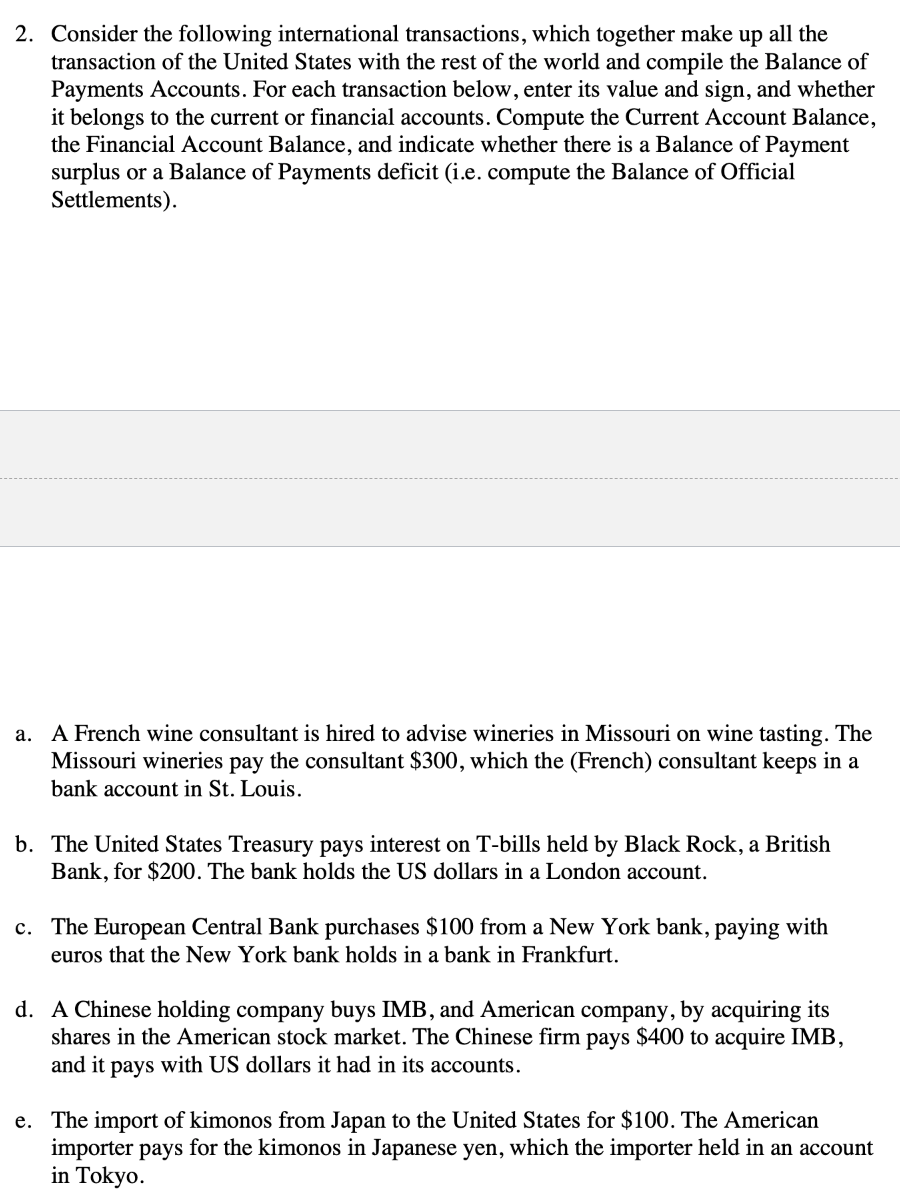

2. Consider the following international transactions, which together make up all the transaction of the United States with the rest of the world and compile the Balance of Payments Accounts. For each transaction below, enter its value and sign, and whether it belongs to the current or financial accounts. Compute the Current Account Balance, the Financial Account Balance, and indicate whether there is a Balance of Payment surplus or a Balance of Payments deficit (i.e. compute the Balance of Official Settlements).

2. Consider the following international transactions, which together make up all the transaction of the United States with the rest of the world and compile the Balance of Payments Accounts. For each transaction below, enter its value and sign, and whether it belongs to the current or financial accounts. Compute the Current Account Balance, the Financial Account Balance, and indicate whether there is a Balance of Payment surplus or a Balance of Payments deficit (i.e. compute the Balance of Official Settlements).

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter24: Recording International And Internet Sales

Section: Chapter Questions

Problem 1CP

Related questions

Question

Transcribed Image Text:2. Consider the following international transactions, which together make up all the

transaction of the United States with the rest of the world and compile the Balance of

Payments Accounts. For each transaction below, enter its value and sign, and whether

it belongs to the current or financial accounts. Compute the Current Account Balance,

the Financial Account Balance, and indicate whether there is a Balance of Payment

surplus or a Balance of Payments deficit (i.e. compute the Balance of Official

Settlements).

a. A French wine consultant is hired to advise wineries in Missouri on wine tasting. The

Missouri wineries pay the consultant $300, which the (French) consultant keeps in a

bank account in St. Louis.

b. The United States Treasury pays interest on T-bills held by Black Rock, a British

Bank, for $200. The bank holds the US dollars in a London account.

c. The European Central Bank purchases $100 from a New York bank, paying with

euros that the New York bank holds in a bank in Frankfurt.

d. A Chinese holding company buys IMB, and American company, by acquiring its

shares in the American stock market. The Chinese firm pays $400 to acquire IMB,

and it pays with US dollars it had in its accounts.

e. The import of kimonos from Japan to the United States for $100. The American

importer pays for the kimonos in Japanese yen, which the importer held in an account

in Tokyo.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning