2. Páid up čapital of 3. Required percentac

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 12MCQ

Related questions

Question

Subject: LAW ON

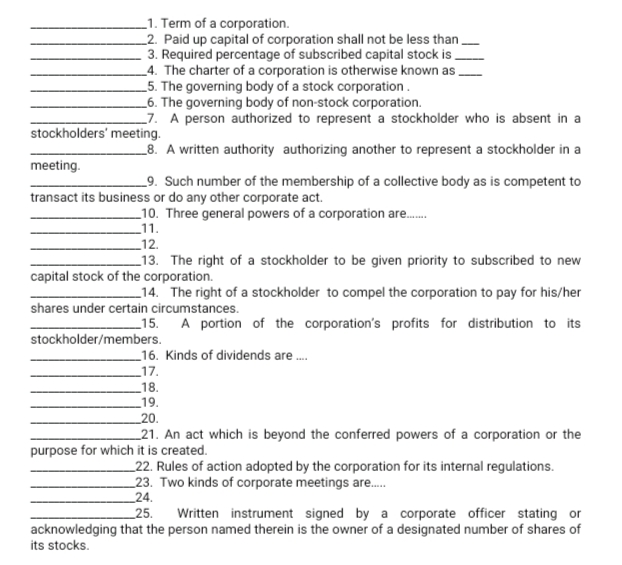

Transcribed Image Text:_1. Term of a corporation.

_2. Paid up capital of corporation shall not be less than.

3. Required percentage of subscribed capital stock is

_4. The charter of a corporation is otherwise known as,

_5. The governing body of a stock corporation.

_6. The governing body of non-stock corporation.

_7. A person authorized to represent a stockholder who is absent in a

stockholders' meeting.

_8. A written authority authorizing another to represent a stockholder in a

meeting.

_9. Such number of the membership of a collective body as is competent to

transact its business or do any other corporate act.

_10. Three general powers of a corporation are.

_11.

_12.

_13. The right of a stockholder to be given priority to subscribed to new

capital stock of the corporation.

_14. The right of a stockholder to compel the corporation to pay for his/her

shares under certain circumstances.

_15. A portion of the corporation's profits for distribution to its

stockholder/members.

_16. Kinds of dividends are .

_17.

_18.

_19.

_20.

_21. An act which is beyond the conferred powers of a corporation or the

purpose for which it is created.

_22. Rules of action adopted by the corporation for its internal regulations.

_23. Two kinds of corporate meetings are.

_24.

25.

Written instrument signed by a corporate officer stating or

acknowledging that the person named therein is the owner of a designated number of shares of

its stocks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you