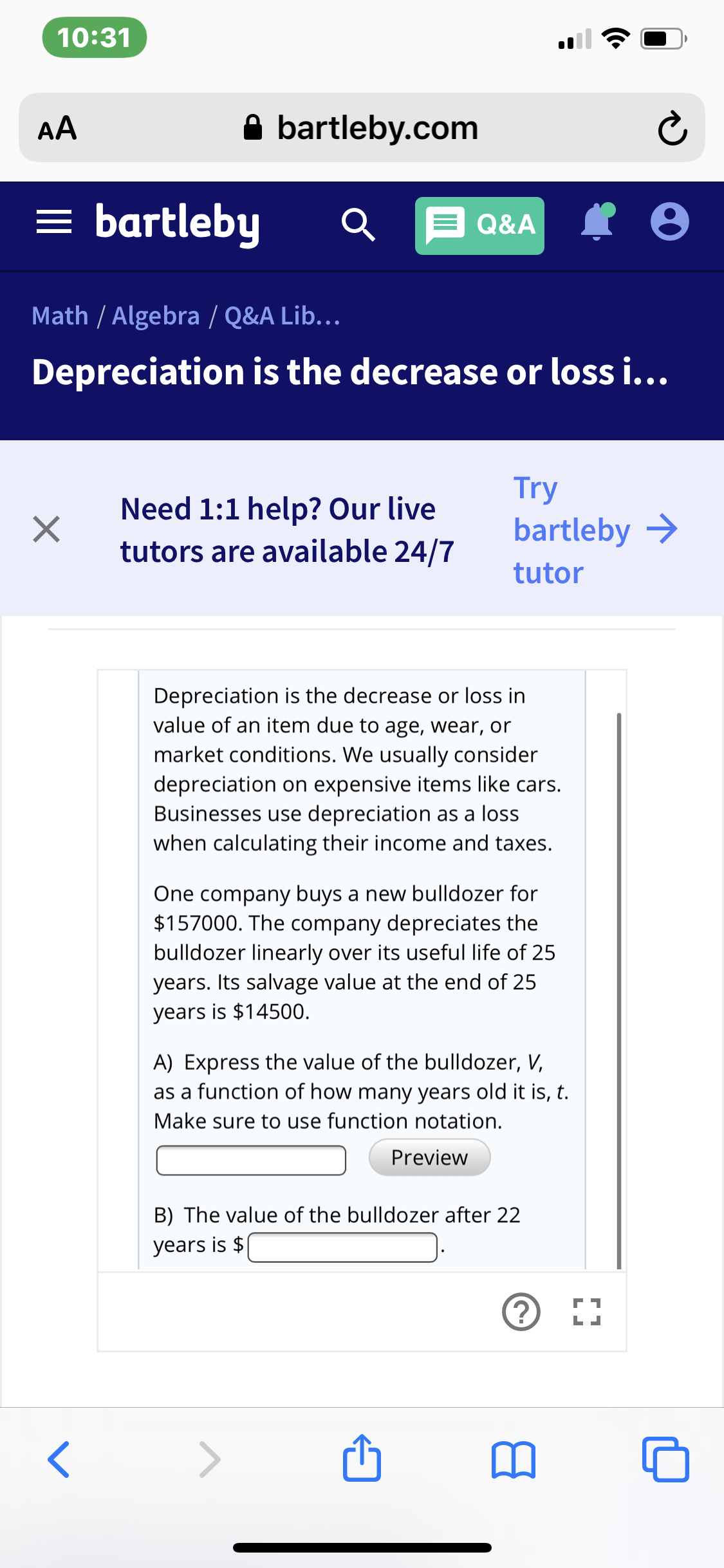

10:31 A bartleby.com AA = bartleby Q E Q&A Math / Algebra / Q&A Lib... Depreciation is the decrease or loss i... Try bartleby > Need 1:1 help? Our live tutors are available 24/7 tutor Depreciation is the decrease or loss in value of an item due to age, wear, or market conditions. We usually consider depreciation on expensive items like cars. Businesses use depreciation as a loss when calculating their income and taxes. One company buys a new bulldozer for $157000. The company depreciates the bulldozer linearly over its useful life of 25 years. Its salvage value at the end of 25 years is $14500. A) Express the value of the bulldozer, V, as a function of how many years old it is, t. Make sure to use function notation. Preview B) The value of the bulldozer after 22 years is $

10:31 A bartleby.com AA = bartleby Q E Q&A Math / Algebra / Q&A Lib... Depreciation is the decrease or loss i... Try bartleby > Need 1:1 help? Our live tutors are available 24/7 tutor Depreciation is the decrease or loss in value of an item due to age, wear, or market conditions. We usually consider depreciation on expensive items like cars. Businesses use depreciation as a loss when calculating their income and taxes. One company buys a new bulldozer for $157000. The company depreciates the bulldozer linearly over its useful life of 25 years. Its salvage value at the end of 25 years is $14500. A) Express the value of the bulldozer, V, as a function of how many years old it is, t. Make sure to use function notation. Preview B) The value of the bulldozer after 22 years is $

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 7DQ: A net present value analysis used to evaluate a proposed equipment acquisition indicated a 7,900 net...

Related questions

Question

Transcribed Image Text:10:31

A bartleby.com

AA

= bartleby

Q E Q&A

Math / Algebra / Q&A Lib...

Depreciation is the decrease or loss i...

Try

bartleby >

Need 1:1 help? Our live

tutors are available 24/7

tutor

Depreciation is the decrease or loss in

value of an item due to age, wear, or

market conditions. We usually consider

depreciation on expensive items like cars.

Businesses use depreciation as a loss

when calculating their income and taxes.

One company buys a new bulldozer for

$157000. The company depreciates the

bulldozer linearly over its useful life of 25

years. Its salvage value at the end of 25

years is $14500.

A) Express the value of the bulldozer, V,

as a function of how many years old it is, t.

Make sure to use function notation.

Preview

B) The value of the bulldozer after 22

years is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,