2 Quiz Saved A double-entry accounting system is an accounting system: 15 Multiple Choice kipped That records each transaction twice. That records the effects of transactions and other events in at least two accounts with equal debits and credits In which each transaction affects and is recorded in two or more accounts but that could include two debits and no credits That may only be used if T-accounts are used. That insures that errors never occur

2 Quiz Saved A double-entry accounting system is an accounting system: 15 Multiple Choice kipped That records each transaction twice. That records the effects of transactions and other events in at least two accounts with equal debits and credits In which each transaction affects and is recorded in two or more accounts but that could include two debits and no credits That may only be used if T-accounts are used. That insures that errors never occur

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter2: Analyzing Transactions Into Debit And Credit Parts

Section: Chapter Questions

Problem 1CP

Related questions

Question

Transcribed Image Text:2 Quiz

Saved

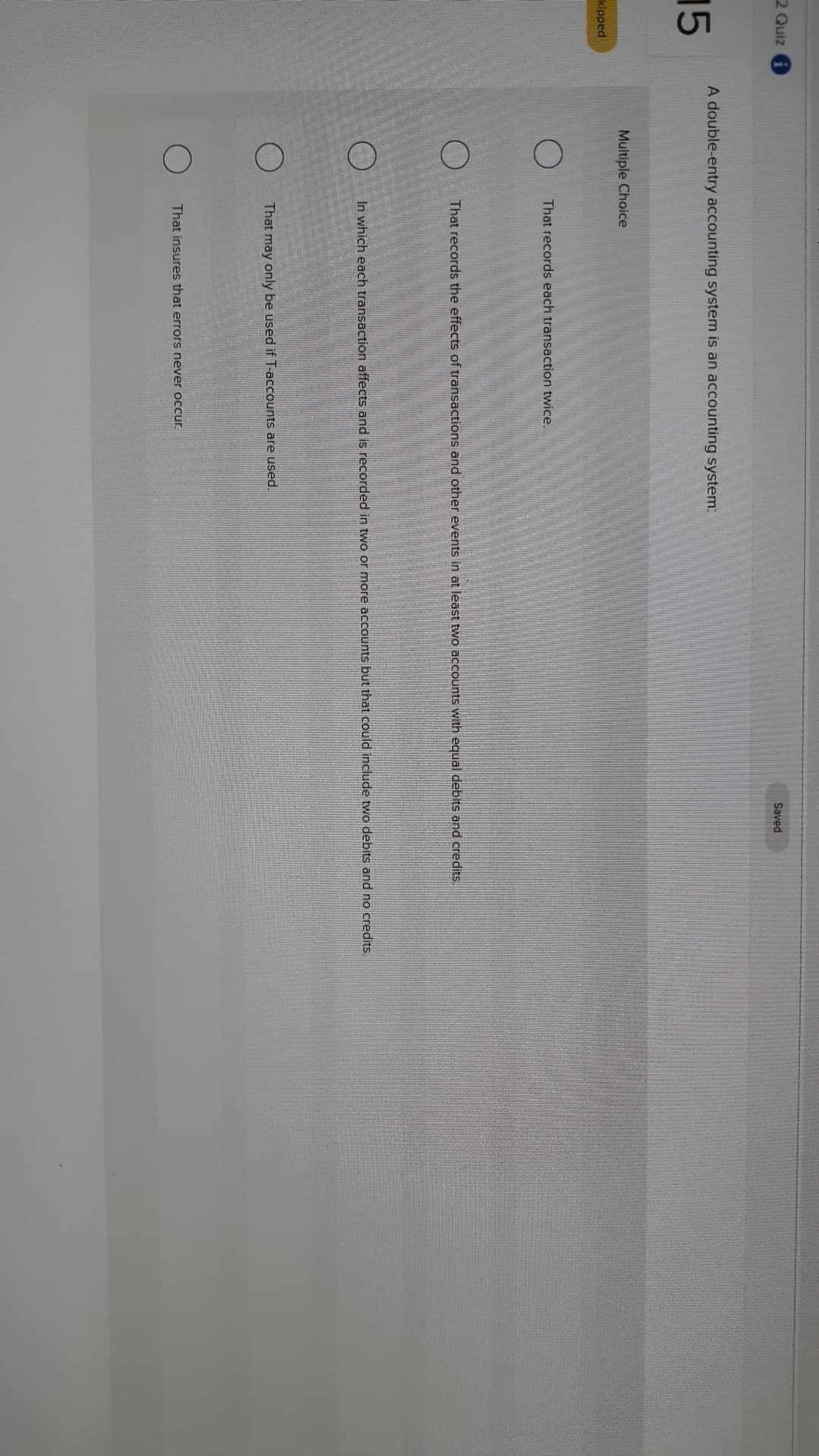

A double-entry accounting system is an accounting system:

15

Multiple Choice

kipped

That records each transaction twice.

That records the effects of transactions and other events in at least two accounts with equal debits and credits

In which each transaction affects and is recorded in two or more accounts but that could include two debits and no credits

That may only be used if T-accounts are used.

That insures that errors never occur

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College