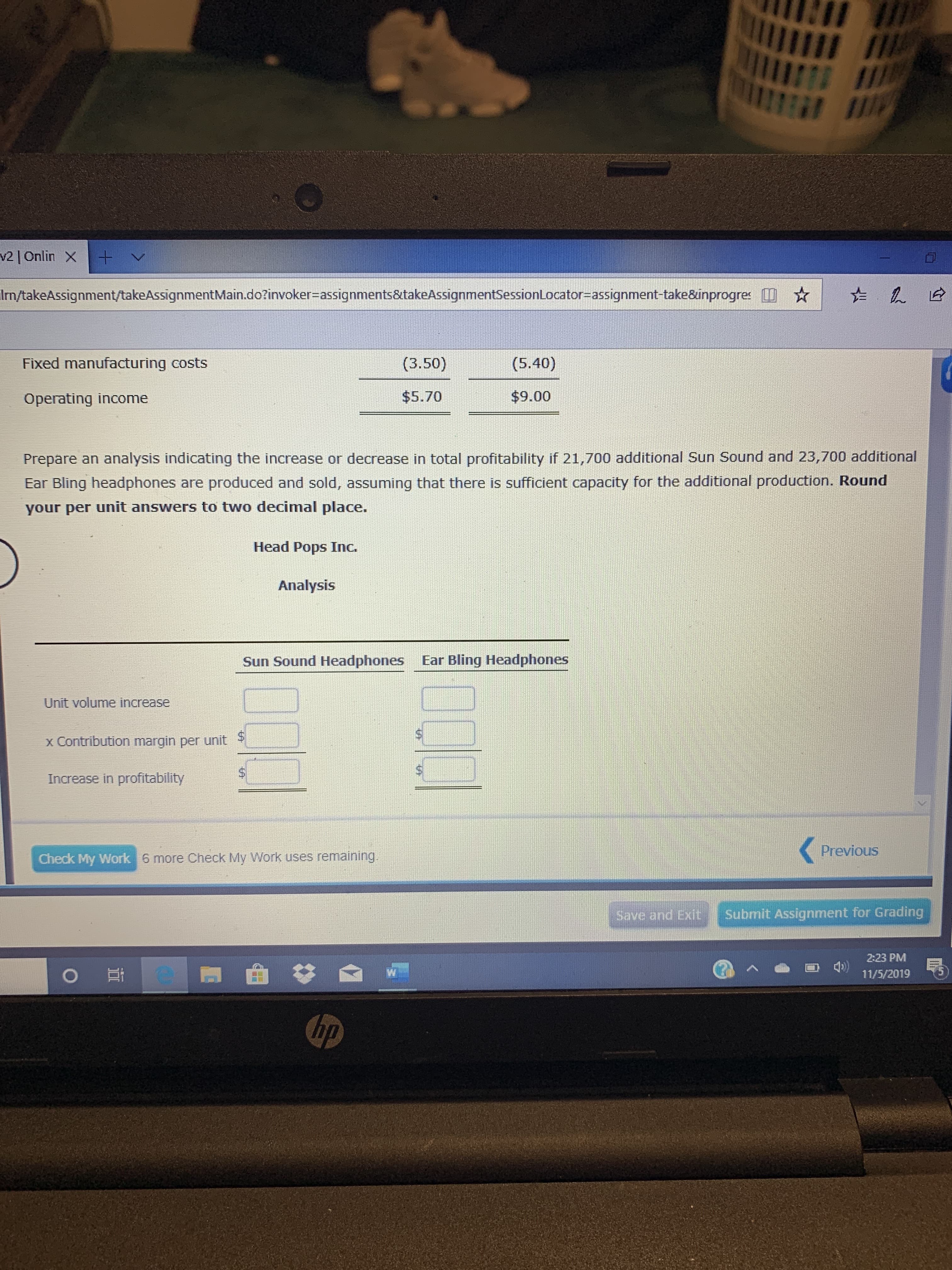

Prepare an analysis indicating the increase or decrease in total profitability if 21,700 additional Sun Sound and 23,700 additional

Ear Bling headphones are produced and sold, assuming that there is sufficient capacity for the additional production. Round

your per unit answers to two decimal place.

Head Pops Inc.

Analysis

Ear Bling Headphones

Sun Sound Headphones

Unit volume increase

$

x Contribution margin per unit

$

$

Increase in profitability

Previous

Check My Work

6 more Check My Work uses remaining.

Submit Assignment for Grading

Save and Exit

2:23 PM

O

W

11/5/2019

hp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education