1. Ibrahim is paid P54,000, and the excess amount paid over Ibrahim's capital account balance is recorded as a bonus to Ibrahim from Cebedo and Basa. 2. Ibrahim is paid P45,000, and the difference is recorded as a bonus to Cebedo and Basa from Ibrahim. 3. Ibrahim accepted cash of P40,500 and plant assets (equipment) with a current fair value of P9,000. The equipment had cost P30,000 and was 60% depreciated, with no residual value (Record any gain or loss on the disposal of the equipment in the partners' capital accounts).

1. Ibrahim is paid P54,000, and the excess amount paid over Ibrahim's capital account balance is recorded as a bonus to Ibrahim from Cebedo and Basa. 2. Ibrahim is paid P45,000, and the difference is recorded as a bonus to Cebedo and Basa from Ibrahim. 3. Ibrahim accepted cash of P40,500 and plant assets (equipment) with a current fair value of P9,000. The equipment had cost P30,000 and was 60% depreciated, with no residual value (Record any gain or loss on the disposal of the equipment in the partners' capital accounts).

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 12.1BPR

Related questions

Question

Kindly answer the problem below.

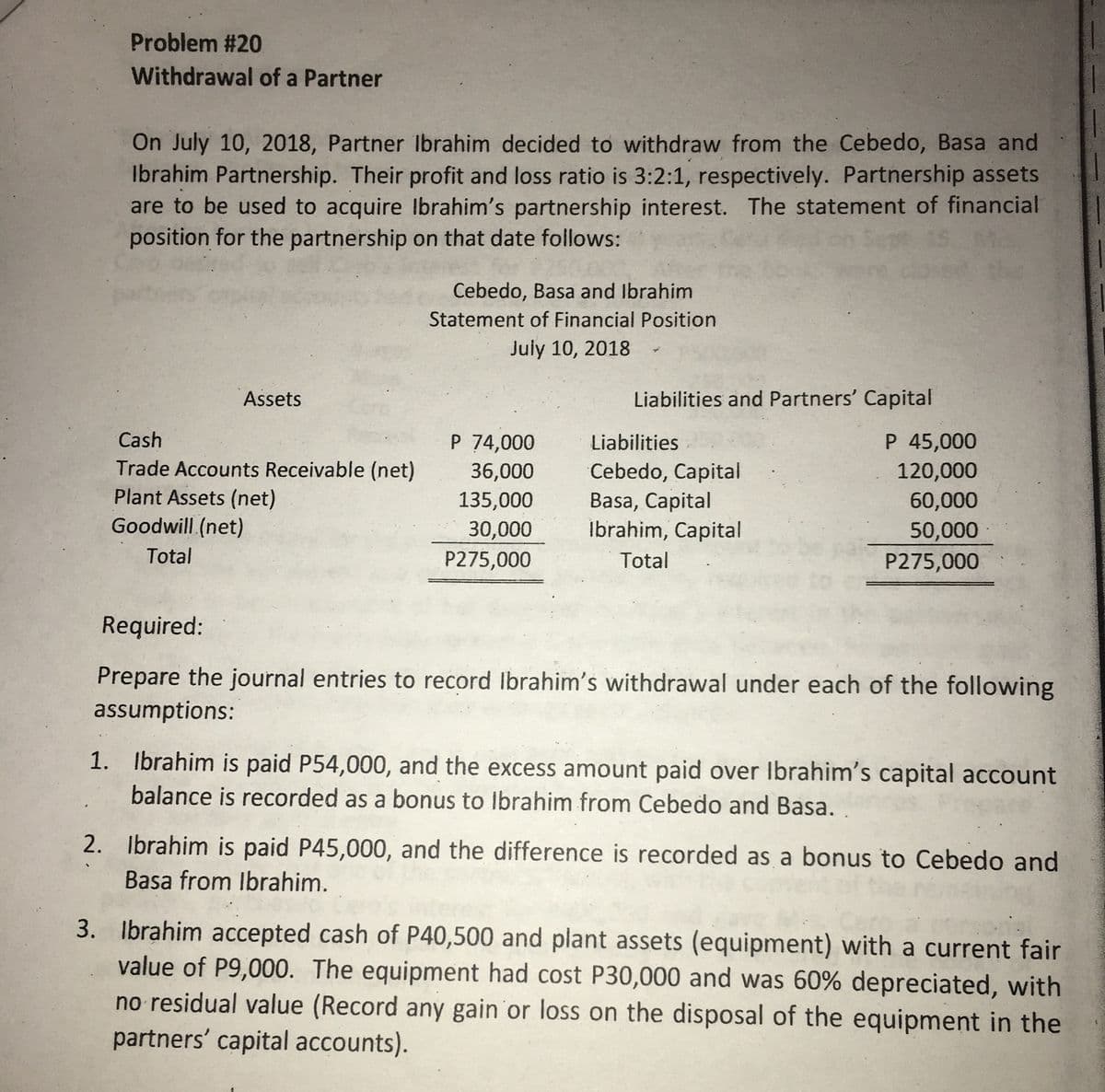

Transcribed Image Text:Problem #20

Withdrawal of a Partner

On July 10, 2018, Partner Ibrahim decided to withdraw from the Cebedo, Basa and

Ibrahim Partnership. Their profit and loss ratio is 3:2:1, respectively. Partnership assets

are to be used to acquire Ibrahim's partnership interest. The statement of financial

position for the partnership on that date follows:

Cebedo, Basa and Ibrahim

Statement of Financial Position

July 10, 2018

Assets

Liabilities and Partners' Capital

P 45,000

120,000

60,000

Cash

P 74,000

Liabilities

Trade Accounts Receivable (net)

Plant Assets (net)

Goodwill.(net)

Cebedo, Capital

Basa, Capital

Ibrahim, Capital

36,000

135,000

30,000

50,000

P275,000

Total

P275,000

Total

Required:

Prepare the journal entries to record Ibrahim's withdrawal under each of the following

assumptions:

1. Ibrahim is paid P54,000, and the excess amount paid over Ibrahim's capital account

balance is recorded as a bonus to Ibrahim from Cebedo and Basa.

2. Ibrahim is paid P45,000, and the difference is recorded as a bonus to Cebedo and

Basa from Ibrahim.

3. lbrahim accepted cash of P40,500 and plant assets (equipment) with a current fair

value of P9,000. The equipment had cost P30,000 and was 60% depreciated, with

no residual value (Record any gain or loss on the disposal of the equipment in the

partners' capital accounts).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,