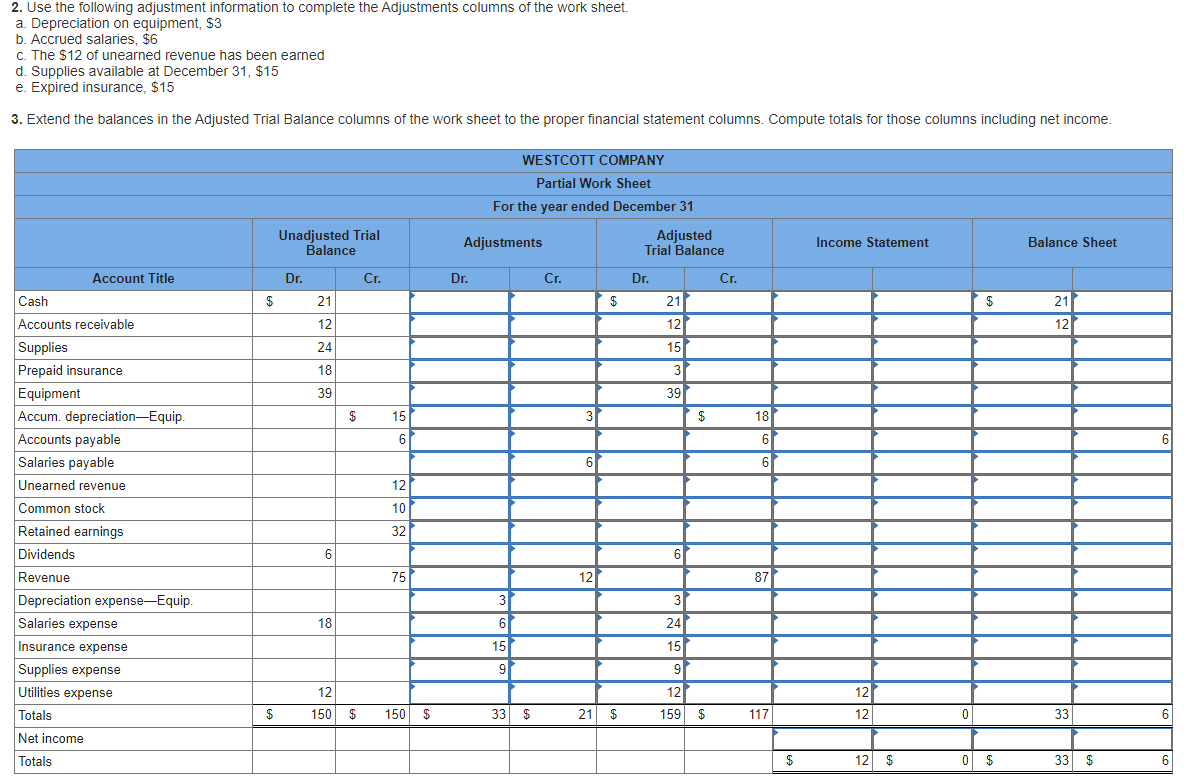

2. Use the following adjustment information to complete the Adjustments columns of the work sheet. a. Depreciation on equipment, $3 b. Accrued salaries, $6 c. The $12 of unearned revenue has been earned d. Supplies available at December 31, $15 e. Expired insurance, $15 3. Extend the balances in the Adjusted Trial Balance columns of the work sheet to the proper financial statement columns. Compute totals for those columns including net income. WESTCOTT COMPANY Partial Work Sheet For the year ended December 31 Unadjusted Trial Balance Adjusted Trial Balance Adjustments Income Statement Balance Sheet Account Title Cr. Dr. Cr. Dr. Dr. Cr. Cash 21 21 21 S Accounts receivable 12 12 12 15 Supplies 24 Prepaid insurance Equipment Accum. depreciation-Equip Accounts payable 3 18 39 39 18 $ 15 3 6 6 Salaries payable 6 6 Unearned revenue 12 Common stock 10 Retained earnings 32 6 Dividends Revenue 87 75 12 Depreciation expense-Equip 3 3 24 Salaries expense 18 6 Insurance expense 15 15 Supplies expense 9 9 Utilities expense 12 12 12 21 $ 159 $ Totals 150 $ 33 $ 150 117 12 C 33 6 Net income 12 $ 33 6 Totals

2. Use the following adjustment information to complete the Adjustments columns of the work sheet. a. Depreciation on equipment, $3 b. Accrued salaries, $6 c. The $12 of unearned revenue has been earned d. Supplies available at December 31, $15 e. Expired insurance, $15 3. Extend the balances in the Adjusted Trial Balance columns of the work sheet to the proper financial statement columns. Compute totals for those columns including net income. WESTCOTT COMPANY Partial Work Sheet For the year ended December 31 Unadjusted Trial Balance Adjusted Trial Balance Adjustments Income Statement Balance Sheet Account Title Cr. Dr. Cr. Dr. Dr. Cr. Cash 21 21 21 S Accounts receivable 12 12 12 15 Supplies 24 Prepaid insurance Equipment Accum. depreciation-Equip Accounts payable 3 18 39 39 18 $ 15 3 6 6 Salaries payable 6 6 Unearned revenue 12 Common stock 10 Retained earnings 32 6 Dividends Revenue 87 75 12 Depreciation expense-Equip 3 3 24 Salaries expense 18 6 Insurance expense 15 15 Supplies expense 9 9 Utilities expense 12 12 12 21 $ 159 $ Totals 150 $ 33 $ 150 117 12 C 33 6 Net income 12 $ 33 6 Totals

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 13PA: Prepare adjusting journal entries, as needed, considering the account balances excerpted from the...

Related questions

Question

Transcribed Image Text:2. Use the following adjustment information to complete the Adjustments columns of the work sheet.

a. Depreciation on equipment, $3

b. Accrued salaries, $6

c. The $12 of unearned revenue has been earned

d. Supplies available at December 31, $15

e. Expired insurance, $15

3. Extend the balances in the Adjusted Trial Balance columns of the work sheet to the proper financial statement columns. Compute totals for those columns including net income.

WESTCOTT COMPANY

Partial Work Sheet

For the year ended December 31

Unadjusted Trial

Balance

Adjusted

Trial Balance

Adjustments

Income Statement

Balance Sheet

Account Title

Cr.

Dr.

Cr.

Dr.

Dr.

Cr.

Cash

21

21

21

S

Accounts receivable

12

12

12

15

Supplies

24

Prepaid insurance

Equipment

Accum. depreciation-Equip

Accounts payable

3

18

39

39

18

$

15

3

6

6

Salaries payable

6

6

Unearned revenue

12

Common stock

10

Retained earnings

32

6

Dividends

Revenue

87

75

12

Depreciation expense-Equip

3

3

24

Salaries expense

18

6

Insurance expense

15

15

Supplies expense

9

9

Utilities expense

12

12

12

21 $

159 $

Totals

150 $

33 $

150

117

12

C

33

6

Net income

12 $

33

6

Totals

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning