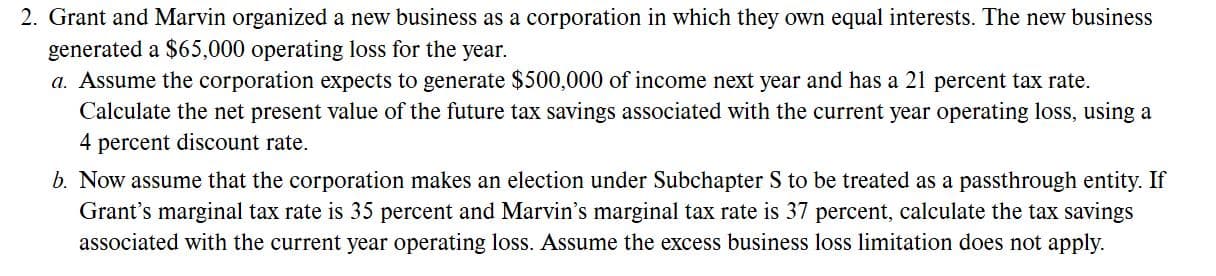

2. Grant and Marvin organized a new business as a corporation in which they own equal interests. The new business generated a $65,000 operating loss for the year. a. Assume the corporation expects to generate $500,000 of income next year and has a 21 percent tax rate Calculate the net present value of the future tax savings associated with the current year operating loss, using a 4 percent discount rate b. Now assume that the corporation makes an election under Subchapter S to be treated as a passthrough entity. If Grant's marginal tax rate is 35 percent and Marvin's marginal tax rate is 37 percent, calculate the tax savings associated with the current year operating loss. Assume the excess business loss limitation does not apply.

2. Grant and Marvin organized a new business as a corporation in which they own equal interests. The new business generated a $65,000 operating loss for the year. a. Assume the corporation expects to generate $500,000 of income next year and has a 21 percent tax rate Calculate the net present value of the future tax savings associated with the current year operating loss, using a 4 percent discount rate b. Now assume that the corporation makes an election under Subchapter S to be treated as a passthrough entity. If Grant's marginal tax rate is 35 percent and Marvin's marginal tax rate is 37 percent, calculate the tax savings associated with the current year operating loss. Assume the excess business loss limitation does not apply.

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 11MCQ

Related questions

Question

Transcribed Image Text:2. Grant and Marvin organized a new business as a corporation in which they own equal interests. The new business

generated a $65,000 operating loss for the year.

a. Assume the corporation expects to generate $500,000 of income next year and has a 21 percent tax rate

Calculate the net present value of the future tax savings associated with the current year operating loss, using a

4 percent discount rate

b. Now assume that the corporation makes an election under Subchapter S to be treated as a passthrough entity. If

Grant's marginal tax rate is 35 percent and Marvin's marginal tax rate is 37 percent, calculate the tax savings

associated with the current year operating loss. Assume the excess business loss limitation does not apply.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT