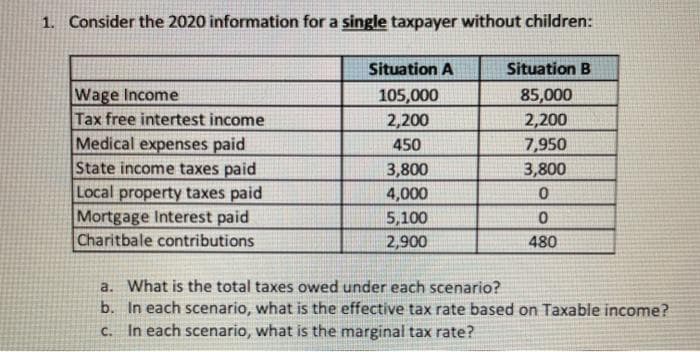

1. Consider the 2020 information for a single taxpayer without children: Situation A Situation B Wage Income Tax free intertest income 85,000 105,000 2,200 2,200 7,950 3,800 Medical expenses paid State income taxes paid Local property taxes paid Mortgage Interest paid Charitbale contributions 450 3,800 4,000 5,100 2,900 480 a. What is the total taxes owed under each scenario? b. In each scenario, what is the effective tax rate based on Taxable income? C. In each scenario, what is the marginal tax rate?

1. Consider the 2020 information for a single taxpayer without children: Situation A Situation B Wage Income Tax free intertest income 85,000 105,000 2,200 2,200 7,950 3,800 Medical expenses paid State income taxes paid Local property taxes paid Mortgage Interest paid Charitbale contributions 450 3,800 4,000 5,100 2,900 480 a. What is the total taxes owed under each scenario? b. In each scenario, what is the effective tax rate based on Taxable income? C. In each scenario, what is the marginal tax rate?

Chapter12: Alternative Minimum Tax

Section: Chapter Questions

Problem 24CE

Related questions

Question

Transcribed Image Text:1. Consider the 2020 information for a single taxpayer without children:

Situation A

Situation B

Wage Income

Tax free intertest income

Medical expenses paid

State income taxes paid

85,000

105,000

2,200

2,200

7,950

3,800

450

3,800

Local property taxes paid

Mortgage Interest paid

Charitbale contributions

4,000

5,100

2,900

480

a. What is the total taxes owed under each scenario?

b. In each scenario, what is the effective tax rate based on Taxable income?

In each scenario, what is the marginal tax rate?

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning