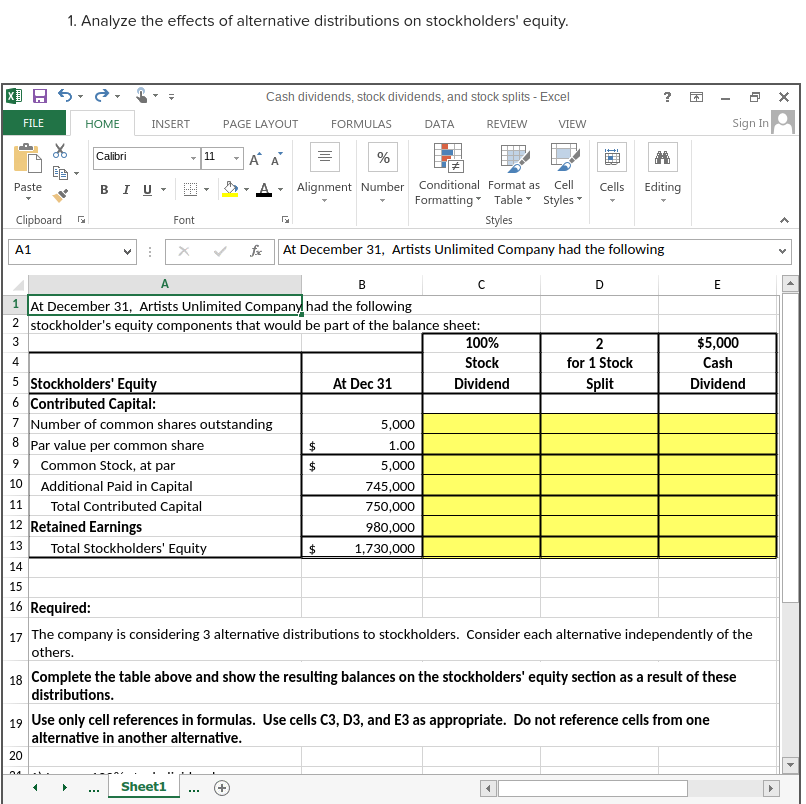

1. Analyze the effects of alternative distributions on stockholders' equity. Cash dividends, stock dividends, and stock splits - Excel FILE Sign In HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Calibri 11 A A % Alignment Number Conditional Format as Cell Formatting Table Styles Cells Editing Paste BIU Clipboard Font Styles A1 fe At December 31, Artists Unlimited Company had the following B D E At December 31, Artists Unlimited Company had the following 2 stockholder's equity components that would be part of the balance sheet: 100% 2 $5,000 Stock for 1 Stock Cash 5 Stockholders' Equity 6 Contributed Capital: 7 Number of common shares outstanding 8 Par value per common share 9 Common Stock, at par 10 Additional Paid in Capital 11 At Dec 31 Dividend Split Dividend 5,000 24 1.00 5,000 745,000 Total Contributed Capital 12 Retained Earnings 13 750,000 980,000 Total Stockholders' Equity 14 15 16 Required: 1,730,000 17 The company is considering 3 alternative distributions to stockholders. Consider each alternative independently of the others. 18 Complete the table above and show the resulting balances on the stockholders' equity section as a result of these distributions. 19 Use only cell references in formulas. Use cells C3, D3, and E3 as appropriate. Do not reference cells from one alternative in another alternative. 20 123 4

1. Analyze the effects of alternative distributions on stockholders' equity. Cash dividends, stock dividends, and stock splits - Excel FILE Sign In HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Calibri 11 A A % Alignment Number Conditional Format as Cell Formatting Table Styles Cells Editing Paste BIU Clipboard Font Styles A1 fe At December 31, Artists Unlimited Company had the following B D E At December 31, Artists Unlimited Company had the following 2 stockholder's equity components that would be part of the balance sheet: 100% 2 $5,000 Stock for 1 Stock Cash 5 Stockholders' Equity 6 Contributed Capital: 7 Number of common shares outstanding 8 Par value per common share 9 Common Stock, at par 10 Additional Paid in Capital 11 At Dec 31 Dividend Split Dividend 5,000 24 1.00 5,000 745,000 Total Contributed Capital 12 Retained Earnings 13 750,000 980,000 Total Stockholders' Equity 14 15 16 Required: 1,730,000 17 The company is considering 3 alternative distributions to stockholders. Consider each alternative independently of the others. 18 Complete the table above and show the resulting balances on the stockholders' equity section as a result of these distributions. 19 Use only cell references in formulas. Use cells C3, D3, and E3 as appropriate. Do not reference cells from one alternative in another alternative. 20 123 4

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter18: Acquiring Capital For Growth And Development

Section18.3: Capital Stock

Problem 1OYO

Related questions

Question

Transcribed Image Text:1. Analyze the effects of alternative distributions on stockholders' equity.

Cash dividends, stock dividends, and stock splits - Excel

Sign In

FILE

HOME

INSERT

PAGE LAYOUT

FORMULAS

DATA

REVIEW

VIEW

Calibri

A A

11

%

Alignment Number Conditional Format as Cell

Formatting Table Styles

Paste

в I U

Cells

Editing

Clipboard a

Font

Styles

A1

fe

At December 31, Artists Unlimited Company had the following

A

B

D

E

1 At December 31, Artists Unlimited Company had the following

2 stockholder's equity components that would be part of the balance sheet:

3

100%

2

$5,000

4

Stock

for 1 Stock

Cash

5 Stockholders' Equity

6 Contributed Capital:

7 Number of common shares outstanding

8 Par value per common share

9 Common Stock, at par

At Dec 31

Dividend

Split

Dividend

5,000

1.00

5,000

10

Additional Paid in Capital

745,000

11

Total Contributed Capital

750,000

12 Retained Earnings

980,000

Total Stockholders' Equity

13

1,730,000

14

15

16 Required:

17 The company is considering 3 alternative distributions to stockholders. Consider each alternative independently of the

others.

18 Complete the table above and show the resulting balances on the stockholders' equity section as a result of these

distributions.

19 Use only cell references in formulas. Use cells C3, D3, and E3 as appropriate. Do not reference cells from one

alternative in another alternative.

20

04.

Sheet1

>

%24

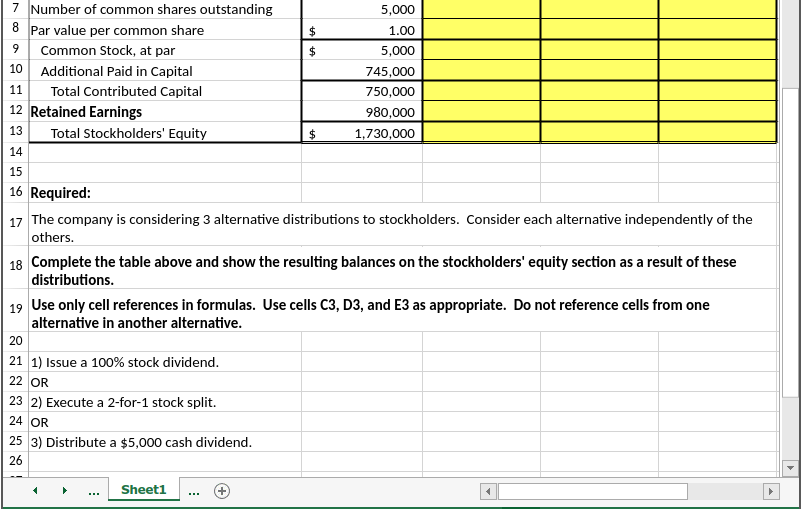

Transcribed Image Text:7 Number of common shares outstanding

8 Par value per common share

9 Common Stock, at par

10 Additional Paid in Capital

5,000

1.00

5,000

745,000

11

Total Contributed Capital

12 Retained Earnings

Total Stockholders' Equity

750,000

980,000

13

2$

1,730,000

14

15

16 Required:

17 The company is considering 3 alternative distributions to stockholders. Consider each alternative independently of the

others.

18 Complete the table above and show the resulting balances on the stockholders' equity section as a result of these

distributions.

19 Use only cell references in formulas. Use cells C3, D3, and E3 as appropriate. Do not reference cells from one

alternative in another alternative.

20

21 1) Issue a 100% stock dividend.

22 OR

23 2) Execute a 2-for-1 stock split.

24 OR

25 3) Distribute a $5,000 cash dividend.

26

Sheet1

....

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning