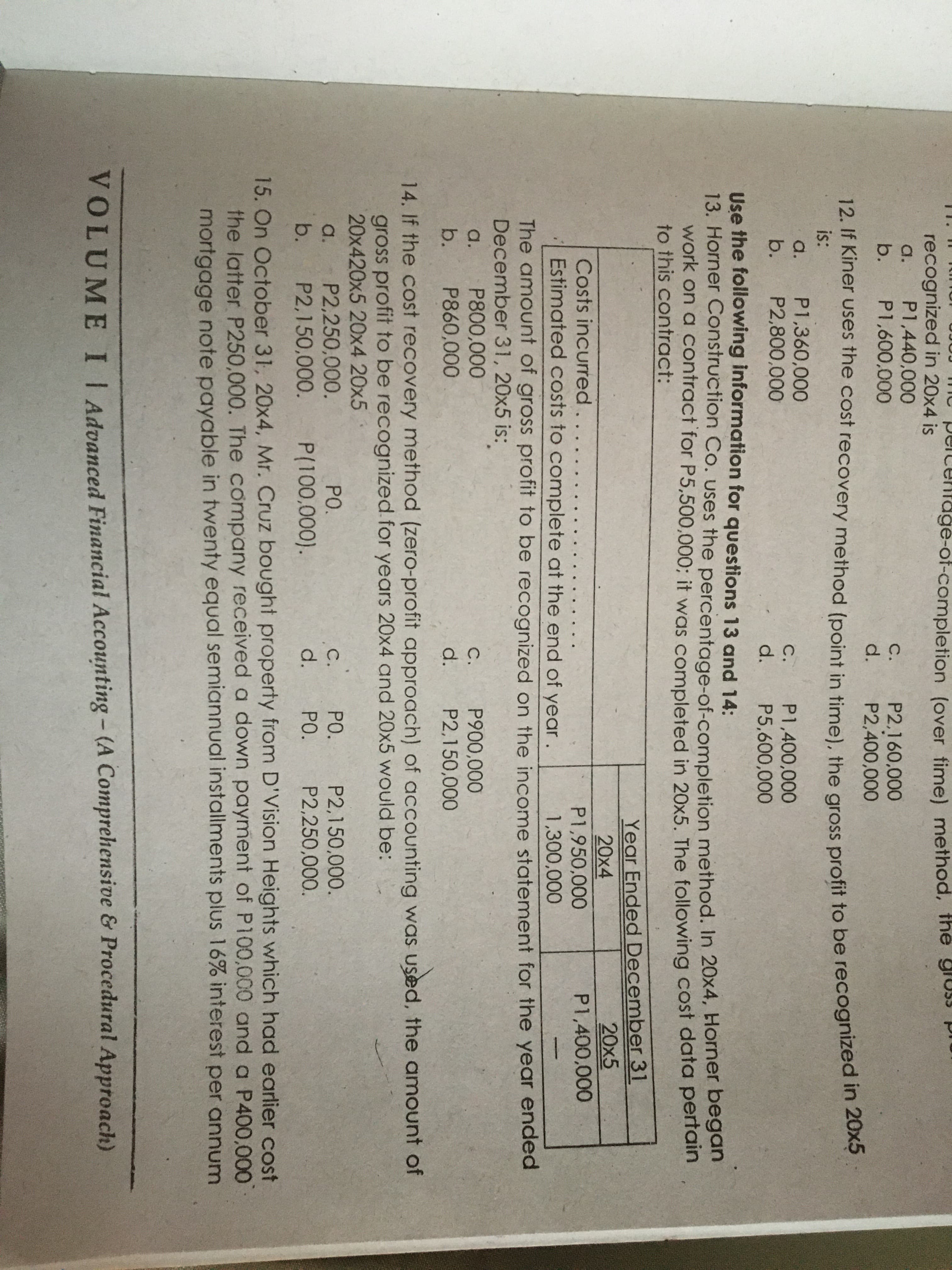

14. If the cost recovery method (zero-profit approach) of accounting was used, the amount of gross profit to be recognized.for years 20x4 and 20x5 would be: 20x420x5 20x4 20x5 P2,150,000. PO. P2,250,000. PO. P2,250,000. P2,150,000. a. PO. C. b. P(100,000). d.

Q: The profit function of a company is P(x) = 100x- 13200x + 435600 then the break-even point is Select…

A: Profit function is referred as the function which focus on applications of businesses. The main…

Q: 11. Use the same information in MC 10. How much should the sales manager and each sales agent…

A: Employee means a person who work in our company and get wages or salaries in return of work…

Q: Fill in the missing numbers for the following income statement. (Do not roun intermediate…

A: Given Information: Sales = $657,800 Costs = $418,700 Depreciation = $98,300

Q: 26-If the sales of the company are OMR 300,000, Profit OMR 30,000, variable cost 60%, find out the…

A: Sales revenue: It is the revenue earned by an organization on selling the products to the outsiders.…

Q: What will be the total operating expense? a.41200 b.53200 c. 19700 d. 21500 2-What will be the net…

A: Operating expense is defined as the expense which business make from its normal course of business…

Q: item/company A B Revenue 38.51% 14.23% net income 32.60% 1,596.39% net profit margin -4.26%…

A: A B Revenue% 38.51% 14.23% Net Income 32.60% 1596.39% Net Profit Margin -4.26% 1410.59%…

Q: 13. Use the same information given in Problem 12. How much compensation expense should be recorded…

A: Compensation expenses in case of share appreciation right means the amount of expenses to be borne…

Q: 9. If profit or loss is #100 while other comprehensive income is $20, total comprehensive income…

A: NOTE : As per BARTLEBY guidelines, when multiple independent questions are given then first question…

Q: Problem 2: Sander Company presents the following information below: Sales Cost of Goods Sold Gross…

A: Sales = 970,000 Cost of goods sold = 387,000

Q: Fill in the missing numbers for the following income statement. (Do not round intermediate…

A: Sales = $ 665000 Costs = $ 427,100 Depreciation = $ 101,900

Q: The following information relates to Pure Corporation for the past accounting period. Service…

A: This question deals with the allocation of service department cost. In simultaneous method, service…

Q: The following financial information was provided by Anya Company: Net Income 8,255,000.00…

A: Depreciation A depreciation is a non-cash expenses for the company. The depreciation expenses is…

Q: 16. LSP Manufacturing recently reported Net income of $350,000, Intere expense $112,000. It has ROA…

A: Bartleby honor code states that when various questions are asked, the expert should answer only the…

Q: How are we calculating this income from annual operating cost? what's the logic Income from annual…

A: Discount rate shall be applicable to ensure that the values are reflected and compared in today's…

Q: 0. The total sales for this year is ₱5,000,000, cost of sales if 30%, operating expense is 20%, net…

A: Solution: Operating income = Sales - Cost of sales - Operating expenses = P5,000,000 -…

Q: 9. What is the cost effect of the price recovery component? A. $1,500,000 U B.. $4,587,500 U C.…

A: The variation in the operating income due to the variation in the sale price of the goods if the…

Q: A summary of HM Co's recent statement of profit or loss is given below: $'000 Revenue 10,123 Cost…

A: We have the following information: Revenue: $10,123,000 Cost of sales: ($7,222,000) Gross profit:…

Q: The following extracts relate to Company X and Company Y for 20X1: Co X $000 Co Y $00 Revenue 20,000…

A: Operating profit margin = Operating profit / Revenue

Q: The following financial information was provided by Anya Company: Net Income 8,255,000.00…

A: Given, Net income is 8,255,000 Tax rate is 35%

Q: During the current year, XYZ Company increased its variable SG&A expenses while keeping fixed SG&A…

A: Accounting: Accounting is a system, or a process of collecting and organizing economic…

Q: Fill in the missing numbers for the following income statement. (Do not round intermediate…

A: Sales 663800 Costs -425700 Depreciation -101300 EBIT 136800 663800-425700-101300 Taxes…

Q: Belowis an income statem ent for NUBD Company: Sales P400,000 (120,000) Contribution margin P280,000…

A: Contribution margin ratio = Contribution margin / sales = 280000/400000 = 70%

Q: 20. A company’s contribution approach income statement showed net income, variable production…

A: Sales = Net income + Variable cost + Fixed cost = P4,000 + P15,000 + P10,000 = P29,000

Q: $15,500 and Fry $10.500, and the remainder is shared equally. Show the distribution of income. (If…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: 7. The Gross Profit is 40%, total sales is ₱625,000. The company incurred an operating expense of…

A: Net profit means the difference between the income and expenses. Financial statement means the…

Q: Sales $ 643,700 Costs 384,300 Depreciation 136,500 ЕBIT Taxes (25%) Net income b. What is the OCF?…

A: INCOME STATEMENT PARTICULARS AMOUNT ($) SALES $643,700 COSTS $384,300 DEPRECIATION…

Q: The Gross Profit of James Ltd is ₹1,92,000 and expenses of indirect nature other than manager’s…

A: Gross profits refer to the amount remaining with the firm after deducting total direct expenses from…

Q: If the sales this year amounted to P276,000, sales this year at last year’s price is P230,000, the…

A: The term "sales" represents total earnings generated by a firm before adjusting any cost. It is a…

Q: Assume none of the fixed expenses for the hard rubber line are avoidable. What will be total net…

A: Introduction:- Calculation of total net income if the line is dropped as follows under:-

Q: Required A Required B *....... Assume that more than one product is being sold in each of the four…

A: Contribution margin ratio refers to the percentage measure of the contribution margin as a…

Q: How much is controllable margin? * Do not use money sign. Sample format: 11,111 NUBD Manufacturing…

A: The controllable margin is calculated as excess of contribution margin over controllable fixed cost.…

Q: Carla Vista Company is considering two alternatives. Alternative A will have revenues of $148.000…

A: Lets understand the basics. When there are two alternatives then management tries to choose…

Q: 33- Compute total income from the following? Gross Profit OMR 10000, Rent Paid OMR 1000, Commission…

A: Given Gross Profit OMR 10000, Rent Paid OMR 1000, Commission received OMR 3000 and Dividend…

Q: If the gross profit 196 000 ID, other revenue and gains 4 360 ID , operating expenses 143.900 ID,…

A: Given that, Gross profit = 196000 ID The gross profit is determined with the net sales plus the…

Q: i need Part B solution Part A here solution Computation of net income: Net sales 680,400…

A: Income statement of the business shows all incomes and all expenses of the business and at the end…

Q: 1) A Corporation generated these gross profits during the past recent years when the sales price was…

A: NOTE : As per BARTLEBY guidelines, when multiple questions are given then first question is to be…

Q: 6. If the sales this year amounted to P500,000, sales this year at last year's prices is P460,000o.…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Pierce Corporation has the following gross profits for 2018 and 2019: Sales = 2019 - P810,000; 2018…

A: Let us assume that in year 2019, 1,000 units are sold Revenue in 2019 = P810,000 .Unit selling price…

Q: Coronado Company is considering two alternatives. Alternative A will have revenues of $146,300 and…

A: The difference in revenues and costs between various courses of action is represented by…

Q: Belowis an income statem ent for NUBD Company P400,000 (120.000) Contribution margin P280,000…

A: Contribution margin ratio = Contribution margin /sales = 280000/400000 = 70%

Q: Fill in the missing numbers for the following income statement. (Do not round intermediate…

A: Operating cash flow(OCF) is a cash flow that is generated from normal operations. It can be…

Q: The following are the respective costs and revenues incurred by USA company: costs for months 1, 2,…

A: solution given month cost revenues 1 (80000.00) 2 (90000.00) 70000 3…

Q: 9. Assuming the management chooses the first option, which amount the product lines will be…

A: Blackpink Inc. has 4 product lines - La-Lisa, Jennie, Jisoo and Rose. Two products out of the 4 are…

Q: explanation and solution to the question for a better understanding. Thank you! 6. Pierce…

A: The right answer is option b P47,290

Q: If the gross profit 196 000 ID , other revenue and gains 4 360 ID , operating expenses 143.900 ID ,…

A: Net profit refers to the net value of income earned by a entity or an individual in a given period…

Answe no. 14 and 15 thank you

Step by step

Solved in 2 steps

- In the table below x denotes the X-Tract Company’s projected annual profit (in $1,000). The table also shows the probability of earning that profit. The negative value indicates a loss. x f(x) x = profit -100 0.01 f(x) = probability -200 0.04 0 100 0.26 200 0.54 300 0.05 400 0.02 10 On average, profit (loss) amounts deviate from the expected profit by ______ thousand. a $114.77 thousand b $112.52 thousand c $110.31 thousand d $108.15 thousandHow much is the true profit of the branch? A. 1,266,667B. 1,250,000C. 1,200,000D. 1,400,000IF the profit are 50% of operating cost, it is ……………. of invoice price a. 20% b. 25% c. 16.66667% d. 33.33334%

- 9. Assuming the management chooses the first option, which amount the product lines will be eliminated?a. La-Lisab. Jenniec. Jisood. Rose_____ 10. Assuming the management chooses to discontinue the unprofitable product line, what is the net impact to the Company’s overall profit?a. P 7,000b. P 17,000c. P 13,000d. P 23,00026-If the sales of the company are OMR 300,000, Profit OMR 30,000, variable cost 60%, find out the sale volume to earn a profit of OMR 75,000. O a. OMR 400000 O b. OMR 412500 O c. OMR 375000 O d. OMR 451200here are the choices: what is the gross profit: a. 241000 b. 151000 c. 141000 d. none e. 177000 how much is the operating expense? a. none b. 141000 c. 151000 d. 241000 e.177000 How much is the operating income? a. 136150 b. none c. 124450 d. 130950 e. 137450

- What is the value to be given to product Del? A. P25,000 B. P21,000 C. P24,000 D. P20,000Use attachment to answer the following If Brierton used percentage-of-completion method to account for this project, what would they have reported as profit in year 2? a) $1.33 million b) $0 c) $1.50 million d) $0.67 millionIf the gross profit is P5,000 and the net profit is 25% of the gross profit. What are the expenses?a. P3,750b. P1,250c. P4,150d. P6,250

- 1-What will be the total operating expense? a.41200 b.53200 c. 19700 d. 21500 2-What will be the net income? a. 56000 b. 338000 c. 16000 d. 72000 3-What will be the total Selling and distribution expense? a. 41200 b. 17200 c. 19700 d. 14800 4-What will be the Gross Profit at the end of the year December 2019 a. OMR 338,000 b. OMR 16000 c. OMR 336,000 d. OMR 56000 5-What is the Gross Margin in terms of Percentage? a. Cannot be determined b. 20.66 c. 16.66 d. 16.56please answer 4a,b,c and 5 only. 4-a. What will be the new breakeven point if the additional $213,280 is spent on advertising? 4-b. Prepare a contribution income statement at the new breakeven point. 4-c. What is the percentage change in both fixed costs and in the breakeven point? 5. If the additional $213,280 is spent for advertising in the next year, what is the sales level (in units) needed to equal the current year’s operating profit at 60,000 units. With a tax rate of 25%, fixed costs of P34,000, and a contribution ratio of 45%, how much revenue is required to achieve a desired after-tax profit of P36,000? a.P111,111 b.P182,222 c.P149,091 d.P 83,636