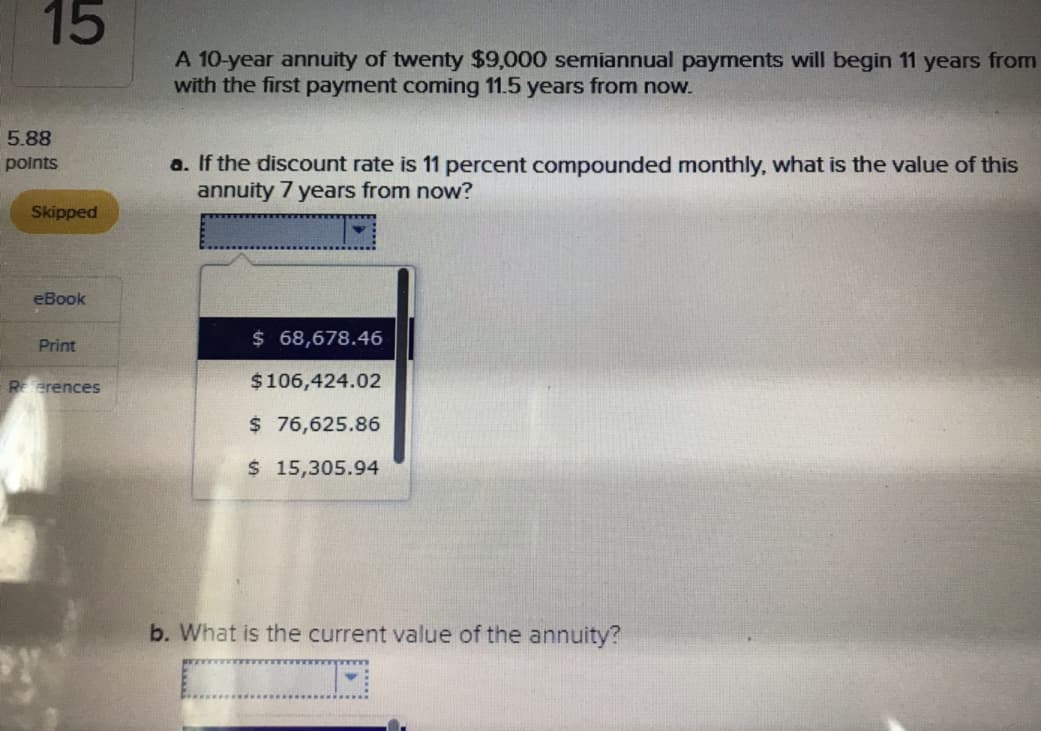

15 A 10-year annuity of twenty $9,000 semiannual payments will begin 11 years from with the first payment coming 11.5 years from now. 5.88 points a. If the discount rate is 11 percent compounded monthly, what is the value of this annuity 7 years from now? Skipped eBook Print erences 68,678.46 $106,424.02 $ 76,625.86 S15,305.94 b. What is the current value of the annuity?

15 A 10-year annuity of twenty $9,000 semiannual payments will begin 11 years from with the first payment coming 11.5 years from now. 5.88 points a. If the discount rate is 11 percent compounded monthly, what is the value of this annuity 7 years from now? Skipped eBook Print erences 68,678.46 $106,424.02 $ 76,625.86 S15,305.94 b. What is the current value of the annuity?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 20E

Related questions

Question

Transcribed Image Text:15

A 10-year annuity of twenty $9,000 semiannual payments will begin 11 years from

with the first payment coming 11.5 years from now.

5.88

points

a. If the discount rate is 11 percent compounded monthly, what is the value of this

annuity 7 years from now?

Skipped

eBook

Print

erences

68,678.46

$106,424.02

$ 76,625.86

S15,305.94

b. What is the current value of the annuity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 5 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning