19. Fuschia Company is a calendar year corporation. Its financial statements for the years 2018 and 2017 contained errors as follows: 2017 P400,000 understated 200,000 overstated 350,000 overstated 2018 Ending inventory Depreciation expense 500,000 understated Rent income P300,000 overstated ? Unearned rent income 350,000 understated Assume that no correcting entries were made at December 31, 2017. By how much will 2018 profit before income taxes be overstated because of the foregoing errors? A. P850,000 B. P800,000 C. P750,000 D. P250,000

19. Fuschia Company is a calendar year corporation. Its financial statements for the years 2018 and 2017 contained errors as follows: 2017 P400,000 understated 200,000 overstated 350,000 overstated 2018 Ending inventory Depreciation expense 500,000 understated Rent income P300,000 overstated ? Unearned rent income 350,000 understated Assume that no correcting entries were made at December 31, 2017. By how much will 2018 profit before income taxes be overstated because of the foregoing errors? A. P850,000 B. P800,000 C. P750,000 D. P250,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10MC: Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended...

Related questions

Question

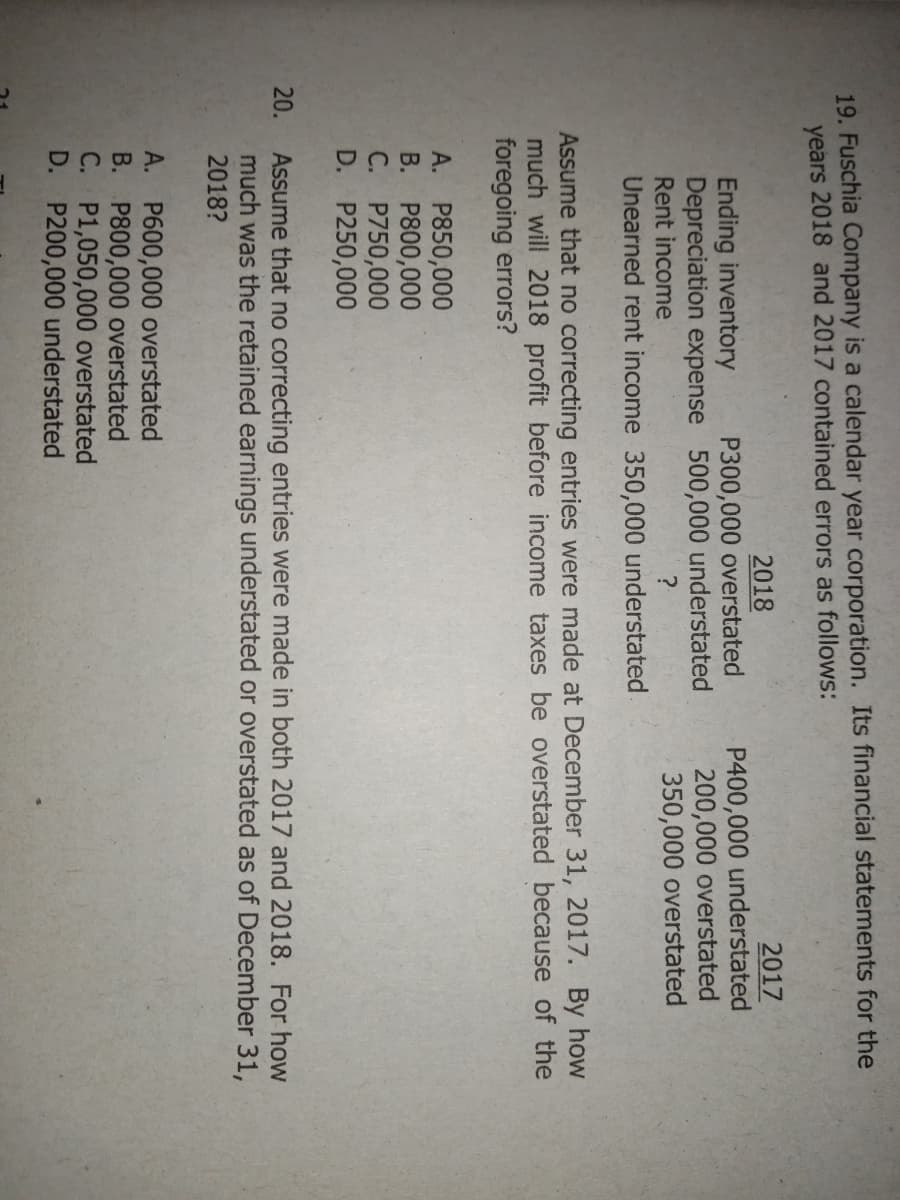

Transcribed Image Text:19. Fuschia Company is a calendar year corporation. Its financial statements for the

years 2018 and 2017 contained errors as follows:

2017

P400,000 understated

200,000 overstated

350,000 overstated

2018

Ending inventory

Depreciation expense 500,000 understated

Rent income

Unearned rent income 350,000 understated

P300,000 overstated

Assume that no correcting entries were made at December 31, 2017. By how

much will 2018 profit before income taxes be overstated because of the

foregoing errors?

A. P850,000

B. P800,000

C. P750,000

D. P250,000

20.

Assume that no correcting entries were made in both 2017 and 2018. For how

much was the retained earnings understated or overstated as of December 31,

2018?

A. P600,000 overstated

B. P800,000 overstated

C. P1,050,000 overstated

D. P200,000 understated

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning