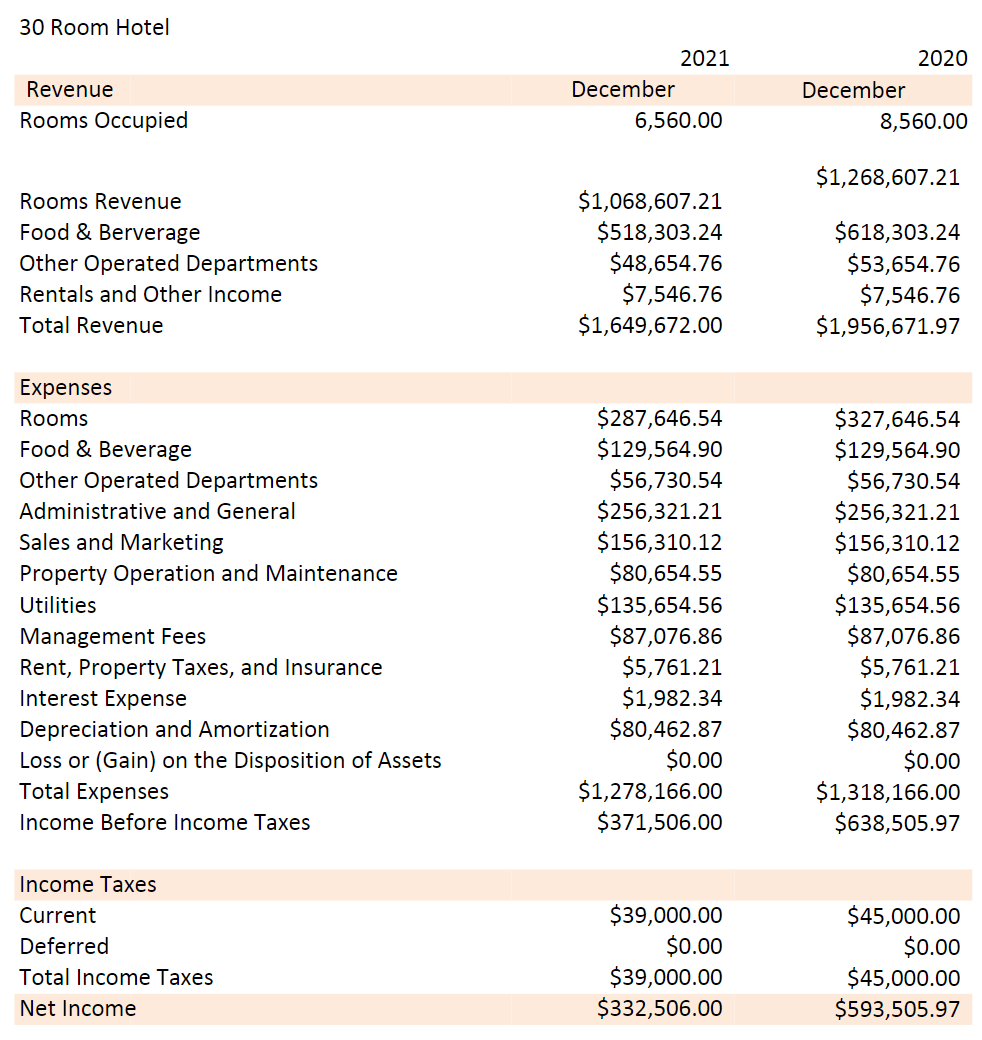

1. What is the GOPPAR of Hotel X for the year of 2021? 2. What is the flow-through for Hotel X for the period of 2020-2021?

1. What is the GOPPAR of Hotel X for the year of 2021? 2. What is the flow-through for Hotel X for the period of 2020-2021?

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter25: Departmental Accounting

Section: Chapter Questions

Problem 7SPA: INCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT AND OPERATING INCOME Thomas and Hill Distributors...

Related questions

Question

1. What is the GOPPAR of Hotel X for the year of 2021?

2. What is the flow-through for Hotel X for the period of 2020-2021?

Transcribed Image Text:30 Room Hotel

Revenue

Rooms Occupied

Rooms Revenue

Food & Berverage

Other Operated Departments

Rentals and Other Income

Total Revenue

Expenses

Rooms

Food & Beverage

Other Operated Departments

Administrative and General

Sales and Marketing

Property Operation and Maintenance

Utilities

Management Fees

Rent, Property Taxes, and Insurance

Interest Expense

Depreciation and Amortization

Loss or (Gain) on the Disposition of Assets

Total Expenses

Income Before Income Taxes

Income Taxes

Current

Deferred

Total Income Taxes

Net Income

December

2021

6,560.00

$1,068,607.21

$518,303.24

$48,654.76

$7,546.76

$1,649,672.00

$287,646.54

$129,564.90

$56,730.54

$256,321.21

$156,310.12

$80,654.55

$135,654.56

$87,076.86

$5,761.21

$1,982.34

$80,462.87

$0.00

$1,278,166.00

$371,506.00

$39,000.00

$0.00

$39,000.00

$332,506.00

December

2020

8,560.00

$1,268,607.21

$618,303.24

$53,654.76

$7,546.76

$1,956,671.97

$327,646.54

$129,564.90

$56,730.54

$256,321.21

$156,310.12

$80,654.55

$135,654.56

$87,076.86

$5,761.21

$1,982.34

$80,462.87

$0.00

$1,318,166.00

$638,505.97

$45,000.00

$0.00

$45,000.00

$593,505.97

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning