1. If the financial market is informationally efficient, then you, as an investor, on average, should earn a. only zero return b. positive normal return and zero abnormal return zero rormal return and positive abnormal return d. positive normal return and positive abnormal return in the long run. с.

1. If the financial market is informationally efficient, then you, as an investor, on average, should earn a. only zero return b. positive normal return and zero abnormal return zero rormal return and positive abnormal return d. positive normal return and positive abnormal return in the long run. с.

Chapter15: Choice Of Business Entity—other Considerations

Section: Chapter Questions

Problem 94TPC

Related questions

Question

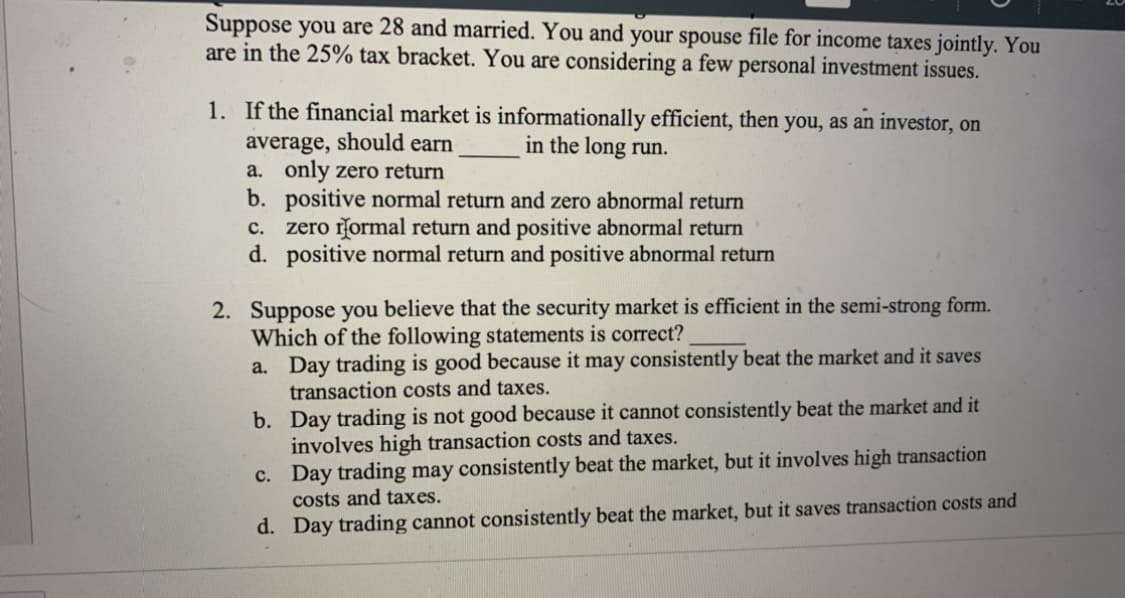

Transcribed Image Text:Suppose you are 28 and married. You and your spouse file for income taxes jointly. You

are in the 25% tax bracket. You are considering a few personal investment issues.

1. If the financial market is informationally efficient, then you, as an investor, on

average, should earn

a. only zero return

b. positive normal return and zero abnormal return

zero rormal return and positive abnormal return

d. positive normal return and positive abnormal return

in the long run.

c.

2. Suppose you believe that the security market is efficient in the semi-strong form.

Which of the following statements is correct?

a. Day trading is good because it may consistently beat the market and it saves

transaction costs and taxes.

b. Day trading is not good because it cannot consistently beat the market and it

involves high transaction costs and taxes.

c. Day trading may consistently beat the market, but it involves high transaction

costs and taxes.

d. Day trading cannot consistently beat the market, but it saves transaction costs and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you