1. A small business owner Borrowed Php8,500.00 at 9% for 18 months. How much interest will be repaid upon maturity of the loan?

1. A small business owner Borrowed Php8,500.00 at 9% for 18 months. How much interest will be repaid upon maturity of the loan?

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3PA: Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate...

Related questions

Question

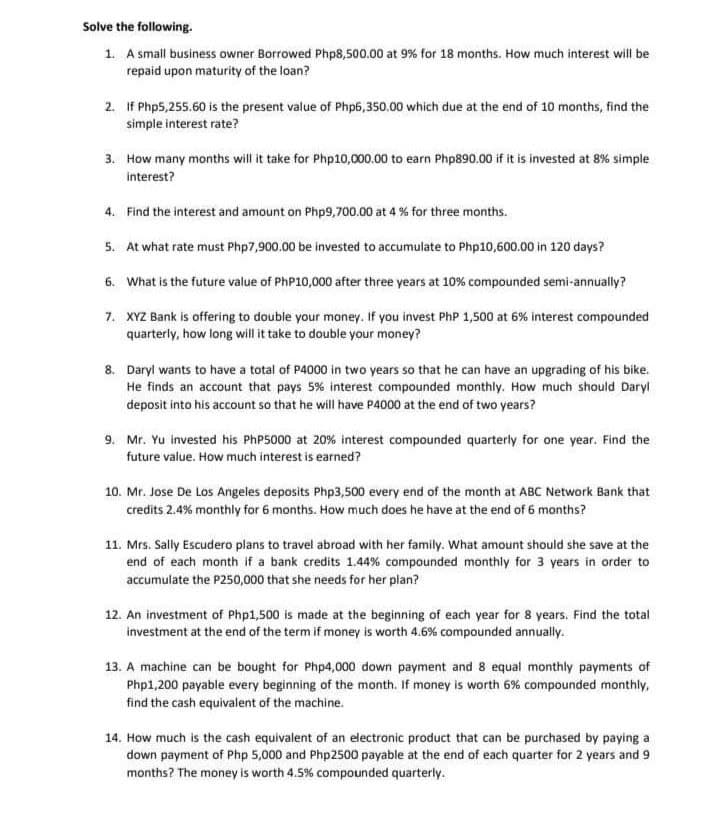

Transcribed Image Text:Solve the following.

1. A small business owner Borrowed Php8,500.00 at 9% for 18 months. How much interest will be

repaid upon maturity of the loan?

2. If Php5,255.60 is the present value of Php6,350,00 which due at the end of 10 months, find the

simple interest rate?

3. How many months will it take for Php10,000.00 to earn Php890.00 if it is invested at 8% simple

interest?

4. Find the interest and amount on Php9,700.00 at 4 % for three months.

5. At what rate must Php7,900.00 be invested to accumulate to Php10,600.00 in 120 days?

6.

What is the future value of PhP10,000 after three years at 10% compounded semi-annually?

7. XYZ Bank is offering to double your money. If you invest PhP 1,500 at 6% interest compounded

quarterly, how long will it take to double your money?

8. Daryl wants to have a total of P4000 in two years so that he can have an upgrading of his bike.

He finds an account that pays 5% interest compounded monthly. How much should Daryl

deposit into his account so that he will have P4000 at the end of two years?

9. Mr. Yu invested his PhP5000 at 20% interest compounded quarterly for one year. Find the

future value. How much interest is earned?

10. Mr. Jose De Los Angeles deposits Php3,500 every end of the month at ABC Network Bank that

credits 2.4% monthly for 6 months. How much does he have at the end of 6 months?

11. Mrs. Sally Escudero plans to travel abroad with her family. What amount should she save at the

end of each month if a bank credits 1.44 % compounded monthly for 3 years in order to

accumulate the P250,000 that she needs for her plan?

12. An investment of Php1,500 is made at the beginning of each year for 8 years. Find the total

investment at the end of the term if money is worth 4.6 % compounded annually.

13. A machine can be bought for Php4,000 down payment and 8 equal monthly payments of

Php1,200 payable every beginning of the month. If money is worth 6% compounded monthly,

find the cash equivalent of the machine.

14. How much is the cash equivalent of an electronic product that can be purchased by paying

down payment of Php 5,000 and Php2500 payable at the end of each quarter for 2 years and 9

months? The money is worth 4.5% compounded quarterly.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning