1. How much income would Figland report on its 2017 income statement from its investment Irene? 2. What would be the balance in the Investment in Irene Company account on December 31,

1. How much income would Figland report on its 2017 income statement from its investment Irene? 2. What would be the balance in the Investment in Irene Company account on December 31,

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterD: Investments

Section: Chapter Questions

Problem D.7EX

Related questions

Question

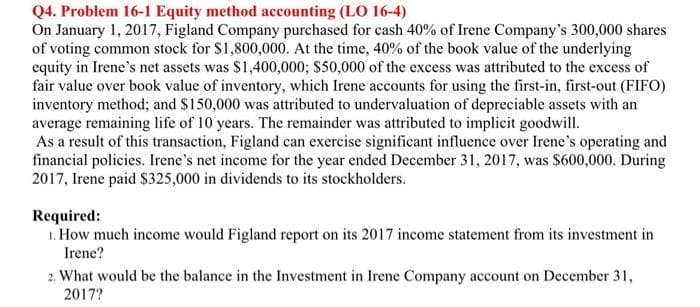

Transcribed Image Text:Q4. Problem 16-1 Equity method accounting (LO 16-4)

On January 1, 2017, Figland Company purchased for cash 40% of Irene Company's 300,000 shares

of voting common stock for $1,800,000. At the time, 40% of the book value of the underlying

equity in Irene's net assets was $1,400,000; $50,000 of the excess was attributed to the excess of

fair value over book value of inventory, which Irene accounts for using the first-in, first-out (FIFO)

inventory method; and $150,000 was attributed to undervaluation of depreciable assets with an

average remaining life of 10 years. The remainder was attributed to implicit goodwill.

As a result of this transaction, Figland can exercise significant influence over Irene's operating and

financial policies. Irene's net income for the year ended December 31, 2017, was $600,000. During

2017, Irene paid $325,000 in dividends to its stockholders.

Required:

1. How much income would Figland report on its 2017 income statement from its investment in

Irene?

2. What would be the balance in the Investment in Irene Company account on December 31,

2017?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub