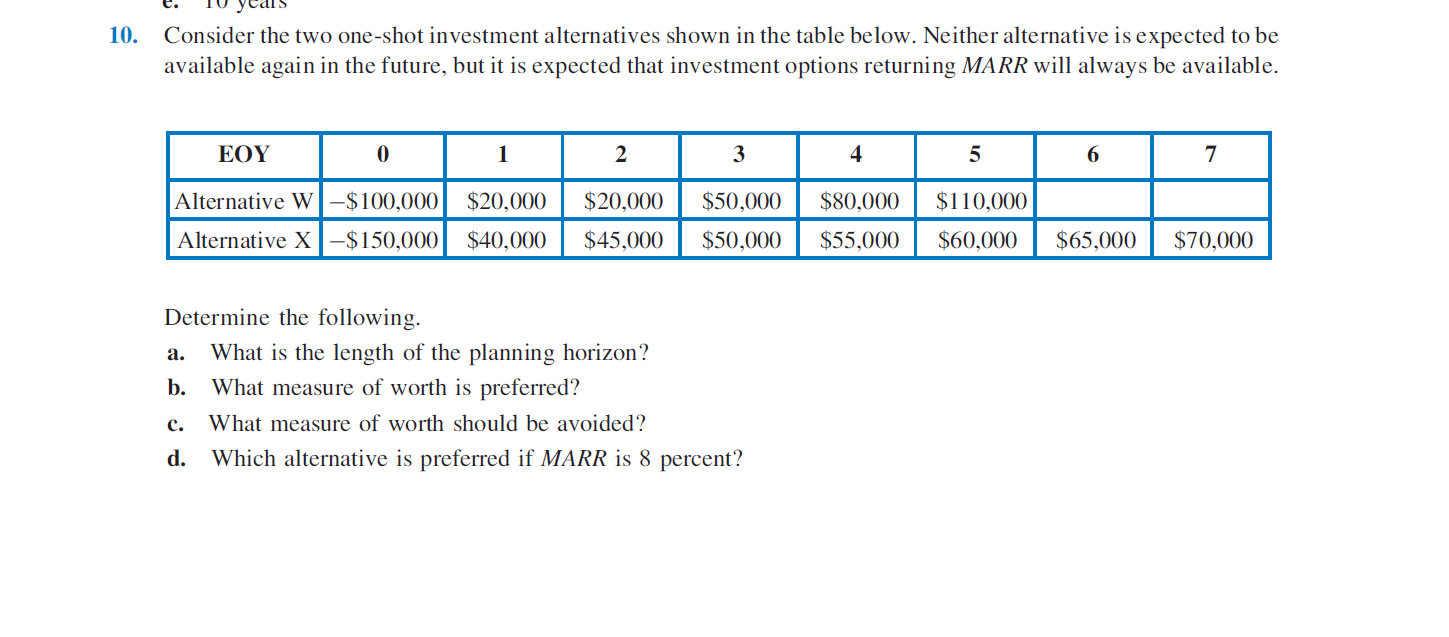

10. Consider the two one-shot investment alternatives shown in the table below. Neither alternative is expected to be available again in the future, but it is expected that investment options returning MARR will always be available EOY 1 2 3 6 7 Alternative W-$100,000 $50,000 $80,000 $20,000 $20,000 $110,000 Alternative X-$150,000 $60,000 $40,000 $45,000 $50,000 $55,000 $65,000 $70,000 Determine the following. What is the length of the planning horizon? а. What measure of worth is preferred? b. What measure of worth should be avoided? с. Which alternative is preferred if MARR is 8 percent? d.

10. Consider the two one-shot investment alternatives shown in the table below. Neither alternative is expected to be available again in the future, but it is expected that investment options returning MARR will always be available EOY 1 2 3 6 7 Alternative W-$100,000 $50,000 $80,000 $20,000 $20,000 $110,000 Alternative X-$150,000 $60,000 $40,000 $45,000 $50,000 $55,000 $65,000 $70,000 Determine the following. What is the length of the planning horizon? а. What measure of worth is preferred? b. What measure of worth should be avoided? с. Which alternative is preferred if MARR is 8 percent? d.

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 5TP: Giorgio Co. is looking at an investment project with an internal rate of return of 10.8%. The...

Related questions

Question

Transcribed Image Text:10.

Consider the two one-shot investment alternatives shown in the table below. Neither alternative is expected to be

available again in the future, but it is expected that investment options returning MARR will always be available

EOY

1

2

3

6

7

Alternative W-$100,000

$50,000

$80,000

$20,000

$20,000

$110,000

Alternative X-$150,000

$60,000

$40,000

$45,000

$50,000

$55,000

$65,000

$70,000

Determine the following.

What is the length of the planning horizon?

а.

What measure of worth is preferred?

b.

What measure of worth should be avoided?

с.

Which alternative is preferred if MARR is 8 percent?

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College