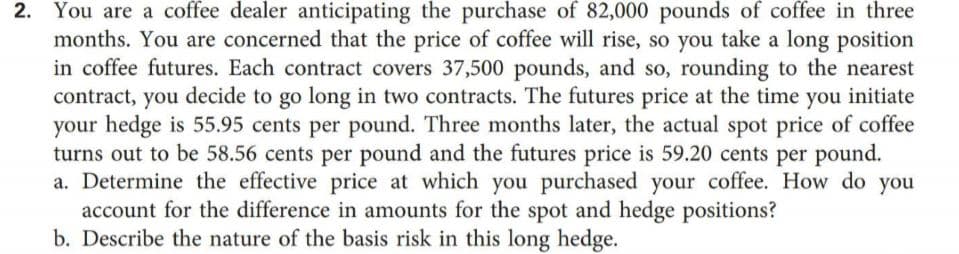

2. You are a coffee dealer anticipating the purchase of 82,000 pounds of coffee in three months. You are concerned that the price of coffee will rise, so you take a long position in coffee futures. Each contract covers 37,500 pounds, and so, rounding to the nearest contract, you decide to go long in two contracts. The futures price at the time you initiate your hedge is 55.95 cents per pound. Three months later, the actual spot price of coffee turns out to be 58.56 cents per pound and the futures price is 59.20 cents per pound. a. Determine the effective price at which you purchased your coffee. How do you account for the difference in amounts for the spot and hedge positions? b. Describe the nature of the basis risk in this long hedge.

2. You are a coffee dealer anticipating the purchase of 82,000 pounds of coffee in three months. You are concerned that the price of coffee will rise, so you take a long position in coffee futures. Each contract covers 37,500 pounds, and so, rounding to the nearest contract, you decide to go long in two contracts. The futures price at the time you initiate your hedge is 55.95 cents per pound. Three months later, the actual spot price of coffee turns out to be 58.56 cents per pound and the futures price is 59.20 cents per pound. a. Determine the effective price at which you purchased your coffee. How do you account for the difference in amounts for the spot and hedge positions? b. Describe the nature of the basis risk in this long hedge.

Chapter22: International Financial Management

Section: Chapter Questions

Problem 3P

Related questions

Question

Transcribed Image Text:2. You are a coffee dealer anticipating the purchase of 82,000 pounds of coffee in three

months. You are concerned that the price of coffee will rise, so you take a long position

in coffee futures. Each contract covers 37,500 pounds, and so, rounding to the nearest

contract, you decide to go long in two contracts. The futures price at the time you initiate

your hedge is 55.95 cents per pound. Three months later, the actual spot price of coffee

turns out to be 58.56 cents per pound and the futures price is 59.20 cents per pound.

a. Determine the effective price at which you purchased your coffee. How do you

account for the difference in amounts for the spot and hedge positions?

b. Describe the nature of the basis risk in this long hedge.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT