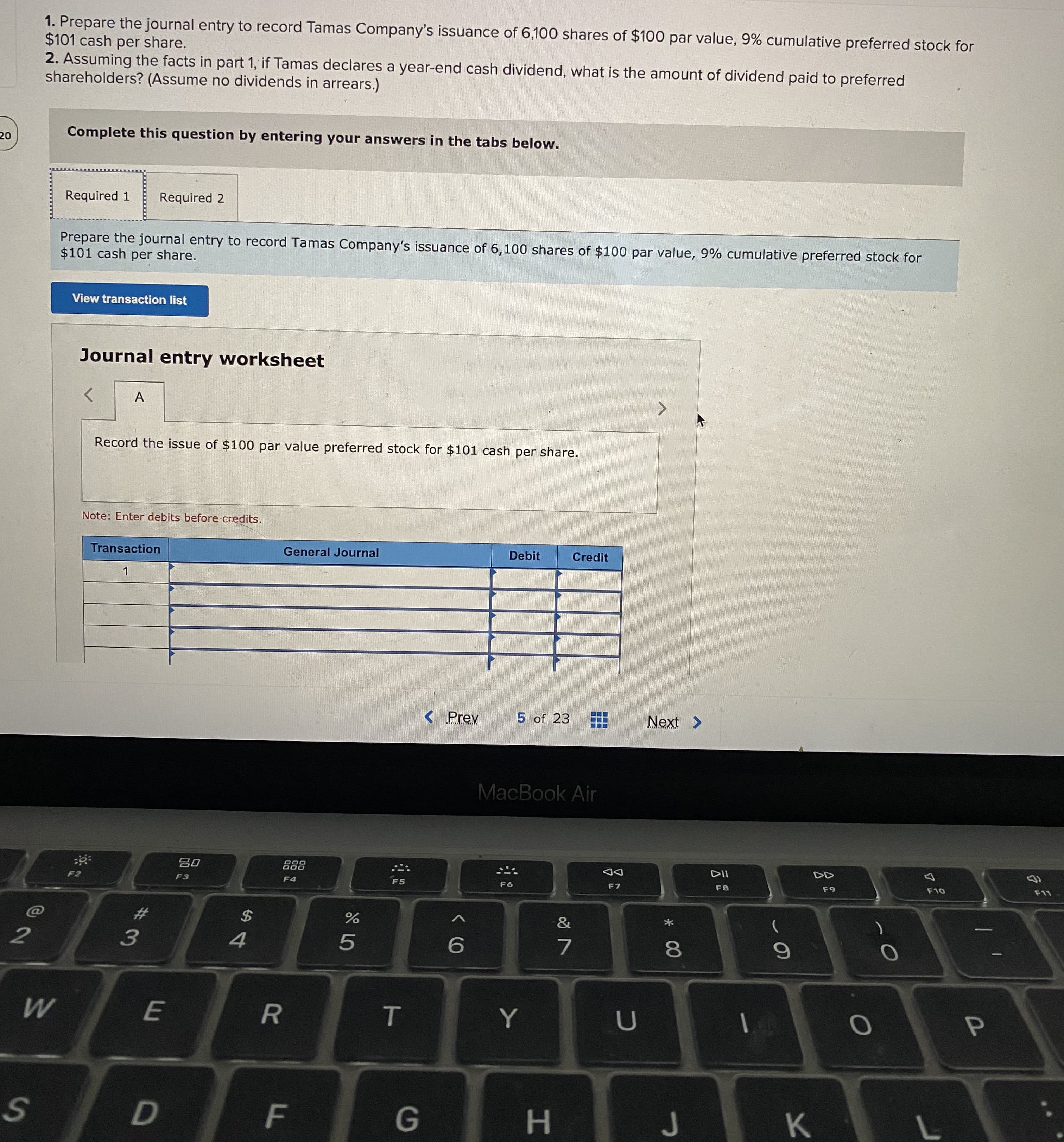

1. Prepare the journal entry to record Tamas Company's issuance of 6,100 shares of $100 par value, 9% cumulative preferred stock for $101 cash per share. 2. Assuming the facts in part 1, if Tamas declares a year-end cash dividend, what is the amount of dividend paid to preferred shareholders? (Assume no dividends in arrears.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry to record Tamas Company's issuance of 6,100 shares of $100 par value, 9% cumulative preferred stock for $101 cash per share.

1. Prepare the journal entry to record Tamas Company's issuance of 6,100 shares of $100 par value, 9% cumulative preferred stock for $101 cash per share. 2. Assuming the facts in part 1, if Tamas declares a year-end cash dividend, what is the amount of dividend paid to preferred shareholders? (Assume no dividends in arrears.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry to record Tamas Company's issuance of 6,100 shares of $100 par value, 9% cumulative preferred stock for $101 cash per share.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter15: Shareholders’ Equity: Capital Contributions And Distributions

Section: Chapter Questions

Problem 13E

Related questions

Question

Transcribed Image Text:1. Prepare the journal entry to record Tamas Company's issuance of 6,100 shares of $100 par value, 9% cumulative preferred stock for

$101 cash per share.

2. Assuming the facts in part 1, if Tamas declares a year-end cash dividend, what is the amount of dividend paid to preferred

shareholders? (Assume no dividends in arrears.)

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Prepare the journal entry to record Tamas Company's issuance of 6,100 shares of $100 par value, 9% cumulative preferred stock for

$101 cash per share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning