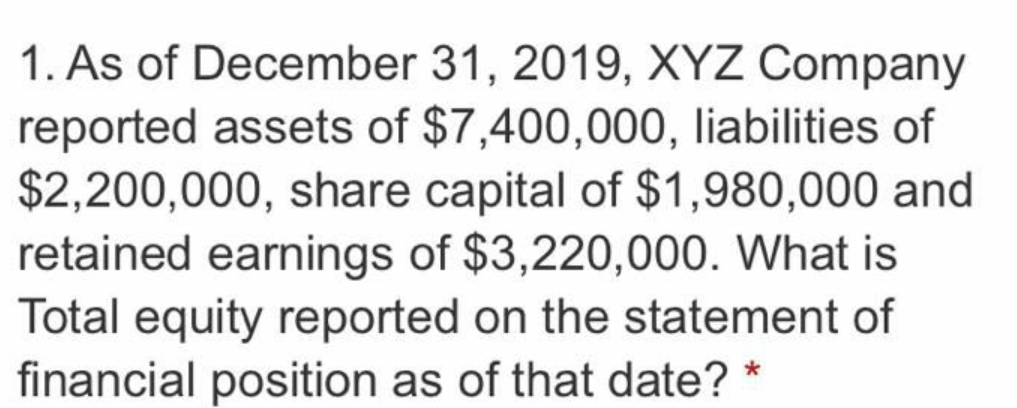

1. As of December 31, 2019, XYZ Company reported assets of $7,400,000, liabilities of $2,200,000, share capital of $1,980,000 and retained earnings of $3,220,000. What is Total equity reported on the statement of financial position as of that date?

Q: For the year ending December 31, 2020, Oriole Inc. reports net income $142,000 and cash dividends…

A: Retained Earning: Retained Earning are the undistributed income that belongs to the owner of the…

Q: re the information of Talc Inc. for the year 2020 · Net assets, Jan.1, 2020- P1,000,000 ·…

A: Solution: Net assets are equal to equity of the company.

Q: The comparative balance sheet for ENGRO Corporation is presented below: ENGRO CORPORATION…

A: cash flow statement : sum of cash flows from operating activities , investing activities and…

Q: The information presented here represents selected data from the December 31, 2019, balance sheets…

A: Lets understand the basics. As per balance sheet equation, total assets is always equal to total…

Q: Assets Cash Accounts receivable (net) Prepaid insurance Land Equipment Accumulated depreciation…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: Bridgeport Corporation’s balance sheet at the end of 2019 included the following items. Current…

A: Cash flow statement is a statement which shows all cash inflows and cash outflows of business for…

Q: The following information pertains to BT21 Co. for the year. · Net assets, Jan.1, 2021-…

A: Solution: Profit (Loss) = Net asset on Dec 31, 2021 - Net asset Jan 1, 2021 + Dividend declared -…

Q: From the following particulars pertaining to Assets and Liabilities of a company calculate and…

A: Current Ratio = Current Asset / Current Liabilities Current Assets = Sundry Debtors + Stock +Cash in…

Q: On jan. 1, 2019, Bacardi Limited had retained earnings of $8,000,000. During 2019, the corporation…

A: Retained earnings are the free reserves that are attributable to the owners of the entity. Profits…

Q: The following are the financial statements of Michelangelo Corp and VanGogh Inc. prepared on…

A: 2015 Income Statement…

Q: Presented here are summarized data from the balance sheets and income statements of Wiper Inc.:…

A: As posted multiple sub parts we are answering only first three sub parts kindly repost the…

Q: As of December 31, 2019, the capital of Sweet & Spicy Company are equal to two-thirds of the total…

A: Total assets = Capital - liabilities Capital = total assets x 2/3

Q: Take me to the text Marry Inc. provided the following information from its accounting records for…

A: Introduction:- Shares are equity ownership units in a firm. Shares exist as a financial asset for…

Q: 33. In 2019, Luscious Lemons reported net income of $16,335 thousand, retained earnings at the…

A: Retained earnings: Retained earnings are the portion of earnings kept by the business for the…

Q: Presented here are summarized data from the balance sheets and Income statements of Wiper Inc.:…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Comparative Statements of Retained Earnings for Renn-Dever Corporation were reported as follows for…

A: Earnings per share is the ratio between net income and the outstanding number of shares. EPS = Net…

Q: Using the following company W information, prepare a retained earnings statement. *Retained…

A: Retained earnings are accumulated profits of a company not distributed as dividends.

Q: 1. Condensed balance sheets for B Company and C Company on January 1, 2019 are as follows: B $…

A: The acquisition represents the absorption of existing business by another business entity which…

Q: At the beginning of its fiscal year July 1, 2020, RPC had a balance of $2,150,000. It had generated…

A: The Statement of Retained Earnings provides an overview of the Changes in the company's retained…

Q: The comparative balance sheet for ENGRO Corporation is presented below: ENGRO CORPORATION…

A: Cash flow statement is a statement which is prepared to find out the cash comes in and goes out , by…

Q: For the year ending December 31, 2022, Sheridan Inc reports net income Ss147,000 and cash dividends…

A: Retained earnings: Retained earnings is the accumulation of the profit earned by the organization…

Q: ARR Corporation's account balances during 2019 showed the following changes, all increases: Assets -…

A: The income statement is prepared by the business organizations so as to know how much amount of…

Q: The statement of financial position of Marigold Corporation follows for the current year, 2020:…

A: Introduction: Statement of financial Position of Marigold Corporation for the year 2020

Q: For the year ending December 31, 2022. Sheridan Inc reports net income S147,000 and cash dividends…

A: Retained earnings: Retained earnings mean the cumulative balance of earnings/net profit after tax of…

Q: The following information pertains to BTS Co. for the year. · Net assets, Jan.1, 2021-…

A: Increase in Net assets = Net assets, Dec. 31. 2021 - Net assets, Jan.1, 2021 = P2,112,960-1,008,480…

Q: Groom Company began operations on January 1, 2021 with P 1,000,000 from the issuance of shares and…

A: Answer) Calculation of Total Assets on December 31, 2021 Total Assets = Stockholders’ Equity +…

Q: Doris Corporation has retained earnings of 684,800 at January 1, 2019. Net income during 2019 was…

A: Ending retained earnings formula: = Opening retained earnings + Income earned - cash dividend paid

Q: Below is some selected information from the financial statements of ManyFaces, Ltd: As of As of…

A: Beginning equity = Beginning assets - Beginning liabilities = 3930560-2063990 = $1,866,570

Q: For the year ending December 31, 2022, Sheridan Inc. reports net income $147,000 and cash dividends…

A: Formula: Ending Retained earnings balance = Beginning retained earnings + Net income - Dividends…

Q: The stockholders’ equity of Kowalski Company at the beginning and end of 2018totaled $122,000 and…

A: Stockholders' equity: Stockholders' equity means the remaining net assets available to shareholders.…

Q: Presented below are data taken from the records of Crane Company. December 31, 2020…

A: Cash flow statement is one of the financial statements, which are presented in the annual reports of…

Q: Prepare a retained earnings statement for the year ended December 31, 2021 in proper format: Ladila…

A: Retained earnings statement is the statement created as notes to the financial statement that shows…

Q: For the year ending December 31, 2022, Sheridan Inc. reports net income $147,000 and cash dividends…

A: Retained earnings is the balance of net income which is left after paying dividend to the…

Q: eturn on Assets Sue Company reports the following information in its financial statements. Numbers…

A: Ratio analysis is a method of measuring the financial position of the organization with different…

Q: On January 1, 2022, Sheridan Company had retained earnings of $527,000. During the year, Sheridan…

A: Ending retained earnings balance = Beginning retained earnings balance + Net income - total dividend

Q: The summarized balance sheets of Cullumber Company and Vaughn Company as of December 31, 2021 are as…

A: When one company is holding shares in another company from 20% to 50% , then it is called as…

Q: Complete the balance sheet of Energy Corp., given the following information: Energy Corp. Balance…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: The following is a condensed version of the comparative balance sheets for Zubin Mehta Corporation…

A: a. Prepare a statement of cash flows for 2020 for Zubin Mehta Corporation.

Q: From the balance sheet of M/s Sharma Limited, for the year ending 31 March 2020, compute the…

A: Lets understand the basics. Current ratio indicates the firm's ability to pay short term obligations…

Q: On january 1, christian company showed total assets of 5,000,000, total liabilities of million and…

A: solution : first let us calculate the balance of reserve and surplus on January 1 Total assets…

Q: Bridgeport Corporation’s balance sheet at the end of 2019 included the following items. Current…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: The company shows a balance of ₱299,500 as of December 31, 2018. During 2019, the company…

A: Formula: Ending Retained earnings = Beginning Retained Earnings + Net Income - Cash dividends paid

Q: BE4-9 Portman Corporation has retained earnings of $675,000 at January 1, 2020. Net income during…

A: Statement of Retained Earnings is a financial statement that represents changes in earnings over a…

Q: Balance Sheet Jack and Jill Corporation's year-end 2018 balance sheet lists current assets of…

A: Introduction: The number of assets remaining in a company after all liabilities have been resolved…

Q: At the beginning of its fiscal year on April 1, 2018, Extra Vienna Oil Corp, had a balance of…

A: Retained earnings (RE) is the amount of net income left over for the business after it has paid out…

Q: The following information has been extracted from the draft financial statements of Snowdrop, a…

A: Introduction: The net quantity of cash and cash equivalents carried into and out of a firm is…

Q: 11. On May 2, 2020, the separate statement of financial position of Peter Corporation and Simon…

A: WN- 1 Computation of Fair value of net identifiable assets (NIA) Total net Identifiable assets…

Q: Applying the Fundamental Accounting Equation At the beginning of 2019, KJ Corporation had total…

A: As per accounting equation, Total of assets should be equal to total liabilities and equity all the…

Q: At the end of the year of 2019, Red Barney Inc. has a total assets of P 10, 556,964 and total…

A: Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by…

Step by step

Solved in 2 steps

- Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000Income Statement and Retained Earnings Huff Company presents the following items derived from its December 31, 2019, adjusted trial balance: The following information is also available for 2019 and is not reflected in the preceding accounts: 1. The common stock has been outstanding all year. A cash dividend of 1.28 per share was declared and paid. 2. Land was sold at a pretax gain of 6,300. 3. Division X (a major component of the company) was sold at a pretax gain of 4,700. It had incurred a 9,500 pretax operating loss during 2019. 4. A tornado, which is an unusual event in the area, caused a 5,400 pretax loss. 5. The income tax rate on all items of income is 30%. 6. The average shareholders equity is 90,000. Required: 1. Prepare a 2019 multiple-step income statement for Huff. 2. Prepare a 2019 retained earnings statement. 3. Compute the 2019 return on common equity (Net Income 4 Average Shareholders Equity).Included in the December 31, 2018, Jacobi Company balance sheet was the following shareholders equity section: The company engaged in the following stock transactions during 2019: Required: 1. Prepare journal entries to record the preceding transactions. 2. Prepare the December 31, 2019, shareholders equity section (assume that 2019 net income was 270,000).

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Comprehensive The shareholders equity section of Superior Corporations balance sheet as of December 31, 2018, is as follows: The following events occurred during 2019: Required: 1. Prepare journal entries for each of the above transactions. 2. Calculate the number of authorized, issued, and outstanding common shares as of December 31, 2019. 3. Calculate Superior's legal capital at December 31, 2019.

- Income Statement, Lower Portion Cunningham Company reports a retained earnings balance of 365,200 at the beginning of 2019. For the year ended December 31, 2019, the company reports pretax income from continuing operations of 150,500. The following information is also available pertaining to 2019: 1. The company declared and paid a 0.72 cash dividend per share on the 30,000 shares of common stock that were outstanding the entire year. 2. The company incurred a pretax 21,000 loss as a result of an earthquake, which is not unusual for the area. This is included in the 150,500 income from continuing operations. 3. The company sold Division P (a component of the company) in May. From January through May, Division P had incurred a pretax loss from operations of 33,000. A pretax gain of 15,000 was recognized on the sale of Division P. Required: Assuming that all the pretax items are subject to a 30% income tax rate: 1. Complete the lower portion of Cunningham's 2019 income statement beginning with Pretax Income from Continuing Operations. Include any related note to the financial statements. 2. Prepare an accompanying retained earnings statement.Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 loss

- On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Using the following Company X information, prepare a Retained Earnings Statement: Retained earnings balance January 1, 2019, $121,500 Net income for year 2019, $145,800 Dividends declared and paid for year 2019, $53,000Gray Company lists the following shareholders equity items on its December 31, 2018, balance sheet: The following stock transactions occurred during 2019: Required: 1. Prepare journal entries to record the preceding transactions. 2. Prepare the December 31, 2019, shareholders equity section (assume that 2019 net income was 225,000).