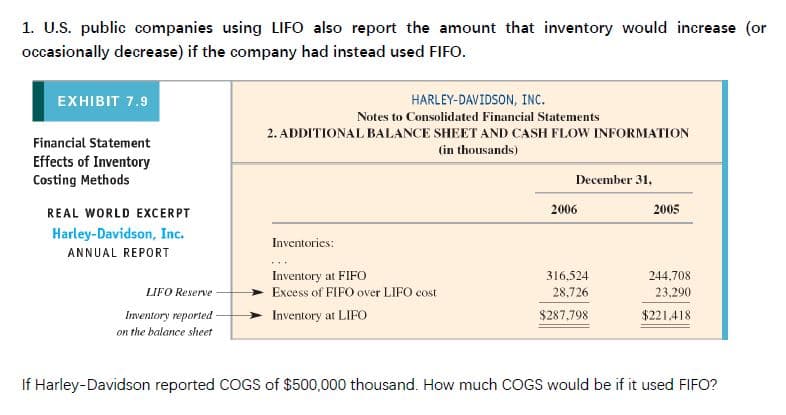

1. U.S. public companies using LIFO also report the amount that inventory would increase (or occasionally decrease) if the company had instead used FIFO. HARLEY-DAVIDSON, INC EXHIBIT 7.9 Notes to Consolidated Financial Statements 2. ADDITIONAL BALANCE SHEET AND CASH FLOW INFORMATION Financial Statement (in thousands) Effects of Inventory Costing Methods December 31, 2006 2005 REAL WORLD EXCERPT Harley-Davidson, Inc. Inventories ANNUAL REPORT Inventory at FIFO Excess of FIFO over LIFO cost 316.524 244,708 28,726 23,290 LIFO Reserve Inventory reported Inventory at LIFO $287,798 $221.418 on the balance sheet If Harley-Davidson reported COGS of $500,000 thousand. How much COGS would be if it used FIFO?

1. U.S. public companies using LIFO also report the amount that inventory would increase (or occasionally decrease) if the company had instead used FIFO. HARLEY-DAVIDSON, INC EXHIBIT 7.9 Notes to Consolidated Financial Statements 2. ADDITIONAL BALANCE SHEET AND CASH FLOW INFORMATION Financial Statement (in thousands) Effects of Inventory Costing Methods December 31, 2006 2005 REAL WORLD EXCERPT Harley-Davidson, Inc. Inventories ANNUAL REPORT Inventory at FIFO Excess of FIFO over LIFO cost 316.524 244,708 28,726 23,290 LIFO Reserve Inventory reported Inventory at LIFO $287,798 $221.418 on the balance sheet If Harley-Davidson reported COGS of $500,000 thousand. How much COGS would be if it used FIFO?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 36BE: Effects of Inventory Costing Methods Refer to the information for Tyler Company above. Required: 1....

Related questions

Topic Video

Question

1. U.S. public companies using LIFO also report the amount that inventory would

increase (or

occasionally decrease) if the company had instead used FIFO.

See file please.

Transcribed Image Text:1. U.S. public companies using LIFO also report the amount that inventory would increase (or

occasionally decrease) if the company had instead used FIFO.

HARLEY-DAVIDSON, INC

EXHIBIT 7.9

Notes to Consolidated Financial Statements

2. ADDITIONAL BALANCE SHEET AND CASH FLOW INFORMATION

Financial Statement

(in thousands)

Effects of Inventory

Costing Methods

December 31,

2006

2005

REAL WORLD EXCERPT

Harley-Davidson, Inc.

Inventories

ANNUAL REPORT

Inventory at FIFO

Excess of FIFO over LIFO cost

316.524

244,708

28,726

23,290

LIFO Reserve

Inventory reported

Inventory at LIFO

$287,798

$221.418

on the balance sheet

If Harley-Davidson reported COGS of $500,000 thousand. How much COGS would be if it used FIFO?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning