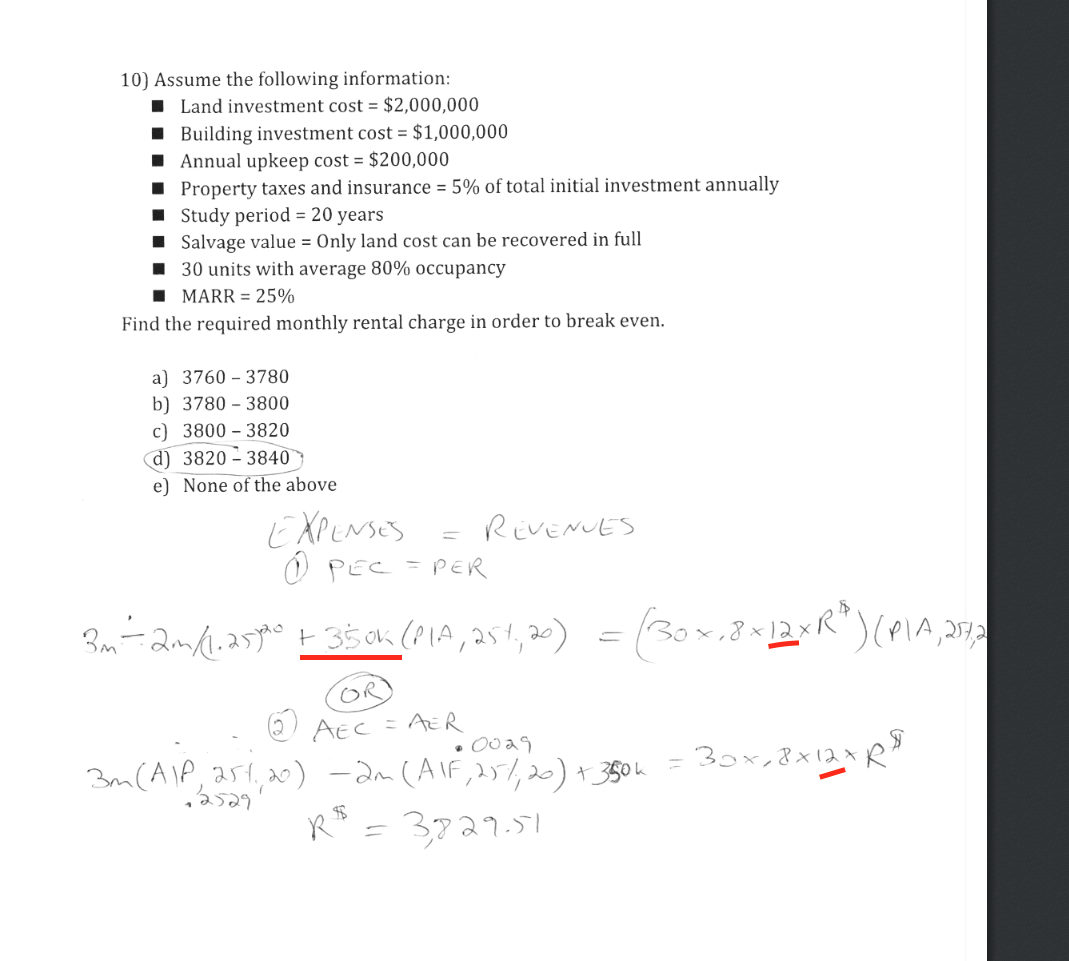

10) Assume the following information: I Land investment cost = $2,000,000 1 Building investment cost = $1,000,000 I Annual upkeep cost = $200,000 I Property taxes and insurance = 5% of total initial investment annually 1 Study period = 20 years 1 Salvage value = Only land cost can be recovered in full 1 30 units with average 80% occupancy %3D MARR = 25% Find the required monthly rental charge in order to break even. a) 3760 – 3780 b) 3780 – 3800 c) 3800 – 3820 d) 3820 – 3840 > e) None of the above

10) Assume the following information: I Land investment cost = $2,000,000 1 Building investment cost = $1,000,000 I Annual upkeep cost = $200,000 I Property taxes and insurance = 5% of total initial investment annually 1 Study period = 20 years 1 Salvage value = Only land cost can be recovered in full 1 30 units with average 80% occupancy %3D MARR = 25% Find the required monthly rental charge in order to break even. a) 3760 – 3780 b) 3780 – 3800 c) 3800 – 3820 d) 3820 – 3840 > e) None of the above

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 4CE: Manzer Enterprises is considering two independent investments: A new automated materials handling...

Related questions

Question

where does the 350k come from?

Transcribed Image Text:10) Assume the following information:

I Land investment cost = $2,000,000

I Building investment cost = $1,000,000

I Annual upkeep cost = $200,000

1 Property taxes and insurance = 5% of total initial investment annually

1 Study period = 20 years

1 Salvage value = Only land cost can be recovered in full

1 30 units with average 80% occupancy

I MARR = 25%

Find the required monthly rental charge in order to break even.

a) 3760 – 3780

b) 3780 – 3800

c) 3800 – 3820

d) 3820 - 3840

e) None of the above

E XPENSES

O PEC =PER

RivEnUES

3m-2m/(.2590 +35ck (PIA, 251, 20) =(3ox.8~12×R")(PIA, 25

OR

2) AEc = AER

3m(AP, a51, 20) -2m (A\F,25,20) +350h

3or,8x12x

= 37a151

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT